As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Fertilizer Costs: “Split as Some Prices Rise and Others Fall,” While Diesel Prices Climb

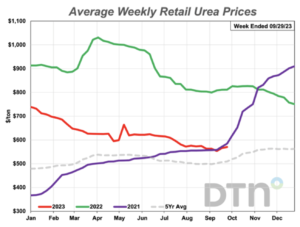

DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices tracked by DTN for the fourth week of September 2023 are showing a more pronounced split as some prices rise and others fall.

For the first time in many months, multiple fertilizers were higher in price. DTN designates a significant move as anything 5% or more.

“Five of the eight major fertilizers were more expensive compared to last month. Of the five, three fertilizers had a considerable price increase.”

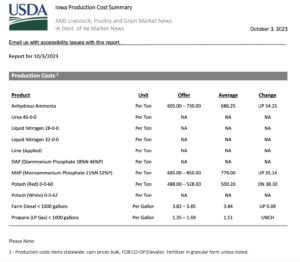

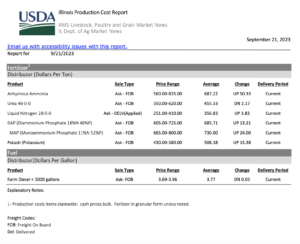

Quinn pointed out that, “Anhydrous was 13% higher compared to last month with an average price of $767/ton. Both MAP and UAN32 were 6% more expensive looking back a month. MAP had an average price of $777/ton while UAN32 was at $413/ton

“The two remaining fertilizers had slightly higher prices compared to last month. Urea had an average price of $570/ton and 10-34-0 was at $610/ton.

“Three fertilizers were lower compared to the prior month, albeit just slightly lower. DAP had an average price of $703/ton, potash $508/ton and UAN28 $353/ton.”

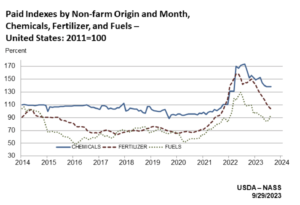

Elsewhere, in its monthly Agricultural Prices report last week, the USDA’s National Agricultural Statistics Service (NASS) indicated in the prices paid by farmers section of the report that, “Fertilizer: The index for August, at 103.4, is down 2.9 percent from July and 29 percent from August a year ago. Since July, lower prices for nitrogen and mixed fertilizer more than offset higher prices for potash & phosphate.”

With respect to fuel costs, the NASS report noted that, “Fuels: At 95.2, the August index is up 10 percent from July but down 14 percent from August 2022. Compared with July, prices are higher for diesel, gasoline, and LP gas.”

And in its Grain Transpiration Report last week, the USDA’s Agricultural Marketing Service pointed out that, “For the week ending September 25, the U.S. average diesel fuel price decreased 4.7 cents from the previous week to $4.586 per gallon, 30.3 cents below the same week last year.”

New York Times writers Santul Nerkar and Clifford Krauss reported today that, “Inflation has been easing around the world. But what happens next could depend partly on the cost of diesel, a wild card that few analysts have been able to predict well.

“Higher gasoline prices — lit up on giant signs on streets and highways — are typically the most visible, visceral reminder of inflation to consumers. But analysts say diesel can have a bigger impact on inflation because the fuel powers trucks, industrial machinery and agricultural equipment. The prices of heating oil and jet fuel are also closely connected to the price of diesel.

“Diesel prices have risen in recent weeks because traders fear that refineries will not be able or willing to sell enough fuel to meet global demand. The apparent supply shortfall is also being driven by the geopolitical struggle between Russia and the West.”

Today’s article added that, “Businesses facing higher fuel costs are more likely to raise prices on groceries, consumer goods and other things. That, in turn, could force the Federal Reserve and other central banks to raise interest rates or keep them high for longer.

“Diesel prices in the United States have climbed about 11 cents over the last month, to around $4.56 a gallon. Gasoline prices are down 2 cents, to $3.79 a gallon.”