As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Fertilizer “Scarce and Expensive” in Some Lower-Income Countries, as “Politics of the Dinner Table” Emerge

Peter S. Goodman reported in Sunday’s New York Times that, “Suleiman Chubado is not entirely clear what caused the price of fertilizer to more than double over the past year, but he is bitterly aware of the consequences. At his farm in northeastern Nigeria, he can no longer afford enough fertilizer, so his corn is stunted and pale, the scraggly plants bending toward the powdery earth.”

“As he and his neighbors commiserate over the calamity unfolding across much of Africa, they exchange theories on one source of trouble: Russia’s war on Ukraine, which disrupted shipments of key ingredients for fertilizer.

“‘We are in two different worlds, separated by airplanes and oceans,’ Mr. Chubado said. ‘How can it be affecting us here?'”

The Times article pointed out that, “That question is reverberating in many lower-income countries. Farmers are grappling with shocks that made fertilizer scarce and unaffordable, diminishing harvests, raising food prices and spreading hunger.

“The war in Ukraine reduced the region’s grain exports and sent the price of staples like wheat soaring from Egypt to Indonesia. The world’s food supply is also menaced by the ravages of climate change — heat waves, drought, floods.

Now, scarce and expensive fertilizer is combining with these other forces to threaten livelihoods.

Goodman explained that, “The breakdown in fertilizer production challenges the orthodoxy that has dominated international trade for decades. Prominent economists have promoted globalization as insurance against upheaval. When factories in one place cannot produce goods, they can be summoned from somewhere else. Yet as farmers across Africa and parts of Asia contend with fertilizer shortages, their anguish attests to a less celebrated aspect of the interlinked economy: Shared dependence on vital products from dominant suppliers yields widespread danger when shocks emerge.”

The Times article stated that, “The crisis started with the Covid-19 pandemic, which increased the cost of transporting fertilizer ingredients. Then came the war. Finally, over the last 18 months, the U.S. Federal Reserve aggressively lifted interest rates to choke off domestic inflation. That has lifted the value of the American dollar against many currencies. Because fertilizer components are priced in dollars, they have become vastly more expensive in countries like Nigeria.

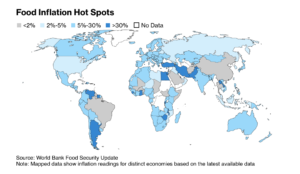

“Since February 2022, the price of fertilizer has more than doubled in Nigeria and 13 other countries, according to a survey by ActionAid, an international relief group. Concern about food insecurity has been ‘alarmingly high’ in much of West and Central Africa, according to a World Bank bulletin.”

And on Friday, Bloomberg’s Rodney Jefferson reported that, “Food has long been a political issue, hunger a revolutionary force.”

“Call it the politics of the dinner table, which is now also playing out in a series of key elections around the world,” the Bloomberg article said.

Jefferson stated that, “All world leaders know food security is fundamental to their political survival. Amid growing global upheaval, though, many are finding it much harder to guarantee.”

Meanwhile, New York Times writer Stanley Reed reported on Thursday’s paper that, “Natural gas prices have jumped this week in Europe on worries about supplies stemming from the conflicts in Israel and Ukraine.”

And Ian Johnston reported on Thursday at The Financial Times Online that, “European gas prices hit their highest point since March on Thursday as traders worried that global energy supplies would be hit by pipeline disruptions and the conflict between Israel and Hamas.”

The FT article noted that, “The moves are the latest jolt for a market that has been volatile since Russia’s invasion of Ukraine last year. Prices have fallen from a peak of more than €300 per megawatt hour in August 2022 and Europe has largely filled its gas stocks in preparation for winter, cushioning it from further disruption.

“But continued rises will push up prices for businesses and consumers once the continent’s winter stocks diminish. While oil markets have largely shrugged off the impact of the Israel-Hamas conflict, traders have grown worried about threats to supplies around the world.”