As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

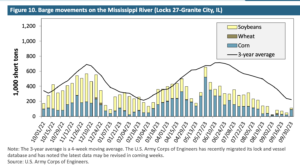

USDA Explores Third-Quarter Barged Grain Movements on the Mississippi River

In its weekly Grain Transportation Report on Thursday, the USDA’s Agricultural Marketing Service (AMS) indicated that, “The Mississippi River System (MRS) comprises the Nation’s primary waterways for moving grain from Midwest production areas to the U.S. Gulf region for export. Close to 60 percent of U.S. grain exports (wheat, soybeans, and corn) travel this route by barge.”

AMS explained that, “In June, low water on the MRS led to draft and tow restrictions on barges, as happened in fall 2022. From the week ending July 8 to the week ending September 30, downbound barged grain volumes on the MRS totaled 3.9 million tons—35 percent lower than the third quarter last year and 53 percent lower than the previous 5-year average.”

Last week’s report pointed out that, “Low Water on the Mississippi River System. In 2022, the MRS saw historic low water levels that stymied barge transportation from late September to early December. This dramatic reduction in MRS barge traffic resulted in below-average yearly grain volume and record high freight rates. In 2023, low water levels in the MRS became a problem in June, about 2 months earlier than in 2022, and continued for most of third quarter 2023.

.@usda_oce Wx: South, parts of the lower Mississippi River are teetering near record-low levels, amid warm, dry conditions in much of the drainage basin.

— FarmPolicy (@FarmPolicy) October 3, 2023

On October 2, the Mississippi River stage in Greenville, Mississippi, fell to 6.00 feet, just 0.7 foot above the record-low…

“Since June 2023, increasingly stringent restrictions have governed draft and tow sizes on various sections of the MRS. The most severe restrictions have been on the Lower Mississippi and Ohio Rivers at Cairo, IL.”

Months of excessive heat and drought have parched the Mississippi River. These images show the Mississippi River near Memphis on Sept. 16, 2023 compared to Sept. 10, 2021.

— NASA Earth (@NASAEarth) October 4, 2023

Low water levels in the river have exposed some of the river bottom.https://t.co/pLhLvSp2Go pic.twitter.com/GR3kbxJosQ

AMS noted that, “Third-quarter weekly spot rates at St. Louis were below last year, until the week of August 28. In that week, responding to continued low water in the MRS, the U.S. Coast Guard further tightened draft and tow size restrictions that had been active in June and July.

#Drought Monitor, Upper Mississippi Region pic.twitter.com/Qdu3AogRpY

— FarmPolicy (@FarmPolicy) October 6, 2023

“Although partly reflecting the start of harvest, the late-August rise in third quarter 2023 spot rates mostly stemmed from the tightened constraints on barge capacity.

“As of September 26, spot rates at St. Louis had reached $52.91/ton, up 6 percent from last year and up 115 percent from the previous 3-year average.”

#Drought Monitor - River Basins pic.twitter.com/0Bta2QT8m5

— FarmPolicy (@FarmPolicy) October 6, 2023

The Transportation report sated that,

In fourth quarter 2023, barged grain movements should begin to pick up as the corn and soybean harvests progress. However, if low-water conditions in the MRS continue, lack of precipitation may lead to increased restrictions, which would further shrink an already tight barge supply.

“The rising harvest demand and shrinking barge supply may lead to above average spot rates that approach last year’s record rates. However, lessons learned last year and early preventive measures may help mitigate conditions that created record-high spot rates seen in 2022.”

AMS added that, “In the longer term, USDA’s September World Agricultural Supply and Demand Estimates report projects, for MY 2023/24, 52.1 million metric tons (mmt) of U.S. corn exports (up 23 percent from MY 2022/23) and 48.7 mmt of U.S. soybean exports (down 10 percent from MY 2022/23). While the rise in grain exports could signal a greater demand for barges, over half of corn sales in the current marketing year are destined for Mexico, which is less reliant on barge transportation.”

Dow Jones writer Kirk Maltais reported on Friday that, “U.S. grains are likely to face shipping delays, as worsening drought conditions around the Mississippi River were reported by the U.S. Drought Monitor.”