As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

China Soybean Imports Could Set Record in 2023, While Black Sea Transit Concerns Arise

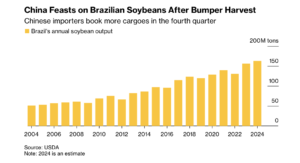

Reuters writers Mei Mei Chu and Naveen Thukral reported today that, “China’s soybean imports are likely to stay high through the fourth quarter, taking 2023 purchases to an all-time record, but lackluster demand from loss-making hog farms is seen reducing purchases in early 2024, traders and analysts said.

“Record Brazilian soybean supplies are expected to dominate China’s imports in the last three months of the year, they said, citing better oil and meal quality, reducing demand for U.S. cargoes in the world’s biggest market for the oilseed.

“The larger share of Brazilian soybeans in China’s import basket is likely to add pressure on benchmark Chicago futures which have slumped nearly 15% this year, snapping a four-year rally.”

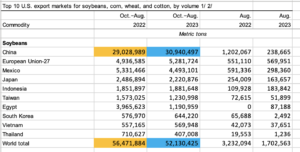

The Reuters article explained that, “Typically, freshly harvested U.S soybeans dominate the global export market from September as the Brazilian export season winds down. But this year China’s purchases from the U.S. are well below normal.

China will import around 26 million during the last three months of the year, with around 45% of the volumes arriving from Brazil, based on the forecasts of four trading sources.

“China’s soybean imports in January-September 2023 jumped 14.4% year-on-year to 77.8 million tons, according to customs data.”

Recall that China also has the potential to import a record amount of wheat this year.

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for December delivery rose 0.9% to $5.62 1/4 a bushel on the Chicago Board of Trade on Wednesday as analysts and traders anticipate China buying more wheat exports.”

“China’s buying of wheat exports on the world market — from varying sources including the U.S. — provided CBOT wheat with a lift,” Maltais noted; adding that, “If China has a larger-than-usual need for wheat exports as the marketing year progresses, it may ramp up the demand side of the market.”

And last month, China grain companies signed an agreement to purchase U.S. farm goods, although “the deals were signed as ‘frame contracts,’ which are typically non-binding letters of intent to buy at a later date, without formal sales terms.”

Meanwhile, Reuters News reported today that, “Ukraine said Russian warplanes dropped ‘explosive objects’ into the likely paths of civilian vessels in the Black Sea three times in the last 24 hours, but its fledgling shipping corridor was still operating.

“‘The lack of buy-in from Russia on the route raises questions about its long term viability, said Rod Baker at Australian Crop Forecasters, warning that because of this, ‘volatility does remain.’

“Ukraine has struggled to maintain its grain exports in recent weeks amid Russian attacks and blockades. However, wheat remains under pressure from an abundance of cheap wheat flowing from Russia.”

The Reuters article added that, “Russia should harvest 140 million metric tons of grain this year, its agriculture minister said last month, including 93 million tons of wheat. It is Russia’s second biggest harvest after last year’s record crop.”

More broadly with respect to Ukraine, Financial Times writer Roman Olearchyk reported today that “Ukraine is rushing to bolster its energy infrastructure ahead of winter as a renewed Russian aerial campaign starts to home in on the country’s power stations, seeking to leave its people in the dark and cold.

“Over the summer Russia largely targeted Ukraine’s seaports and grain-exporting infrastructure. But in recent weeks missile and drone strikes have again started to focus on energy infrastructure, as they did last year when they caused blackouts for days. This time around Kyiv is confident it is better prepared.”