Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

China to Encourage “More Reasonable Level” of Pig Production

Reuters writer Dominique Patton reported this week that, “China’s sow herd at the end of October was still larger than needed at 42.1 million pigs, state media reported on Monday, raising the supply of live pigs to the market and pressuring prices.

“The number of breeding sows was slightly lower than September’s 42.4 million and has been declining for 10 months.

“However, given the rising production rate of sows and lower than expected pork consumption, pig production capacity is still too much, said state broadcaster CCTV, citing the Ministry of Agriculture and Rural Affairs.”

Patton explained that, “The ministry will ‘stabilise’ land, environmental, financial and other supportive policies to encourage a more reasonable level of production, it added without providing further detail.”

Lower pork prices in China are considered to be “bad news” for soybean and corn exporters, as feed demand could be negatively impacted.

Meanwhile, Reuters writer Michael Hogan reported this week that, “Chinese importers are believed to have purchased some 66,000 metric tons of animal feed corn from Ukraine in the week, European traders said on Thursday.”

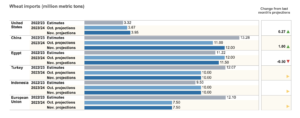

🇨🇳#China imported significantly more bulk commodities this October versus last October with the exception of #wheat. But YTD wheat and #barley imports are well above year-ago levels, while #corn and #pork are slightly below. YTD #soybeans are record high. pic.twitter.com/pERMz7BjC3

— Karen Braun (@kannbwx) November 20, 2023

And Reuters writer Mei Mei Chu reported today that, “China’s state-run food group COFCO Group said it had imported Canadian durum wheat for the first time, which it would process into flour.

“China mainly imports finished pasta or flour processed from durum wheat, COFCO said in a statement.”

The article explained that, “China has imported record volumes of wheat this year, with rain damage to its crop and worries over dry weather in exporting nations fuelling Beijing’s appetite to buy while prices are low.

“The world’s largest wheat consumer has imported 10.83 million tons of wheat in the first 10 months of this year, a 37.7% surge from a year ago, customs data showed.”

Also with respect to Chinese grain demand, Dow Jones writer Kirk Maltais reported this week that, “The USDA confirmed on Wednesday morning a new flash sale of U.S. wheat exports to China. Beijing purchased 110,000 metric tons of soft red winter wheat for delivery in the 2023-24 marketing year.”

Turning to soybeans, Maltais pointed out that,

According to data compiled by StoneX, more than 4.8 million metric tons of soybeans were sold from Brazil to China in October, while the U.S. sold only 228,623 tons of soybeans to China in the same period, a near 71% slide from the same time last year.

“The clear favoring of Brazil over the U.S. by China hurts sentiments around export demand.”

Elsewhere, Reuters writer Andrew Hayley reported this week that, “China will launch a series of pilot projects to spur domestic production and consumption of biodiesel, the National Energy Administration (NEA) has said, beefing up environmental efforts in an area where the country lags other big economies.

“Sparse policy support has kept consumption of biodiesel, a low-carbon alternative to petroleum diesel made from feedstocks such as palm oil and used cooking oil (UCO), low in China, compared to the the European Union and the United States.”