Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Chinese Soybean Demand Sizzles- “Enormous” U.S. Purchase Unfolds as “Soybean Diplomacy” Precedes Meeting

Bloomberg writer Agnieszka de Sousa reported on Friday that, “China is gobbling up staple crops from around the world.

“Just this week, national stockpiler Sinograin booked more than 1 million tons of US soybeans for delivery between December and March, people familiar with the matter said.

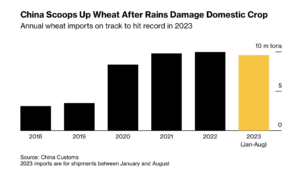

“The country has also been scooping up wheat in huge amounts, with imports heading for a record. Following a splurge on Australian wheat earlier in the year, large volumes were purchased last month from other main exporters including the US, Canada and France.”

The article pointed out that, “Bad weather has been an important driver of the buying spree. China has battled heatwaves, rains and cold snaps that have hurt its crops.

That’s threatening the government’s push to improve food security in a nation that accounts for about a fifth of humanity but only a 10th of arable land.

“In the long run, there are worries that China’s own food production won’t be able to maintain current lifestyles and eating habits, with changing diets, food waste and the loss of farmland all adding to the challenges,” the Bloomberg article said.

Recall that last month, China approved “dozens” of genetically modified corn and soybean varieties, which could enhance domestic production and food security.

Also last month, Chinese grain companies signed agreements to purchase U.S. farm goods, although the deals were nonbinding.

Elsewhere, Stella Yifan Xie reported in Friday’s Wall Street Journal that, “The weak inflation [in China] was mainly driven by a steeper decline in food prices, which fell 4% in October compared with a 3.2% decline in September. Prices of pork, a main dish on Chinese dinner tables, plunged 30% from a year earlier as oversupply haunts the industry.

“Dong Lijuan, a senior statistician with the statistics bureau, said the drop in consumer inflation was due to ‘sufficient supply of agricultural products as weather conditions improved,’ as well as a drop in consumption demand after a weeklong holiday in October.”

Also Friday, Bloomberg writer Tarso Veloso reported that,

Cargill Inc., the world’s biggest crop trader, said China just made an enormous purchase of US soybeans that underscores bullish momentum in the global oilseed market.

“The Asian nation rushed to secure more than 3 million metric tons of US soy on Tuesday and Wednesday, according to Alex Sanfeliu, Cargill’s head of world trading. That signals a much bigger appetite for the commodity than previously expected and comes at a time when plantings in Brazil, the top supplier, are being threatened by adverse weather.”

“‘The message is around: China is stocking up, buying more quantities than everyone thought,’ he said in an interview at Cargill’s Geneva office.”

Veloso added that, “China appears to be buying more soybeans than needed for domestic use, signaling the the world’s largest oilseed importer may be seeking to build up inventories to weather potential supply disruptions in a scenario that includes increased geopolitical risks, according to Sanfeliu.”

For additional perspective on China soy demand, recall that Reuters News reported earlier this month that, “China’s soybean imports are likely to stay high through the fourth quarter, taking 2023 purchases to an all-time record, but lackluster demand from loss-making hog farms is seen reducing purchases in early 2024, traders and analysts said.”

And Bloomberg writers Isis Almeida, Jennifer Jacobs, and Jenny Leonard reported on Friday that, “China is bringing back soybean diplomacy as the world’s second-largest economy seeks closer ties with the US ahead of a meeting between President Xi Jinping and his American counterpart Joe Biden.

“The Asian nation, the world’s top soybean importer, bought more than 3 million metric tons of the commodity from the US just this week, a volume that surprised the market. The move is a gesture of goodwill ahead of Biden-Xi talks scheduled to take place in San Francisco next week, according to people familiar with the matter who asked not to be named discussing governmental decisions.”

The Bloomberg article also explained that, “There are also some concern about the weather in Brazil, and long lines at the country’s ports. Falling prices in the US may also have lured buyers, said Chris Robinson, managing director of agriculture and commodities at TJM Institutional Services in Chicago.

“‘It certainly looks like the Chinese saw that six-month low as an opportunity,’ he said.”

Yasmeen Abutaleb and Ellen Nakashima reported in Saturday’s Washington Post that, “President Biden will meet with his Chinese counterpart Xi Jinping on the sidelines of an economic conference in San Francisco next week, one year after their last face-to-face meeting in Bali.

“The two leaders are expected to meet on Wednesday as they both travel to San Francisco for the Asia-Pacific Economic Cooperation conference, which is being held in San Francisco, senior administration officials told reporters during a call on Thursday. Biden and Xi have not had any direct communication since their last in-person summit last year.”

The Post article noted that, “The Biden administration has described China as the United States’ most serious long term strategic challenge and said it poses the most serious threat to the international order.”