Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Dollar Falls to Three Month Low

Financial Times writers Colby Smith and Stephanie Stacey reported yesterday that, “The dollar hit a three-month low on Tuesday and US Treasury yields slid as investors grew increasingly confident that the US Federal Reserve will start cutting interest rates by mid-2024.

“The US currency dropped 0.5 per cent against a basket of six peers to trade at its lowest level since mid-August.

“The decline accelerated after Christopher Waller, one of the Fed’s most hawkish policymakers, signalled that interest rates were unlikely to rise further and could be cut if inflation continued to slow.”

Smith and Stacey pointed out that, “The dollar is now on course for its worst monthly performance in a year, having shed 3.6 per cent since the start of November.”

“After 11 consecutive interest rate increases after March 2022, the central bank has kept its benchmark interest rate steady at a 22-year high of 5.25 per cent to 5.5 per cent since July,” the article said.

The FT article added that, “By contrast with Waller’s remarks, Michelle Bowman, his fellow Fed governor, said on Tuesday she still thought the central bank would probably need to increase rates further to bring inflation down in a ‘timely way.'”

And Karen Langley reported in today’s Wall Street Journal that, “Benchmark yields crept lower, with the yield on the 10-year U.S. Treasury note ending at 4.335%, down from 4.388% on Monday. Lower yields make the returns offered by the stock market more appealing to investors.

“One contributor to the decline in yields: Federal Reserve governor Christopher Waller, who has advocated raising interest rates to slow inflation, said Tuesday that recent signs of improvement should allow the central bank to hold rates steady into early next year.”

“The dollar weakened, with the WSJ Dollar Index ending the day at its lowest level since August,” the Journal article said.

Meanwhile, Reuters News reported yesterday that, “Deforestation in Brazil’s Cerrado, the world’s most species-rich savanna, rose 3% from August 2022 to July 2023 to 11,022 square kilometers (4,255.6 square miles), data from the country’s space research agency INPE showed on Tuesday.

“The area deforested in 12 months is the largest since 2015, the environment ministry said.

“It said 75% of the deforestation took place in the savanna of the states of Maranhao, Tocantins, Piaui and Bahia, a region known as Matopiba where soybean planting has surged in recent years.”

The article explained that,

The Cerrado biome has given way to Brazil’s expanding agricultural frontier for decades. Roughly half of the savanna’s vegetation has already been destroyed, with much of it converted to farms and ranches.

Reuters writer Peter Hobson reported today that, “Chicago soybean futures shed on Wednesday some of the gains from the previous session even as traders assessed the impact of hot and dry weather conditions in Brazil that are reducing yields in the world’s top producer.”

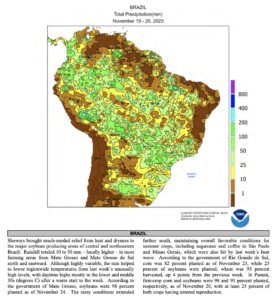

More narrowly with respect to weather conditions in Brazil last week, USDA indicated yesterday in its Weekly Weather and Crop Bulletin that, “Showers brought much-needed relief from heat and dryness to the major soybean producing areas of central and northeastern Brazil. Rainfall totaled 10 to 50 mm – locally higher – in most farming areas from Mato Grosso and Mato Grosso do Sul north and eastward.

“Although highly variable, the rain helped to lower regionwide temperatures from last week’s unusually high levels, with daytime highs mostly in the lower and middle 30s (degrees C) after a warm start to the week. According to the government of Mato Grosso, soybeans were 98 percent planted as of November 24.”

The Bulletin added that, “In Paraná, first-crop corn and soybeans were 98 and 93 percent planted, respectively, as of November 20, with at least 25 percent of both crops having entered reproduction.”

Elsewhere, Dow Jones writer Kirk Maltais reported yesterday that, “Ukrainian farmland is producing more crops than last year, but what is grown isn’t reaching the world export market. According to data from the country’s Agricultural Ministry, production is up 40% from last year, to 55.5 million tons through the end of last week.

“Driving this is a larger corn crop, which is up 84% from last year.

“However, grain exports out of Ukraine are down by roughly 30%.”