Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Fertilizer: Prices and Other Variables

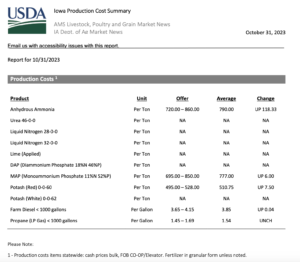

DTN writer Russ Quinn reported earlier this week that, “Average retail prices for all but one fertilizer were higher during the third week of October 2023 compared to last month, according to sellers surveyed by DTN.

“Prices for seven of the eight major fertilizers were higher compared to last month, with one up significantly, which DTN designates as anything 5% or more.

“The only fertilizer price that was up considerably was anhydrous, which was 8% higher compared to a month prior. The nitrogen fertilizer had an average price of $825 per ton.”

Quinn explained that, “Six other fertilizers were just slightly higher than last month. DAP had an average price of $713/ton, MAP $799/ton, urea $574/ton, 10-34-0 $610/ton, UAN28 $360/ton and UAN32 $418/ton.

“One fertilizer was just slightly lower in price compared to last month. Potash had an average price of $507/ton.”

The DTN article added that, “Seventeen new projects were recently announced by USDA highlighting progress made in the push to increase domestic fertilizer production, according to a USDA news release from Oct. 16. In 2022, USDA made $500 million available under the Fertilizer Production Expansion Program.”

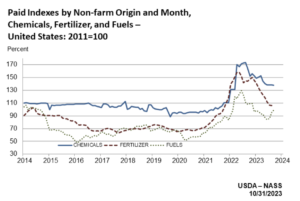

Also this week, in its monthly Agricultural Prices report, the USDA’s National Agricultural Statistics Service highlighted prices paid by farmers in September, and stated that, “Fertilizer: The index for September, at 107.0, is up 0.7 percent from August but down 26 percent from September a year ago. Since August, higher prices for nitrogen and potash & phosphate more than offset lower prices for mixed fertilizer.”

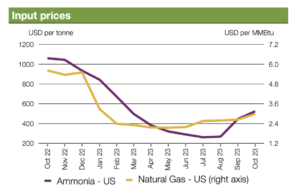

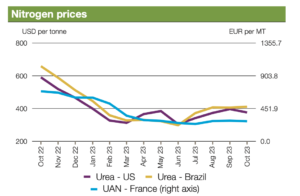

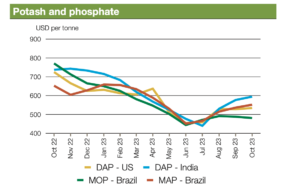

And yesterday, in its November Market Monitor report, the Agricultural Market Information System indicated that, “Fertilizer markets were mixed in October, with nitrogen and potash prices softening and phosphate markets showing signs of firmness.

“Overall, the fertilizer complex was characterized by cautious buying in October, but market activity can be expected to gradually fade as the year closes.

“Looking ahead, several risk factors persist including uncertain export availabilities out of China and European winter energy prices as well as tensions in the Middle East, where several major fertilizer suppliers are located.”

More narrowly on the Middle East, DTN writer Katie Micik Dehlinger reported this week that, “The Israel-Hamas war poses small direct risks to global fertilizer supply and demand, but should the conflict escalate, higher oil and natural gas prices could push prices higher.

“Rabobank farm inputs analyst Sam Taylor said Israel accounts for about 7% of global potash exports and 3% of phosphate exports. The potash and phosphate rock resources are mostly located in the Negev desert, more than 60 miles from the Gaza Strip, where most of the fighting is taking place.

“‘Everything seems to be functioning and flowing,’ Taylor said. ‘However, within the context of a broader mobilization, there is risk in the future that there could be some disruptions to logistics to manufacturing, but there’s nothing to report now.'”

Meanwhile, Reuters writer Rishav Chatterjee reported this week that, “Global miner BHP Group said on Tuesday it would invest $4.9 billion in stage two of its Jansen potash project in Canada to double capacity by the end of the decade.

“The world’s biggest listed miner has picked potash, used in fertilisers, as one of its pillars of future growth, betting that it would be essential for food security and more sustainable farming.”

Dow Jones writer Stephen Nakrosis reported on Wednesday that, “Fertilizer company Nutrien said it sees fertilizer demand increasing, with demand in the fourth quarter expected to grow in both the U.S. and Brazil.”

The article pointed out that, “The U.S. harvest has progressed at an above average pace, Nutrien said, adding ‘fall fertilizer application rates have been strong in regions where harvest has been completed.’ The company expects fertilizer demand to rise 5% to 10% in the fourth quarter, compared to the year-ago period.”

Also on Wednesday, Reuters News reported that, “Nutrien fell short of analysts’ estimates for third-quarter profit on Wednesday, as lower potash prices weighed on the world’s biggest fertilizer producer.

“Potash prices have been falling after shipments from Belarus and Russia resumed. These exports had been significantly restricted last year following Western sanctions imposed on Russia in response to its invasion of Ukraine.”

Yesterday, Bloomberg writer Kim Chipman reported that, “The world’s largest maker of crop nutrients is cautioning against any meddling in the economics of fertilizer markets.

“‘The artificial injection of artificial constraints into supply-and-demand fundamentals never really works very well,’ Nutrien Ltd. Chief Executive Officer Ken Seitz said during an interview Thursday.

“The warning followed an Iowa Corn Growers Association call for US scrutiny of fertilizer pricing and the impact higher costs have on farmers and consumers. The group said it’s seeking increased transparency so growers can better understand ‘reoccurring’ price increases.”

Elsewhere, Dow Jones writer Kirk Maltais reported this week that, “Fertilizer prices could head higher if the Mississippi River doesn’t get enough precipitation this winter, Mark Milam of ICIS said. Low water levels limiting fertilizer-carrying barges this past marketing year could be repeated. Rainfall would be better than snow to replenish the river, he said.”

Financial Times writers Shotaro Tani and Alice Hancock reported this week that, “The EU’s stores of natural gas are nearing full capacity, leading the bloc’s energy companies to park excess reserves in Ukraine ahead of the peak demand of the winter months.”

The FT article noted that, “The figure indicates that the region has stored far more gas to date this year than some had feared in the aftermath of Russia’s full-scale invasion of Ukraine, because of continued imports of liquefied natural gas and reduced demand.

“That makes the EU less vulnerable to an energy shock, although it falls far short of a guarantee that the continent will have all the energy it needs for the coming winter.”