The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

U.S. Wheat Exports Falter to “Unprecedented” Lows, While Chinese Pork Prices Impact Deflation Prospects

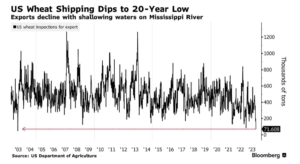

Bloomberg writers Michael Hirtzer and Dominic Carey reported yesterday that, “American wheat shipments dropped to a two-decade low, hampered by a shrinking Mississippi River and competition from ample global grain supplies.

“Drought has dried up the Mississippi, where roughly two-thirds of US grain exports historically have been shipped on barges to the US Gulf. Water levels have improved slightly from last month’s record low, but the world’s crop buyers have already been purchasing more supplies from elsewhere. That’s limited demand for US grain and contributed to the country losing its status as the shipper of choice.”

#Drought Monitor - River Basins

— FarmPolicy (@FarmPolicy) November 6, 2023

* Mississippi #grain barge traffic, harvest... pic.twitter.com/ne6FFVbGM4

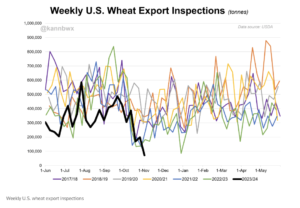

Dow Jones writer Kirk Maltais reported yesterday that, “Inspections of U.S. wheat shipments through the week ended Nov. 2 fell to below 100,000 metric tons for the week, according to the Department of Agriculture.

“In its latest weekly grain export inspections report, the USDA said that wheat inspections totaled 71,608 tons. That is down from 198,298 tons reported for the previous week, and down from 181,989 tons at the same time last year.

For the 2023/24 marketing year, wheat inspections are down nearly 27%.

“Only a few countries were on the books as receiving shipments of U.S. wheat for the week, with Mexico and Egypt being the leading destinations, constituting 64,640 tons of shipped wheat.”

Reuters columnist Karen Braun indicted today that, “U.S. wheat shipments typically weaken at this time of year as soybean exports take the stage, but last week’s decline was unprecedented, reflecting the United States’ shrinking share of world wheat trade.

“Only 71,608 metric tons of U.S. wheat were inspected for export in the week ended Nov. 2, the lowest for any week since records began in January 1983. That surpasses the previous low of 85,672 tons set in late December 2022.”

Braun added that, “One bright spot for U.S. wheat exporters is that China has recently made its largest U.S. wheat purchases in over a year, as heavy rains may have damaged up to 20% of China’s wheat crop. Chinese importers have about 813,000 tons of U.S. wheat on the books as of Oct. 26, up notably from a year ago but a bit less than in 2021.”

Meanwhile, Reuters writer Naveen Thukral reported today that, “The U.S. Department of Agriculture (USDA) on Monday rated 50% of the U.S. winter wheat crop in good-to-excellent condition, up three percentage points from the previous week and the highest for this time of year since 2019 as soil moisture improved in the Plains following a three-year drought.

.@usda_oce Wx: Plains- Conditions are nearly ideal for summer crop harvesting and winter #wheat growth, although pockets of #drought remain a concern with respect to proper wheat establishment. pic.twitter.com/4Gr12DBPdX

— FarmPolicy (@FarmPolicy) November 6, 2023

“The market is monitoring uneven crop weather in Brazil, where soybean planting has been delayed. Dryness is a concern in the leading soy-producing state Mato Grosso, while heavy downpours have soaked southern areas.”

Thukral added that, “The corn harvest was 81% complete by Sunday, slightly below the average analyst estimate of 82% but ahead of the five-year average pace of 77%.

“Similarly, the soybean harvest was 91% done, behind the average estimate of 92% but ahead of the five-year average of 86%.”

Elsewhere, Hudson Lockett reported yesterday at The Financial Times Online that, “Tumbling pork prices could push China back into deflation this week, as the largest listed hog farmers flood the domestic market and complicate Beijing’s efforts to bolster confidence in the world’s second-largest economy.

“Live hog futures traded on China’s Dalian Commodity Exchange have dropped about 15 per cent since the start of October, reflecting a sharp deterioration in expectations for nationwide pork prices. Wholesale pork prices in China are down more than 40 per cent from a year ago.

“Economists say the falling cost of pork, with its heavy weighting in China’s official consumer price index, is likely to tip the country back into deflation when October data is released on Thursday.”

China’s deflationary pressures just aren’t going away, underscoring the fragility of the economic recovery as 2023 enters the home stretch.https://t.co/1NM45QZqSV pic.twitter.com/JFEZGK7jSE

— Stuart Wallace (@StuartLWallace) November 5, 2023

And Reuters writer Joe Cash reported yesterday that, “China’s imports unexpectedly grew in October while exports contracted at a quicker pace, in a mixed set of indicators that showed the world’s second-largest economy facing persistent risks despite a recent improvement in domestic demand.

“The trade figures follow a run of mostly upbeat data that showed Beijing’s support measures have helped bolster a tentative comeback, although a protracted property crisis and soft global demand continue to dog policymakers heading into 2024.”

Cash added that, “Soybean imports jumped 25% from a year earlier, as the surge in cheap and plentiful shipments from Brazil continued.”