As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA Provides Glimpse of 2024 U.S. Planted Acreage, While Fertilizer Prices Mostly Higher

Earlier this week, the U.S. Department of Agriculture released the U.S. focused portion of its upcoming Agricultural Projections to 2033 report. The full report is due to be released in February 2024.

USDA explained that, “These projections use the October 12, 2023, World Agricultural Supply and Demand Estimates (WASDE) report as the starting point, and macroeconomic forecasts developed in August 2023.”

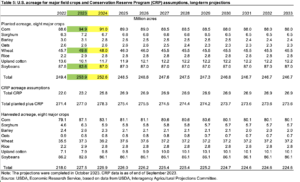

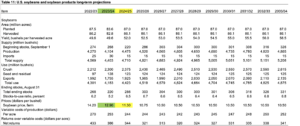

With respect to acreage, USDA showed 2024 planted corn acreage at 91 million, down from 94.9 million this year, and soybean planted acreage at 87 million acres, up from 83.6 million in 2023.

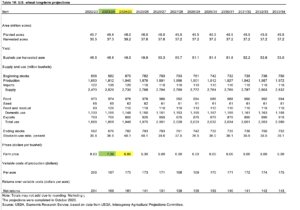

Wheat planted acreage is projected at 48 million, down from last year, while total planted acreage is also expected to fall in 2024.

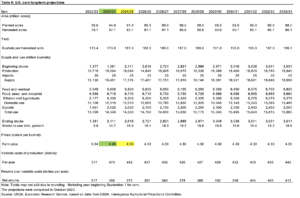

Corn and soybean prices are projected to decline. The 2024/25 prices for corn is projected at $4.50 (down from $4.95), and the anticipated soybean price is $11.30 (down from $12.90).

Likewise, the wheat price is expect to fall to $6.80 from $7.30 in 2023/24.

And today, Reuters writer Naveen Thukral reported that, “Chicago soybeans firmed on Thursday, with the market trading close to last session’s two-month high, as strong Chinese demand and Brazilian planting delays supported prices.”

“Chinese importers bought at least five more U.S. soybean cargoes on Wednesday in a second day of active buying after booking their largest purchases in months a day earlier.”

Thukral explained that, “Chicago soybean futures slumped to a 22-month low in October on U.S. harvest pressure and weak export demand. But futures have been trending upward as erratic weather has caused problems in the world’s No. 1 exporter Brazil and demand for U.S. cargoes underpinning the market.

“Wheat rallied on Wednesday on renewed concerns about the Black Sea export corridor after Ukrainian officials said a Russian missile damaged a Liberia-flagged civilian vessel entering a Black Sea port in the Odesa region.”

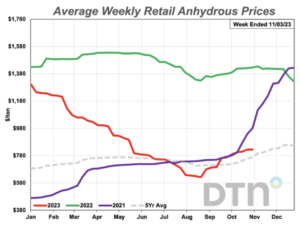

Elsewhere, DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices continue to be mostly higher, according to prices tracked by DTN for the last week of October 2023.

“Six of the eight major fertilizers were higher compared to last month. DTN designates a significant move as anything 5% or more.

“The only fertilizer with a considerably higher move was once again anhydrous, which was 5% higher compared to last month. The nitrogen fertilizer had an average price of $826 per ton.”

And Bloomberg writer Gerson Freitas Jr. reported earlier this week that, “Fertilizer stockpiles will need replenishing next year, boosting the demand outlook for the slumping crop nutrients industry, according to supplier Mosaic Co.

Global shipments of potash, a key crop nutrient, are expected to increase by 5 million metric tons next year to reach 70 million metric tons, Chief Executive Officer James O’Rourke said Wednesday during an earnings call. Such a volume would be the highest since at least 2021, prior to Russia’s invasion of Ukraine.

“Supplies have remained constrained by sanctions on exports from key producer Belarus as well as logistical constraints amid dwindling inventories. Even so, nutrient prices have declined after a surge in the past two years prompted farmers to cut down on use, leaving distributors with a glut.”

The article added that, “Farmers around the world are now seeking to replenish soil nutrients, leading to a rebound in demand for potash and phosphates when supplies are tight. The company’s shipments of potash and phosphate to meet demand from North American farmers during the spring planting season were the highest in five years, O’Rourke said.”

Also, Reuters News reported today that, “Russian President Vladimir Putin called for the development of wheat and fertiliser cargo transport routes in Asia during a visit to Kazakhstan on Thursday, as Russia seeks to forge new export routes due to Western sanctions.

“Chairing a conference on agricultural cooperation with Kazakh President Tokayev, Putin said Russia would have about 60 million metric tons of wheat available for exports from this year’s strong crop.”

Bloomberg writers Celia Bergin and Aine Quinn reported yesterday that, “Russia is looking to keep its seasonal grain export quota at an elevated level that’s unlikely to curb shipments, following another bumper wheat harvest.

“It will likely set a grain-export quota of 24 million tons for the second half of the season, from Feb. 15 to the end of June, Interfax reported, citing First Deputy Agriculture Minister Oksana Lut. The amount of the quota designated for wheat wasn’t specified.”