As 2026 ushers in a fresh start, agricultural economists say the U.S. farm economy has stopped sliding, but it’s far from fully healed.The December Ag Economists’ Monthly Monitor shows month-to-month…

USDA Lowers Agricultural Export Forecast and Trade Aid Payments Begin, as Markets Continue to Adjust

In its latest quarterly forecast for U.S. agricultural trade on Thursday, USDA reduced its fiscal year (October/September) 2019 export projections, “largely due to decreases in soybeans and cotton.” And news articles this week provided additional insight into the market ramifications of the ongoing trade war with China, while trade aid payments from USDA have begun to made to producers. With this background in mind, President Trump and China’s President Xi Jinping are scheduled to meet on Saturday at the Group of 20 summit in Buenos Aires.

USDA Export Forecast

In Thursday’s “Outlook for U.S. Agricultural Trade,” USDA indicated that, “Fiscal year (October/September) 2019 agricultural exports are projected at $141.5 billion, down $1.9 billion from fiscal year 2018 and $3.0 billion from the August 2018 forecast, largely due to decreases in soybeans and cotton.

Soybean export volumes are down because of declining Chinese purchases from the United States as a result of trade tensions, and as a record U.S. crop continues to pressure soybean prices lower.

The report noted that, “Fiscal year 2019 grain and feed exports are forecast at $33.8 billion, up $700 million from the August 2018 forecast, due mainly to corn and wheat. Corn is forecast at $11.8 billion, up $600 million on higher export volumes, as U.S. corn is price-competitive. Sorghum is lowered $300 million to $500 million on a slower export pace with the loss of the Chinese market…[and]…Wheat is forecast at $7.5 billion, up $400 million from the August forecast on higher volumes, and nearly $2.5 billion above FY2018 levels.”

More narrowly on soybeans, USDA stated that, “Record U.S. soybean production continues to pressure soybean prices lower. Declining China soybean purchases from the United States have pushed U.S. export volumes lower, and China is expected to source its soybean imports primarily from South America.”

Meanwhile, in its monthly Agricultural Prices report Thursday, USDA’s National Agricultural Statistics Service pointed out that, “The soybean price, at $8.58 per bushel, is 19 cents lower than September and 60 cents lower than October last year.”

#Iowa: The October 2018 average price received by #farmers for #soybeans, at $8.71 per bushel, was up $0.27 from the September price but $0.44 below the October 2017 price, @usda_nass pic.twitter.com/HVebPWqSUB

— Farm Policy (@FarmPolicy) November 29, 2018

Markets Continue to be Impacted by Tariffs, While USDA Trade Payments Begin

Bloomberg writers Shruti Singh and Dominic Carey reported earlier this week that, “Argentina has become the epicenter of soybean trading dynamics — at least for now.

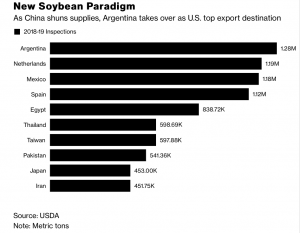

“The South American nation has risen to become the top buyer of U.S. beans in the last three months as China looks elsewhere in an escalating trade war with the Trump administration. Almost 1.3 million metric tons of U.S. oilseed have been inspected for export to Argentina from Sept. 1 through Nov. 22, according to the U.S. Department of Agriculture. That compares with none in the same year-ago period, USDA data show.”

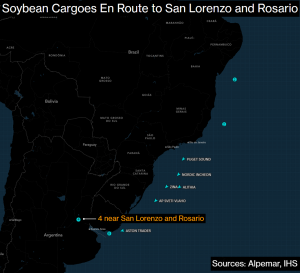

In addition, Bloomberg writers Shruti Singh, Pablo Rosendo Gonzalez, and Kevin Varley reported on Wednesday that, “A long line-up of ships waiting to unload soybeans in Argentina offers a stark reminder of what’s at stake for the oilseed market when Donald Trump and Xi Jinping meet in the country later this week.”

“There are 19 vessels en route or lined up to unload American soybeans in Argentina’s San Lorenzo and Rosario ports, shipping agency data show. There were no U.S. bean cargoes to Argentina last year,” the Bloomberg article said.

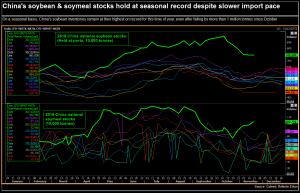

Reuters writers Naveen Thukral and Hallie Gu reported Tuesday that, “China’s imports of soybeans are set to drop as an outbreak of African swine fever hits its huge pig herd and saps demand for the animal feed ingredient, making it easier for buyers to keep shunning U.S. cargoes amid the Sino-U.S. trade war.

“African swine fever, deadly to pigs but not harmful to people, has spread rapidly through China, with more than 70 cases reported across farms since early August.

“That and already large soy inventories are curbing appetite for beans in what is by far the world’s biggest importer of the commodity, traders and analysts said, meaning buyers are unlikely to need to return to importing U.S. crops anytime soon.”

Also on Tuesday, Associated Press writer David Pitt reported that, “American farmers still working to get out their remaining soybeans after a weather-plagued harvest season are struggling to figure out what to do with a record crop now their traditionally dominant export market is largely closed.

Usually by this point in the year, 100-car trains filled with North Dakota soybeans would be moving to ports on the West Coast destined for China. But this year is different, after China all but stopped buying U.S. soybeans in response to President Donald Trump’s trade tariffs. Fearful of economic failure, farmers are frantically trying to determine how to store a potentially 1 billion-bushel surplus until it can be sold at a decent price.

The article noted that, “‘Individually, we’ve got some problems out there,’ said Chad Hart, an agricultural economist at Iowa State University. ‘This squeeze will be enough to put a few farmers out of business.'”

And Greg Hilburn reported this week at the Monroe News-Star (Monroe, La.) Online that, “U.S. Rep. Ralph Abraham filed a bill Monday to help Louisiana soybean farmers mitigate losses created by Chinese tariffs.

“Thousands of acres of Louisiana soybeans were left to rot in the field because of a lack of storage and market for the crop.”

The article explained that, “Soybeans from the Midwest that were being shipped to West Coast ports and destined for China were instead barged down the Mississippi River and parked in Louisiana ports and elevators.

“That left little to no room or markets for Louisiana soybeans that were damaged by an unusually wet September.”

Mr. Hilburn pointed out that, “The U.S. Department of Agriculture’s Market Facilitation Program was designed to mitigate losses, but only harvested acres were eligible for the $1.65-per-bushel tariff retaliatory relief as part of the agency’s $12 billion rescue package.

“Abraham’s bill would amend the MFP to allow payments in some circumstances based on ‘planted acres‘ instead of ‘harvested acres.'”

Also with respect to the MFP payments, Joseph Morton reported on the front page of Wednesday’s Omaha World-Herald that, “Checks are starting to trickle out from the Trump administration program aimed at helping farmers hurt by the ongoing trade disruptions.”

The article stated, “‘The payments might be really substantial, they might just cover my costs of storage,’ [Gary Langbein, who grows corn and soybeans in northwest Iowa] said. ‘I don’t know what’s going to happen. You don’t know what to do.'”

Mr. Morton added that, “Farmers say they would much prefer to sell their products than take the government payments, but under the circumstances, they are accepting the help offered.”

And Reuters writers P.J. Huffstutter and Mark Weinraub reported Wednesday that, “So far, $837.8 million of the total promised $12 billion [in trade aid] has been paid out, according to the USDA.

“For Indiana farmer Randy Kron, the corn trade aid means about $900, enough to pay for a few parts for his planter, or some seeds for next spring’s planting. His son, who helps them run their 2,200 acre crop farm, thinks the amount isn’t worth the effort.”

In addition, New York Times writer Patricia Cohen reported Thursday that, “Justin Knopf finished harvesting soybeans as November’s first snowflakes started falling on his fields in Gypsum, Kan. Then he did what thousands of farmers throughout the grain belt are doing: He got an application for some of the $12 billion in federal emergency relief intended to blunt the economic fallout from President Trump’s trade policy brinkmanship.”

The past year has tested the patience and resilience of Mr. Knopf, 40, who lives on the farm with his wife, Lindsey, and three children. For now, he is waiting to see what happens when Mr. Trump and President Xi Jinping of China meet at the Group of 20 summit meeting in Argentina on Friday and Saturday before deciding what to do with the rest of his soybean harvest.

Ms. Cohen also pointed out that, “The growing cycle has started again, and Mr. Knopf is planning next year’s crop. The meeting this week between Mr. Trump and Mr. Xi, he said, is ‘really important to farmers who are already beginning to think about and make plans for spring.’

“Without an accord by planting season, ‘I think the mood is going to sour pretty quickly,’ he said. ‘Patience will run out.'”

Here's what Trump's "very close to something" with China means to soy markets: pic.twitter.com/s1VA1q89nC

— Tina Davis (@tina_davis) November 29, 2018

Lastly, A farm management specialist says USDA’s Market Facilitation Program will benefit farmers struggling this year.

‘Midwest farmers that raise soybeans will get a considerable payment. It will make the difference between profitability and unprofitability on those soybean acres.’

“Gary Schnitkey with the University of Illinois used an average of $54 per acre on soybeans for the average Illinois farm with a 50-50 corn-soybean rotation for his estimate of the impact in the first round of payments. ‘If we’re looking at a typical commercial farm in Illinois, which would be about 1,500 acres, that payment would add about $40,000 of income to that farm.’ He says if the trade dispute continues, farm incomes will be much lower next year.”