Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Weekend in Buenos Aires: USMCA Signed, and China Has Agreed to Start Purchasing Ag Products

This weekend in Buenos Aires, President Trump took important trade policy action that could impact U.S. agricultural markets. After signing the USMCA, the president indicated that he would quickly withdraw from NAFTA, in an effort to pressure the legislative branch into action on the updated trade measure. Meanwhile, a White House statement at the conclusion of the president’s meeting with Chinese President Xi Jinping Saturday night, indicated that, “China has agreed to start purchasing agricultural product from our farmers immediately.”

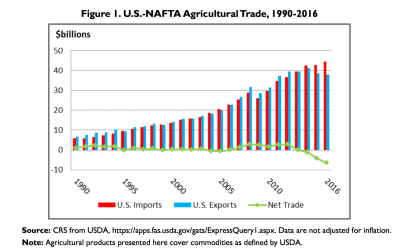

NAFTA – USMCA

Bloomberg writers Josh Wingrove, Jenny Leonard, and Nick Wadhams reported Friday that, “The U.S., Canada and Mexico signed a new trade deal championed by President Donald Trump to replace the quarter-century-old Nafta pact, capping a year of intense negotiations and offering a glimmer of certainty amid rising global tensions over trade.

“Trump, Canadian Prime Minister Justin Trudeau and outgoing Mexican President Enrique Pena Nieto signed an authorization for the deal on Friday morning in Buenos Aires on the sidelines of the Group of 20 summit, with their ministers signing it shortly after. The vast majority of the pact still needs to be ratified by lawmakers in the three countries but the signing enacts a handful of immediate protections, such as from auto tariffs.”

YESTERDAY: President Trump participates in signing ceremony for North American trade deal https://t.co/IRruVYFZTn pic.twitter.com/QI6KaDuIxY

— The Hill (@thehill) December 1, 2018

Looking ahead at the next steps on the trilateral agreement, New York Times writer Glenn Thrush reported Sunday that, “President Trump announced his intention late Saturday to quickly withdraw the United States from the North American Free Trade Agreement, a move intended to force House Democrats to enact a revised version of the pact despite concerns that it fails to protect American workers.

“‘I will be formally terminating Nafta shortly,’ Mr. Trump told reporters aboard Air Force One en route from the Group of 20 conference in Buenos Aires, a day after appearing at a ceremonial signing of the new deal with Canada and Mexico.

If the president follows through on his threat, congressional leaders will have six months to pass the measure. The agreement has been losing support in recent days as Democratic lawmakers, ready to take control of the House in January, reckon with fallout from the announcement last week that General Motors was planning to idle five plants in North America.

Mr. Thrush explained that, “If no deal can be reached, both versions of the treaty would be void, which would result in far more restrictive trade that could have a severe impact on industry and agriculture in all three nations, economists have warned.”

Meanwhile, Jacob M. Schlesinger and Valentina Pop reported on the the front page of Saturday’s Wall Street Journal that, “President Trump, after arm-twisting Mexico and Canada to update the region’s free-trade zone, will now turn his attention to the greater challenge of winning concessions from Chinese President Xi Jinping.”

The Journal article pointed out that, “The split-screen images of Mr. Trump in Argentina—settling one trade dispute while bracing for a showdown over another—illustrates the policy evolution of a president who won office vowing to shake up a decades-old, global commercial order.”

“Mr. Trump’s willingness to strike a deal to rewrite Nafta—instead of killing it, as he has regularly threatened to do—has reassured big business and free-traders. It showed his willingness to keep and even expand free-trade zones, provided trading partners are willing to accept certain new strings attached,” Saturday’s article said.

U.S., China Talks

Wall Street Journal writers Lingling Wei, Bob Davis and Alex Leary reported Sunday that, “China and the U.S. agreed to a cease-fire in a trade battle that has shaken global markets, with the U.S. postponing plans to increase tariffs on $200 billion in Chinese goods and the two sides entering negotiations on other contentious issues.

The truce was designed to ease tensions after months of escalating trade conflict, and held out the prospect that the world’s two largest economies could find an accommodation that would set their trading relationship on a different path. Amid the consensus, though, there were already differing interpretations over what happens next, possibly portending the difficult talks to come.

The Journal writers pointed out that, “According to the White House, the two nations will discuss thorny issues of Chinese economic policy, including forced technology transfer, intellectual-property protection, non-tariff barriers, cyberintrusions and cybertheft, services and agriculture. The two sides would ‘endeavor’ to wrap up the talks in 90 days.

“Should the talks fail, the White House said, the tariffs on the $200 billion of goods would increase to 25% from the current 10%. The tariffs were set to increase to that level on Jan. 1.

“Chinese Foreign Minister Wang Yi and Commerce Vice Minister Wang Shouwen, in a press briefing, said only that the talks would focus on removing all U.S. tariffs and Chinese retaliatory tariffs and made no mention of a deadline.”

Washington Post writer David J. Lynch reported Saturday that, “But the partial accord [between the U.S. and China] recalled previous deals that administration officials have disparaged as unenforceable and unproductive.”

And Los Angeles Times writer Don Lee reported Saturday that, “Ahead of the dinner, analysts were projecting one of three possible outcomes: a grand bargain with substantive action steps; a superficial deal without clear commitments; or essentially the status quo.

“While details were sketchy, the result looked to be somewhere between the first and second.”

The U.S.-China trade war is on hold after Trump and Xi agreed not to introduce new tariffs for 90 days pic.twitter.com/1rnFGmekWA

— TicToc by Bloomberg (@tictoc) December 2, 2018

Mark Landler reported on Saturday at The New York Times Online that, “[The handshake deal between Mr. Trump and Mr. Xi] will reassure jittery financial markets, as well as American farmers, who worried about the fallout from a prolonged trade battle.”

Farmers will be a a very BIG and FAST beneficiary of our deal with China. They intend to start purchasing agricultural product immediately. We make the finest and cleanest product in the World, and that is what China wants. Farmers, I LOVE YOU!

— Donald J. Trump (@realDonaldTrump) December 3, 2018

My meeting in Argentina with President Xi of China was an extraordinary one. Relations with China have taken a BIG leap forward! Very good things will happen. We are dealing from great strength, but China likewise has much to gain if and when a deal is completed. Level the field!

— Donald J. Trump (@realDonaldTrump) December 3, 2018

President Xi and I have a very strong and personal relationship. He and I are the only two people that can bring about massive and very positive change, on trade and far beyond, between our two great Nations. A solution for North Korea is a great thing for China and ALL!

— Donald J. Trump (@realDonaldTrump) December 3, 2018

More specifically, Bloomberg writer Shruti Singh reported Saturday that,

Soybeans weren’t on menu, but it looks like President Donald Trump’s dinner date in Buenos Aires with his Chinese counterpart Xi Jinping could give the market the jolt it’s been desperately looking for.

“China will start buying U.S. agriculture products ‘immediately,’ the White House said in a statement Saturday after the highly anticipated dinner on the sidelines of the Group of 20 summit in Argentina. This marks a significant development in the trade war that has beleaguered American farmers.

President Trump negotiated a “ceasefire” w/ China on trade. Initial reports say that agreement included a commitment from China to buy more American ag commodities & energy. Very encouraging signs & welcomed news for our farmers, who have been patriots during these negotiations.

— Rep. Ralph Abraham (@RepAbraham) December 2, 2018

Great to hear the White House announce a very positive step forward with China last night after its president agreed to purchase more US agricultural products and negotiate an end to its abuse of American intellectual property in exchange for a delay in tariffs.

— Rep. Adrian Smith (@RepAdrianSmith) December 2, 2018

“As tit-for-tat tariffs ratcheted up between the countries, soybeans became the poster child of the trade dispute. China, the world’s dominant importer, started shunning U.S. supplies and Chicago futures tumbled as a result. Across the Midwest, the 2018 harvest had been piling up, unsold, in silos, bins and bags.”

The Bloomberg article noted that, “Many traders and farmers are hoping an eventual China-U.S. pact can help bring things back to normal, or at least make them more predictable.”

“As the Trump-Xi meeting concluded late Saturday, U.S. markets were still shut and won’t reopen until Sunday night,” the Bloomberg article said.

Nonetheless, a separate Bloomberg News article from Sunday reported that, “The U.S. and China emphasized different results from Sunday’s high-stakes meeting between Presidents Donald Trump and Xi Jinping, with the split highlighting how much of a gap needs to be overcome over the next three months.

Confused about what exactly Xi and Trump promised each other yesterday?

— Peter Martin (@PeterMartin_PCM) December 2, 2018

Here's a side-by-side comparison of the readouts from both sides. The U.S. on the left, China on the righthttps://t.co/5N7aISEdew@LucilleLiu @JDMayger @Jeffrey_Black pic.twitter.com/kVVCB8wiqI

“After a dinner which both sides called ‘highly successful,’ White House Press Secretary Sarah Huckabee Sanders and Chinese Foreign Minister Wang Yi released parallel and rarely overlapping statements. The U.S. listed what China had agreed to in exchange for a 90-day pause in raising tariffs on Chinese goods, while Beijing focused on the broad reduction in trade tensions, without going into specifics.”

Bloomberg writer Alfred Cang reported on Sunday that, “Soybeans led advances among U.S. crop futures after the White House said China agreed to immediately restart buying American farm products as part of a trade truce between the two countries.

“The oilseed jumped as much as 3.2 percent to the highest since June in Chicago, as corn and wheat also climbed, while Chinese soybeans fell on expectations of more supply. President Donald Trump and his Chinese counterpart agreed to pause the introduction of new tariffs and intensify trade talks, a significant turnaround in relations between the U.S. and one of its top customers for farm products.”

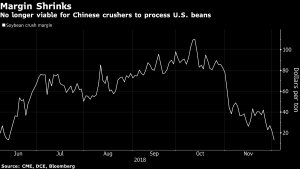

However, in a separate Bloomberg article on Monday, Mr. Cang pointed out that,

For a soybean farmer in Iowa or Illinois, it may be premature to celebrate the ceasefire in the trade war between the U.S. and China.

“After all, there’s still no sign of any easing in the 25 percent retaliatory tariff that China levies on imports of American soybeans, and while the U.S. said China agreed at the summit in Buenos Aires to immediately restart purchases of agricultural products, this wasn’t mentioned in the Chinese statement.

“Plus, market moves on Monday in reaction to news of the truce have so far only worsened crushing margins in China, with benchmark soybean futures rising in Chicago and soybean meal and soybean oil declining in Dalian.”

The Bloomberg article cautioned that, “The different statements issued by the U.S. and China on the outcome of the meeting between President Donald Trump and his counterpart Xi Jinping at the weekend highlight how much needs to be achieved in the next three months if the U.S. soybean farmer is to find any kind of solace from rising stockpiles.”

And Reuters writers Hallie Gu and Dominique Patton reported on Monday that, “China will need to drop its steep tariffs imposed on a range of American farm products earlier this year before it can fulfill its pledge to buy a ‘very substantial’ amount of U.S. goods, said Chinese traders on Monday.”

The article noted that, “But no substantial purchases can happen with a 25 percent duty still in place on U.S. soybeans, corn, sorghum and wheat, said buyers and analysts.

“‘How can you buy U.S. products if China does not reduce the tariffs? We haven’t made any move yet,’ said a trader with a major Chinese trading house. He declined to be identified as he was not allowed to be quoted by media.”