A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Ag Trade Issues: EU and China

As the U.S. and European Union trade negotiations unfold, the two sides have competing perspectives over what will be discussed: The U.S. has included agriculture in its Summary of Specific Negotiating Objectives, while the EU has not. Despite the discord, recent trade data indicates that the EU has purchased an increasing amount of U.S. soybeans. Meanwhile, Bloomberg News reported Friday that Chinese negotiators made a “buying spree offer” during the U.S.-China trade discussions earlier this month in Beijing.

U.S.- EU Trade Talks- Agriculture

Recall that back in July, the U.S. and the European Union agreed to renew trade talks.

A Joint U.S.-EU Statement on July 25th noted that, “We met today in Washington, D.C. to launch a new phase in the relationship between the United States and the European Union – a phase of close friendship, of strong trade relations in which both of us will win, of working better together for global security and prosperity, and of fighting jointly against terrorism…This is why we agreed today, first of all, to work together toward zero tariffs, zero non-tariff barriers, and zero subsidies on non-auto industrial goods. We will also work to reduce barriers and increase trade in services, chemicals, pharmaceuticals, medical products, as well as soybeans.

“This will open markets for farmers and workers, increase investment, and lead to greater prosperity in both the United States and the European Union. It will also make trade fairer and more reciprocal.”

A Des Moines Register article from July 26th reported that, “Trump boasted of his verbal agreement with leaders of the European Union, (‘we’re starting the documents,’ Trump said as an aside), that would move toward the elimination of trade barriers.

The Register article quoted President Tump as saying: “We just opened up Europe for you farmers. You’re not going to be too angry with Trump, I can tell you.”

However, The Wall Street Journal reported on July 27th that, “While Mr. Trump told an Iowa crowd [July 26th] that ‘we just opened up Europe for you farmers,’ officials in Brussels later said he did no such thing.”

More recently, Reuters writer David Lawder reported earlier this month that, “The United States on [January 11th] signaled it would not bow to the European Union’s request to keep agriculture out of planned U.S.-EU trade talks, publishing negotiating objectives that seek comprehensive EU access for American farm products.”

Last week, The Wall Street Journal quoted Iowa GOP Senator Chuck Grassley as saying: “I don’t know how anybody in Europe that wants a free-trade agreement with us [can] expect it to get through the United States Senate if you don’t want to negotiate agriculture.”

I am pleased @realdonaldtrump and @USTradeRep have included agriculture, including sanitary & phytosanitary issues, in objectives for US-EU trade negotiations. There are too many outstanding issues to sideline these sectors from discussion. https://t.co/393DOCCynB

— Rep. Adrian Smith (@RepAdrianSmith) January 12, 2019

Reuters writer Philip Blenkinsop reported late last week that, “The European Union is willing to discuss car tariffs but will not remove duties on farm products in trade talks with the United States, its trade chief said on Friday, setting it on a possible collision course with Washington.

“The European Commission, which coordinates trade policy for the 28 member European Union, published two negotiating mandates on Friday, which were notable more for what they left out than for what they included.”

The Reuters article indicated that,

‘There is a lot that is not covered. We are not proposing any negotiations with the U.S. to reduce or eliminate (duties) on agricultural products,’ EU Trade Commissioner Cecilia Malmstrom told a news conference.

Wall Street Journal writer Emre Peker reported on Friday that, “Efforts to unlock agricultural markets previously got bogged down over safety and food-quality standards, among other differences. The EU has resisted opening up to genetically modified produce from the U.S., while the sides also differed on prized European geographical indicators that protect brands such as champagne, Scotch whisky and Parma ham. Meanwhile, Brussels and Washington had also failed to breach gaps in accessing each other’s government procurement markets–an area where the EU is typically very strong.

“Even as agriculture is specifically ruled out of this negotiating mandate, EU officials point out that there have been exceptions, suggesting that further agricultural items might still be agreed on the side. Under the July agreement, the EU agreed to boost U.S. soybean imports and the bloc is separately negotiating to improve non-hormone beef quotas for American exporters to settle a long-running dispute.

“The EU’s 28 member states still need to approve the commission’s proposal. The bloc’s executive didn’t provide a timeline for approval or starting negotiations with the U.S.”

And Bloomberg writer Jonathan Stearns reported on Friday that,

As the U.S. and European Union gear up for free-trade talks, disagreement over what will be negotiated could sink the effort.

“The split reflects competing claims about what exactly was agreed last July at a White House meeting between U.S. President Donald Trump and European Commission chief Jean-Claude Juncker.”

DTN Ag Policy Editor Chris Clayton reported on Friday that, “Representatives for European agriculture insist Europe will be open to more agricultural products from the U.S. even as the European Union has omitted agriculture from its priority items in negotiating a cross-Atlantic trade deal.

“Agricultural representatives from the EU spoke earlier this week at the American Farm Bureau Federation annual meeting in New Orleans.”

The DTN article noted that, “Jesus Zorrilla, Counselor on Agriculture with the EU, said at the Farm Bureau forum that agricultural products were excluded from the talks to streamline the focus on industrial products and autos.

“‘It’s not exactly that she (Malstrom) doesn’t want agriculture,’ Zorrilla said. ‘Agriculture is not included, because we are already discussing rules and food-safety standards, which have been very much our problem with trade and agriculture.'”

Mr. Clayton added: “Zorrilla acknowledged his doubts about a final EU-U.S. trade deal, adding that the big concern right now is trust, because of the steel and aluminum tariffs placed on Europe by the Trump Administration, and Trump’s threats to impose tariffs on autos as well. ‘I’m not very optimistic, to be frank,’ Zorrilla said. ‘I think the perception from Europe is surprise on unpredictability. We were very surprised to be a target of national security from the U.S. We were hit on steel and now we are told we might be hit on cars.'”

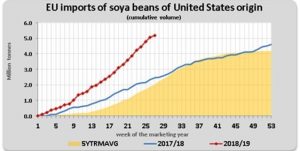

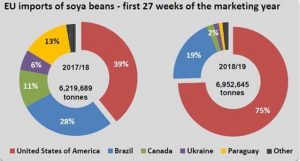

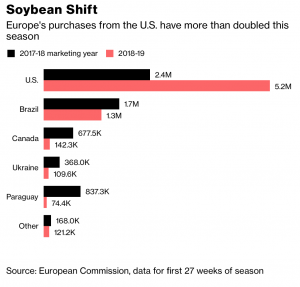

EU Purchasing More U.S. Soybeans

A press release earlier this month from the European Commission stated that, “Imports of U.S. soya beans by the European Union increased by 112% over the current market year (July-December 2018), compared to the same period in the previous year. With a share of 75% of EU soya beans imports, the U.S. remains Europe’s number one supplier.

“Conversely, Europe remains by far the top destination of U.S. soya beans exports (28%), followed by Argentina (10%) and Mexico (9%).

“This is part of the implementation of the Joint Statement agreed between Presidents Juncker and Trump in July 2018. In the Joint Statement, the two sides agreed to increase trade in several areas and products, notably soya beans. As a result, the European Commission is now regularly publishing figures on EU imports.”

Also, Bloomberg writer Megan Durisin reported earlier this month that, “Europe has become a key export destination for U.S. soybeans this season after China, which typically dominates purchases, avoided American farm products. China’s snub helped to push American prices near a decade low in September, boosting their appeal in other markets.”

U.S.-China Trade Issues

Bloomberg News reported on Friday that, “China has offered to go on a six-year buying spree to ramp up imports from the U.S., in a move that would reconfigure the relationship between the world’s two largest economies, according to officials familiar with the negotiations.

“By increasing goods imports from the U.S. by a combined value of more than $1 trillion over that period, China would seek to reduce its trade surplus — which last year stood at $323 billion — to zero by 2024, one of the people said. The officials asked not to be named as the discussions aren’t public.

“The offer, made during talks in Beijing earlier this month, was met with skepticism by U.S. negotiators who nonetheless asked the Chinese to do even better, demanding that the imbalance be cleared in the next two years, the people said. Economists who’ve studied the trade relationship argue it would be hard to eliminate the gap, which they say is sustained in large part by U.S. demand for Chinese products.”

The Bloomberg article noted that, “Even a massive buying binge would likely fail to eliminate the trade deficit with China, said Brad Setser, who served as deputy assistant secretary for international economic analysis in the Treasury during the Obama administration. It’s not clear how quickly U.S. farmers and companies would be able to meet increased Chinese demand, he said. Increasing exports of soybeans would require more land dedicated to growing the crop and investment in storage capacity.”

Friday’s article added that, “No decisions were finalized in the latest Beijing talks and discussions are set to continue at the end of January, when Chinese Vice Premier Liu He is scheduled to travel to Washington.”

Also last week, Reuters writer Humeyra Pamuk reported that, “United States Trade Representative Robert Lighthizer did not see any progress made on structural issues during U.S. talks with China last week, Republican U.S. Senator Chuck Grassley said on Tuesday as plans emerged for higher-level discussions at the end of January.”

And Reuters writers Michael Martina and Chris Prentice reported on Friday that, “The United States is pushing for regular reviews of China’s progress on pledged trade reforms as a condition for a trade deal – and could again resort to tariffs if it deems Beijing has violated the agreement, according to sources briefed on negotiations to end the trade war between the two nations.”