Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Corn, Soybean Production Concerns; While Chinese Tariffs Continue for Second Year

The challenges presented by the extraordinarily bad weather this spring, which have already clouded the production outlook for 2019, continue to plague many farmers as the summer growing season unfolds across the Corn Belt. Meanwhile, Saturday marked the one year anniversary of China’s imposition of tariffs on U.S. agricultural products. Aid from the federal government has helped dull the tariff’s sting, but trade issues continue to linger for producers, with many concerned about the long-term impacts of the ongoing trade war. Today’s update looks at recent news items that highlight these issues in more detail.

Spring Weather Impacts Persist

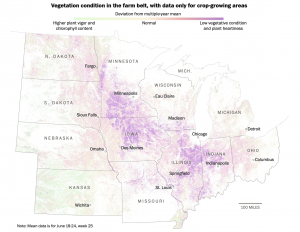

Washington Post writers John Muyskens, Laris Karklis, and Andrew Van Dam reported last week that, “From space, the U.S. Midwest is more brown belt than farm belt right now.

“At this time of year, a band of deep Kelly green should spread from Ohio to North Dakota as corn and soybeans race to pack on size before they pollinate and bear fruit. But 2019’s unprecedented rains have uprooted the typical course of events. Some crops are waterlogged and stunted. Others won’t be planted at all.

Unplanted, drowned or late fields have two things in common: They look brown from space, and they mean farmers will probably harvest less corn and soybeans this year than they had planned.

The Post article stated that, “As seeds begin to germinate and emerge, corn and soybeans are further behind than they’ve ever been at this point in the year, according to about four decades of data from the Agriculture Department.”

“When we seek to understand the brown Corn Belt, a hellish planting season is just the beginning. Planting totals are creeping higher, but many fields were planted in suboptimal conditions and farmers will be dealing with the fallout until harvest time,” last week’s article said.

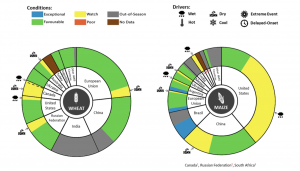

Also, this month’s Market Monitor, from the Agricultural Market Information System, addressed corn production issues and stated that, “In the US, much of the country remains under watch conditions due to the persistent wet spring, which significantly delayed sowing. Additionally, the delay in sowing combined with the long-lasting spring provide risks to final yields.”

And for soybeans, the Market Monitor indicated that, “In the US, conditions remain primarily under watch due to the long-lasting wet spring.”

Reuters writer Stephen Starr reported on Thursday that, “But five months of heavy rain – part of the wettest 12 months in over a century in Ohio, meteorologists say – means harvesting much of anything will be a challenge.”

Ohio, Indiana and Illinois are facing a disastrous year, with unusually heavy rain over five straight months to June.

Mr. Starr noted that, “U.S. corn and soybean harvests for 2019 are expected to fall at least 8% below last year, potentially leading to higher global prices for a wide range of food and other products, including ethanol-blended gasoline.

“The U.N. Food and Agricultural Organization’s cereal price index rose 1.4% in May ‘entirely driven by a sudden surge in maize (corn) quotations in response to diminishing production prospects in the United States,’ it noted.”

Meanwhile, the June FAO cereal price index averaged 173.2 points, up 6.7 percent (almost 11 points) from May and 3.8 percent higher than in June 2018.

The June FAO report stated that, “The latest increase in the value of the Index was driven by a sharp rise in maize export price quotations, for the third consecutive month, mainly due to expectations of much tighter export supplies in the United States – the world’s largest producer and exporter of maize.”

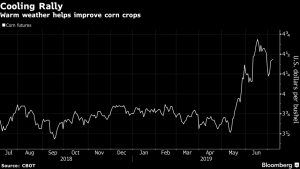

Nonetheless, Bloomberg writer Michael Hirtzer reported on Monday that, “After a cold, soggy start to the summer, it’s finally feeling like summer in the U.S. Midwest, and corn fields are recovering.

“A turn toward warmer weather should be beneficial for the battered crop, and government data signal that conditions are starting to bottom out. The changing weather also means that investors are tapping the brakes on their bullish bets after prices took a spectacular ride higher.”

“U.S. crop ratings rose by 1 percentage point to 57% good or excellent, the Department of Agriculture said on Monday, matching expectations from analysts surveyed by Bloomberg.”

#Illinois #corn condition, @usda_nass pic.twitter.com/jpgbMlvjMz

— Farm Policy (@FarmPolicy) July 8, 2019

Mr. Hirtzer added that, “The USDA will release a monthly supply and demand report on Thursday. Analysts expect the agency to trim its outlook for both domestic corn and soy production. However, the USDA is also conducting an additional survey this month on plantings — those results won’t be published until Aug. 12.”

One Year On- Trade Issues Persist

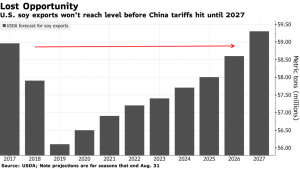

On Friday, Bloomberg writers Shruti Singh and Michael Hirtzer reported that, “Soybean prices have regained the ground lost since China imposed tariffs on U.S. farm goods. For growers, a recovery could take years.

“Saturday marks the anniversary of those tariffs taking effect.

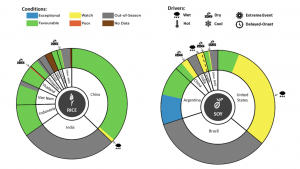

While Chicago futures are back above levels of 12 months ago, they are still well below prices before U.S.-China trade tensions began escalating, and recent gains were driven by record rain that disrupted planting. Now, a disease that’s forced the culling of millions of soy-eating hogs in China further clouds demand.

The Bloomberg writers explained that, “From October 2018 through March 2019, a span that covers the seasonal peak of U.S. soy exports, China imported 21.7 million metric tons less of the oilseed from the U.S. than a year earlier and bought 11.5 million tons more from Brazil, according to the U.S. Department of Agriculture.”

Jesse Newman reported on the front page of Friday’s Wall Street Journal that, “The U.S. Farm Belt is fighting to prevent an industry nightmare—the loss of its best customer for its biggest export.

“The customer is China and the export is soybeans, of which the U.S. shipped $21 billion abroad in 2017, far more than anything else farmers grow. That marked a tripling in two decades, the fruit of a sweeping effort, by nearly every arm of U.S. agriculture, to build a once-obscure crop into a blockbuster.

Then last year, sunk by a bitter trade dispute, American soybean exports to China plunged 74% by volume. Brazil raced to fill the gap, while prices paid to U.S. farmers recently slid to a seven-year low.”

#Farmers Built a #Soybean #Export Empire Around #China. Now They’re Fighting to Save It. https://t.co/NWNxZYCxw7 pic.twitter.com/JUuA5S1PQU

— Farm Policy (@FarmPolicy) July 5, 2019

The Journal article noted that, “Farmers, in fighting to hang onto the Chinese market, are pressing the administration to settle the dispute, pursuing direct channels to Chinese buyers and seeking to address those buyers’ complaints, including foreign material like stems in soybean shipments.”

* The U.S. share of world #soybean #exports is expected to drop to 31% this season, the lowest on record.

— Farm Policy (@FarmPolicy) July 5, 2019

* #Brazil’s portion is forecast to swell to 52%, which would be its largest ever. https://t.co/NWNxZYCxw7 pic.twitter.com/DWX0fVyuAZ

Meanwhile, Donnelle Eller reported on the front page of Sunday’s Des Moines Register that, “President Donald Trump mailed Iowa farmers nearly $1 billion — the second-largest amount nationally — in his first farm bailout, intended to soften the blow from the United States’ ongoing trade battles.

“Only Illinois snagged more, with $1.1 billion, according to data collected by the Associated Press. Iowa growers received $987.7 million.”

"At nearly $1 billion, #Iowa #farmers snagged the second-largest amount of #trade aid under last year’s $12 billion bailout. #Illinois ranked first with $1.1 billion in trade mitigation payments." https://t.co/IVBZ0mNGom pic.twitter.com/1ZCQz5TeFO

— Farm Policy (@FarmPolicy) July 7, 2019

The Register article stated that, “The payments help farmers, but they don’t ‘make them whole,’ said Chad Hart, an Iowa State University agriculture economist. ‘It doesn’t get farmers back to the prices they had when the trade disputes started.’

“Hart is part of a group that has estimated Iowa’s economic loss at $2 billion annually from ongoing trade disputes. ‘They’ll feel residual trade damage for years to come,‘ he said.”

Sunday’s article also pointed out that, “A second $16 billion round of aid was announced in May, as trade disputes with China escalated. A U.S. agreement with Mexico and Canada has been hammered out, but U.S. lawmakers have yet to approve it.

“That assistance will come as Iowa and the U.S. face one of the toughest growing years in history.

“Faced with heavy rains this spring, U.S. farmers may be unable to plant their crops on more than 10 million acres, with insurance claims passing $1 billion. ‘It’s worse than anything we’ve seen in the last 10 years,’ said USDA Under Secretary Bill Northey.”