Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

African Swine Fever Impacting Chinese Protein Markets and U.S. Pork Exports

Despite Chinese tariffs on U.S. pork, dynamics associated with the African Swine Fever (ASF) outbreak have created market opportunities for pork exports to China. In addition, Chinese beef imports surged in June, also due to changing protein demand spurred by the impacts of ASF. Separately, news this week documented that U.S. cotton exports to China have fallen, along with domestic prices, while stocks climb. And news on Tuesday indicated that senior U.S. officials are planning to travel to China next week to continue trade negotiations in person.

U.S. Pork Exports to China, African Swine Fever Impacting Demand

On Monday, Reuters writers Tom Polansek and Nigel Hunt reported that, “It might seem an unlikely time for U.S. farmers to look to China for more business but the devastating impact of African swine fever on the Chinese pork industry is trumping concerns about trade wars and tariffs.

“Experts estimate the disease will wipe out about a third of China’s pork production this year, or 18 million tonnes. That’s twice the amount of pork exported worldwide every year and enough to feed U.S. consumers for almost two years.

The U.S. trade war with China initially forced U.S. pork exporters to scour the world for new markets but as the swine fever crisis deepens they’re gearing up for new opportunities to supply the Chinese market later this year and next.

Polansek and Hunt noted that, “The catch for U.S. hog farmers is that if they want to take advantage of the surge in Chinese pork demand, they can’t feed their pigs with the growth drug ractopamine which is widely used in the United States but banned in China.”

“Citing competitive reasons, Tyson declined to comment on whether it pays farmers more for pigs raised without the feed additive or if it was offering premiums. The company told Reuters it was looking at diversifying its pork supply to include ractopamine-free hogs as demand expands,” the article said.

Monday’s update added that, “Rival U.S. pork producer Smithfield Foods, which is owned by China’s WH Group , already raises all of the hogs on its company-owned and contract farms without the drug.”

Also Monday, Wall Street Journal writer Nathaniel Taplin reported that, “China’s food fight with the U.S. is getting costly at home. That doesn’t mean a resolution to overall trade tensions is near, but it could help keep further escalation in check.”

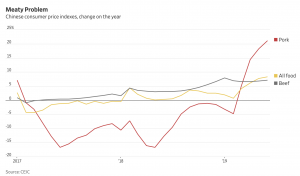

The Journal article stated that, “U.S. imports would help calm Chinese food price inflation, which has long been a political issue in the People’s Republic. The latest jump in pork prices—up around 20% on the year—is the last thing Beijing needs right now, with incomes already under pressure from the weak labor market. An African swine-fever epidemic has decimated China’s hog population in recent months.”

“Pork price inflation in China has gotten so bad that Chinese importers appear to have started buying the meat from the U.S. even with big tariffs already in place. U.S. pork exports to China in May more than doubled on the year to $34 million, according to U.S. International Trade Commission data, reversing the falling trend earlier in 2019.

Punishing U.S. farmers is all very well from Beijing’s perspective. Alienating Chinese consumers and importers who end up paying tariffs anyway is another matter.

And on Tuesday, Reuters writers Hallie Gu and Shivani Singh reported that, “China’s pork imports in June surged from the previous year, customs data showed on Tuesday, as the world’s top consumer of the meat stocked up on supplies after African swine fever has decimated domestic pig herds.

“China brought in 160,467 tonnes of pork in June, up 62.8% from the same month last year, according to data from the General Administration of Customs. This was down 14% from 187,459 tonnes imported in May.”

“China’s pork imports for the first six months of the year came in at 818,703 tonnes, up 26.3% from a year earlier.”

Chinese Beef Imports Surge, Also Due to African Swine Fever

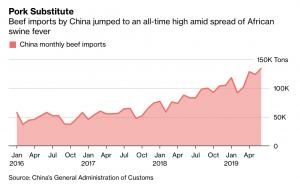

Bloomberg News reported on Monday that, “Beef imports by China, the world’s top meat consumer, jumped to an all-time high in June as the spread of African swine fever throughout the country boosts demand for alternative sources of animal protein.”

The Bloomberg article explained that, “Beef imports are climbing because the deadly virus is driving up pork prices and prompting people to change diets on concerns over safety, even though there’s no evidence that it hurts humans.”

However, the article noted that, “Australia is the big winner. Chinese demand helped lift beef exports to 1.16 million tons in the year to June 30, according to Meat & Livestock Australia. Shipments to China jumped 55% to 206,306 tons.”

“China’s purchases of South American beef are rising too,” the article said.

Chinese Tariffs Impacting U.S. Cotton Producers

Kris Maher reported this week at The Wall Street Journal Online that, “When cotton farmers meet at the Aubrey Country Store & Grill, a lunch spot surrounded by farmland in the Mississippi Delta, the talk inevitably turns to global trade these days.

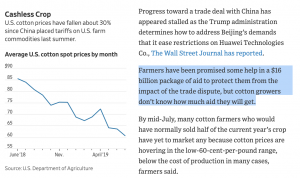

Cotton exports to China have tumbled, and the domestic price for the crop has fallen roughly 30% since China slapped retaliatory 25% tariffs on U.S. farm commodities last summer. Stockpiles of U.S. cotton are forecast to be the highest in a decade.

“‘If China decided it was going to start buying some cotton it would be a game changer,’ said Ramey Stiles, a 60-year-old cotton farmer who lives in nearby Marianna, Ark., in Lee County, an hour southwest of Memphis, Tenn.”

Farmers are starting to do great again, after 15 years of a downward spiral. The 16 Billion Dollar China “replacement” money didn’t exactly hurt!

— Donald J. Trump (@realDonaldTrump) July 23, 2019

The Journal article indicated that, “Farmers have been promised some help in a $16 billion package of aid to protect them from the impact of the trade dispute, but cotton growers don’t know how much aid they will get.”

Monday’s article also noted that, “Farmers who said they voted for President Trump remain supportive. They back his decision to place tariffs on a range of Chinese products, but if there isn’t a deal this year many won’t survive, they said.”

U.S. Officials Head to China

Bloomberg writers Shawn Donnan and Jenny Leonard reported on Tuesday that, “U.S. Trade Representative Robert Lighthizer and senior U.S. officials are set to travel to China next Monday for the first high-level, face-to-face trade negotiations between the world’s two biggest economies since talks broke down in May.

“Lighthizer and a small team will be in Shanghai through Wednesday, according to people familiar with the plans who asked not to be identified. The meeting will involve a broad discussion of the issues outstanding and isn’t expected to yield major breakthroughs, a senior administration official said.”

The Bloomberg article added that, “U.S. officials have played down the likelihood of a quick deal with China.

“‘It is impossible to judge how long it will take when the president’s objective is to get a proper deal or go ahead with tariffs,’ Secretary of Commerce Wilbur Ross told Bloomberg TV on Tuesday. ‘It is not important whether it be done a week from Tuesday or a month or two months.’

“The sides remain at odds over significant issues like Washington’s demands for structural reforms to China’s economy and Beijing’s call for the U.S. to remove existing punitive tariffs on imported Chinese goods.”

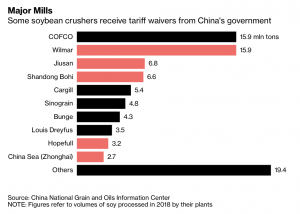

And Bloomberg News reported on Wednesday morning that, “The Chinese government has given the go-ahead for five companies to buy up to 3 million tons of U.S. soybeans free of retaliatory import tariffs as trade negotiations between the two nations continue, according to people familiar with the situation.

“The retaliatory tariff-free quota for 2 million to 3 million tons will be part of a goodwill gesture toward the U.S., and there could be a second round of exemptions depending on how the trade talks progress, two of the people said, declining to be identified as the information is private.”

The Bloomberg article stated that, “Among the companies is state-owned Jiusan Group as well as privately-run Shandong Bohi Industry Co. and China Sea (Zhonghai) Grain and Oil Industry Co., the people said. Yihai Kerry Group, a Chinese subsidiary of Singapore-based Wilmar International Ltd., and Hopefull Grain & Oil Group are also among the firms, said the people.”