As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

2019 Farm Sector Income Forecast, November

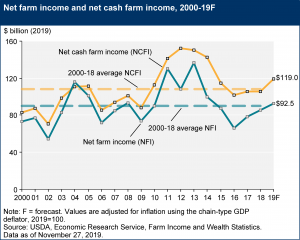

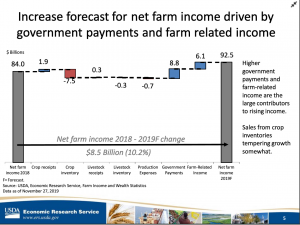

The USDA’s Economic Research Service (ERS) indicated on Wednesday that, “Net farm income, a broad measure of profits, is forecast to increase $8.5 billion (10.2 percent) from 2018 to $92.5 billion in 2019. Net cash farm income is forecast to increase $15.5 billion (15.0 percent) to $119.0 billion.”

“In inflation-adjusted 2019 dollars, net farm income is forecast to increase $7.0 billion (8.2 percent) and net cash farm income is forecast to increase $13.6 billion (12.9 percent).

If realized, inflation-adjusted net farm income and net cash farm income would both be above their historical average across 2000-18.

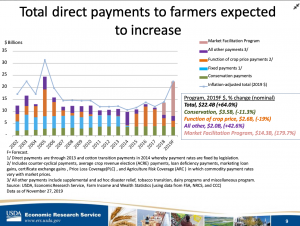

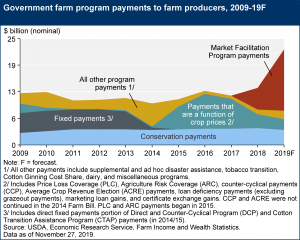

ERS pointed out that, “Direct government farm payments—which include Federal farm program payments paid directly to farmers and ranchers but exclude USDA loans and insurance indemnity payments made by the Federal Crop Insurance Corporation (FCIC)—are forecast to increase $8.8 billion (64.0 percent) to $22.4 billion in 2019, following an additional round of payments from the Market Facilitation Program in 2019.”

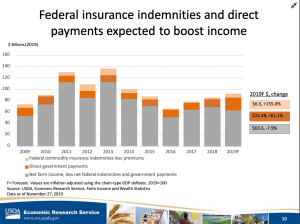

Reuters writer P.J. Huffstutter reported on Wednesday that, “Nearly one-third of projected U.S. net farm income this year will come from government aid and taxpayer-subsidized commodity insurance payments, according to a forecast issued Wednesday by the U.S. Department of Agriculture.”

“Without those payments, U.S. net farm income this year would have dropped by nearly 8%, to $63.6 billion.”

The Reuters article stated that, “Farm income also was boosted by an estimated $6.5 billion paid out in federal commodity insurance indemnities, which does not include the premiums that farmers paid themselves, [ERS senior economist Carrie Litkowski] said. That includes crop insurance payments Midwestern farmers received in the wake of record floods that devastated a wide swath of the Farm Belt this spring.”

“USDA’s latest farm income forecast does take into account the second round of 2019 trade aid payments, Litkowski said, which U.S. farmers began receiving this month,” the Reuters article said.

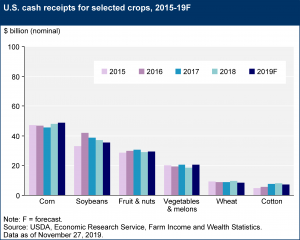

In its update Wednesday, ERS indicated that, “Soybean receipts in 2019 are expected to decrease $1.8 billion (4.9 percent) in nominal terms, reflecting anticipated declines in both price and quantities sold. Corn receipts are expected to rise by $0.9 billion (1.9 percent) in 2019 relative to 2018. The forecast is driven by opposing impacts in 2019 from reduced corn yields and production in the 2019/2020 marketing year and a resulting price rebound due to tightening supplies.”

Meanwhile, “Total animal/animal product cash receipts are expected to rise $0.3 billion (0.1 percent) to $176.8 billion in 2019 in nominal terms. After adjusting for inflation, however, cash receipts are expected to fall $3.0 billion (1.7 percent). Milk and hogs are expected to lead the sector, offset by lower receipts for poultry/eggs.”

In a look at production costs, Wednesday’s update pointed out that, “Farm sector production expenses (including expenses associated with operator dwellings) are forecast to increase $0.7 billion (0.2 percent) in 2019 in nominal terms, but after adjusting for inflation, expenses are forecast to fall $5.5 billion (1.6 percent). Forecast at $344.6 billion, 2019 production expenses are 18.8 percent below the record high of $424.1 billion in 2014, in inflation-adjusted terms.”

Wednesday’s update also provided a perspective on farm household income, and stated that,

Farm households typically receive income from both farm and off-farm sources. Median farm income earned by farm households is forecast to increase slightly to -$1,440 in 2019 from -$1,735 in 2018.

“In recent years, slightly more than half of farm households have had negative farm income each year.

“Many of these households rely on off-farm income—and median off-farm income is forecast to increase 2.2 percent from $65,841 in 2018 to $67,281 in 2019.”