A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Bank of Dallas Ag Credit Survey- Fourth Quarter 2019, MFP Payments Noted

Last week, the Federal Reserve Bank of Dallas released its Agricultural Survey for the Fourth Quarter of 2019.

In part, the update stated that, “Bankers responding to the fourth-quarter survey reported overall weaker conditions across most regions of the Eleventh District. They noted that poor rainfall throughout the year contributed to dry conditions, affecting crop yields. The cattle market is one of the few bright spots in Texas agriculture.

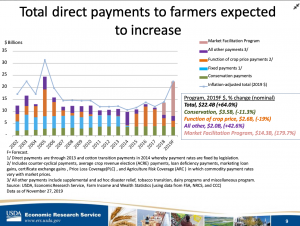

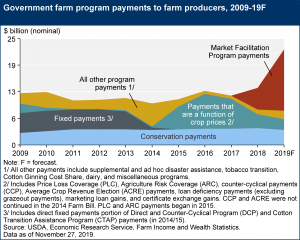

Market Facilitation Program and Price Loss Coverage payments from the U.S. Department of Agriculture have helped, but it may be too little, too late for some, according to respondents.

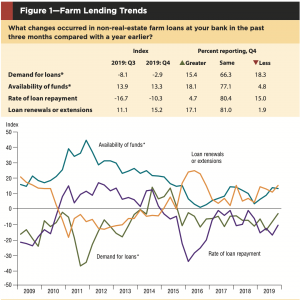

The Fed report noted that, “Demand for agricultural loans continued to decline, with the loan demand index registering its 17th quarter in negative territory. Loan renewals and extensions increased, and the rate of loan repayment continued to decline. Loan volume fell across all major categories compared with a year ago.”

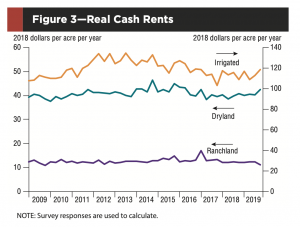

With respect to land values, the Dallas Fed indicated that, “District irrigated cropland values stabilized this quarter, while dryland values held steady and ranchland values increased moderately.

“According to bankers who responded in both this quarter and fourth quarter 2018, nominal cropland and ranchland values increased year over year in Texas, northern Louisiana and southern New Mexico.”

Additional comments from District bankers included the following:

- “Tariffs have hurt producers, but Market Facilitation Program (MFP) payments are lessening the blow.”

- “MFP payments have brought most farm loans to breakeven.”

- “Prices are still the major factor with marketing cotton despite some relief from MFP payments.”

- “MFP and Price Loss Coverage (PLC) payments helped, but it may be too little, too late for some.”

- “MFP payments will help, but this will be a very challenging season.”

- “MFP payments will help low prices for cotton, which has an average yield at best.”

- “MFP payments helped, but [farmers/ranchers] will most likely need more to survive this crisis.”

And regarding the possibility of additional MFP payments in the future, Reuters writers Karl Plume and P.J. Huffstutter reported last week that,

Trump administration officials have not said if farmers will get more payments in 2020.

“Robert Johansson, chief economist at USDA, told Reuters he expected the interim trade deal would solve the issues that the aid program had addressed.

“USDA Deputy Press Secretary Alec Varsamis said the agency would decide in January on future payments. White House spokesman Judd Deere declined to comment and referred to previous statements by U.S. Trade Representative Robert Lighthizer, who has said China committed to ‘massive’ U.S. agriculture purchases.

“Farmers in export-dependent regions say they can’t continue to sell their crops for below the cost of production without a third round of subsidies to cover the losses.”