Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

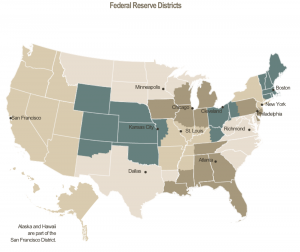

Federal Reserve: Observations on the Ag Economy- January 2020

Last week, the Federal Reserve Board released its January 2020 Beige Book update, a summary of commentary on current economic conditions by Federal Reserve District. The report included several observations pertaining to the U.S. agricultural economy.

* Fifth District- Richmond– “Agriculture contacts were mostly positive because of good crop yields and solid demand; however, farmers faced tighter profit margins due to low selling prices and rising prices for labor, equipment, and land.”

* Sixth District- Atlanta– “Agricultural conditions remained mixed. Recent rains improved drought conditions for most of the District, although parts of Florida, Georgia, and Louisiana experienced abnormally dry or moderate drought conditions.

#Drought Monitor- Southeast: Due to the widespread rainfall, drought-free conditions continued in #Alabama and #SouthCarolina. pic.twitter.com/LorilyQH6F

— Farm Policy (@FarmPolicy) January 16, 2020

“The December production forecast for Florida’s orange crop was unchanged while the grapefruit production forecast increased; both forecasts remain ahead of last year’s production. On a year-over-year basis, prices paid to farmers in November were up for corn, rice, soybeans, eggs, and milk but down for cotton and broilers; beef prices were unchanged. However, on a month-over-month basis, prices increased for cotton, rice, beef, eggs, and milk but declined for corn, soybeans and broilers.”

* Seventh District- Chicago– “The prospects of a trade deal with China created some optimism in the farm sector.

One contact called the potential deal a ‘key market driver.’

“The final results for the 2019 harvest varied from average to well below normal across the District, yet they were better than had been expected in light of poor weather during both planting and harvesting.

“Corn and soybean prices moved higher, with both prices above year-ago levels.

Daily #Grain Review- Tuesday, January 14th, https://t.co/4RoyP8YQ0M @USDA_AMS

— Farm Policy (@FarmPolicy) January 15, 2020

* #Corn, #soybeans- Central #Illinois.

* 2020, 2019 and five-year average prices. pic.twitter.com/HU8YAX1G73

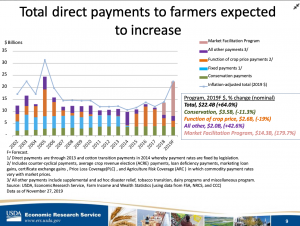

“That said, lower-than-usual corn quality and higher-than-usual drying costs cut into crop farmers’ profits. Overall, with extra government payments boosting farm income, the District’s agricultural sector was in about the same financial shape as it was a year ago.

“Increases in milk and cattle prices provided a boost to dairy and livestock producers.”

* Eighth District- St. Louis– “District agriculture conditions remain unchanged from the previous reporting period. The percentage of winter wheat in the District rated fair or better remained approximately unchanged at 93 percent from the end of October to the end of November. This is roughly the same level of winter wheat rated fair or better at the end of 2018.

Approximately 10% of winter #wheat production is within an area experiencing #drought, @usda_oce pic.twitter.com/dviGfw47pC

— Farm Policy (@FarmPolicy) January 16, 2020

“Contacts reported that continued low crop prices and trade disputes have harmed the industry.

Several reports indicated the federal assistance to farmers via the market facilitation program has helped farmers remain in business.

* Ninth District- Minneapolis– “District agricultural conditions remained weak. Industry contacts reported that trade conflicts combined with poor weather put continued pressure on farm households, with federal aid payments and insurance the only source of relief for many producers.

“One contact called 2019 ‘the mother of all disasters.‘ In contrast, a dairy industry source reported that the sector has begun to rebound, and producers were becoming more bullish; Montana wheat producers also had a strong year.”

#Farm Sector Profitability Was Boosted By #Trade Assistance Dollars, Projected at $92.5 Billion Up $7 Billion or 8% (slide from @New10_AgEcon). pic.twitter.com/HqN63wP76Y

— Farm Policy (@FarmPolicy) January 19, 2020

* Tenth District- Kansas City– “The Tenth District farm economy generally remained subdued despite a modest increase in agricultural commodity prices.

The prices of most major crops increased moderately since the previous reporting period and crop production in the Tenth District was expected to be similar to a year ago, resulting in expectations of slightly higher revenues compared with the previous year.

“In the livestock sector, cattle prices also increased modestly in December and hog prices remained relatively stable, which could provide additional support. The slight increase in agricultural prices and revenues, however, was not expected to significantly improve the financial condition of producers in the District.”

* Eleventh District- Dallas– “More than half of Texas remained abnormally dry or in drought, although drought severity eased somewhat over the reporting period.

#Drought Monitor- South: Most of the South had warmer than normal temperatures this week, though widespread rainfall led to reduction in drought conditions in parts of the region. pic.twitter.com/LZ7aeqqN8U

— Farm Policy (@FarmPolicy) January 16, 2020

“Agricultural producers expressed concern over dry conditions damping crop production next year. This is especially pertinent given relatively low crop prices, as above-average production is needed in order for farmers to achieve profitability. Cotton exports were quite strong, and lower U.S. and world supplies boosted price outlooks. The signing of the USMCA alleviated some uncertainty among agricultural producers, and progress on U.S. and China trade disputes added optimism.”

* Twelfth District- San Francisco– “Activity in the agriculture sector was mixed. Reports from contacts in the Central Valley of California indicated most crop yields performed well despite reported water shortages. Domestic agricultural product sales remained at healthy levels, while sales abroad continued to suffer from issues related to trade disputes and slowing foreign economies. For example, sales of lumber increased domestically following a rebound in the housing market, but lower selling prices squeezed profits from export markets. One report also mentioned slower activity in the market for grapes. Activity in the livestock sector decreased somewhat, with demand for cattle and swine products ticking down a bit.”