Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

U.S. Agricultural Trade Developments: China, the European Union, and India

Background

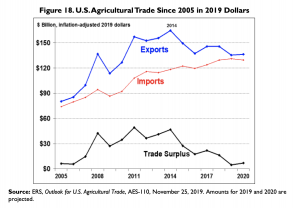

A recent Congressional Research Service report explained that, “U.S. agricultural exports have been a major contributor to farm income, especially since 2005. As a result, the financial success of the U.S. agricultural sector is strongly linked to international demand for U.S. products.”

A recently signed trade-enhancement agreement that will lower agricultural tariffs in Japan, Senate passage of the USMCA agreement, along with a new Phase One trade agreement with China, have been positive developments for U.S. farmers, even if commodity markets have provided a muted response in return.

Trade issues continue to be an important executive branch focal point; today’s update takes a closer look at recent news items regarding agricultural trade with China, the European Union and India.

China

While U.S. producers eagerly anticipated the stepped up Chinese purchases of their agricultural products, Reuters News reported last week that, “China’s purchases of U.S. agricultural products will not impact its imports from other countries, a commerce ministry official said on Tuesday.

“China welcomes the entry of competitive U.S. products into its markets and hopes the United States could create conditions to facilitate exports to China, Li Xingqian told a news conference.”

However, Keith Bradsher reported in Friday’s New York Times that, “The United States and China are already gearing up for the sale of tens of billions of dollars in American-made products to Chinese buyers in the coming months, according to people familiar with the thinking of officials in both countries. If carried through, that would strengthen President Trump’s election-year claims of achieving victory in his trade war with Beijing.

“The two sides are also clear on what that means for other countries. China could pull off those purchases only if it stopped buying a lot of farm products and merchandise from countries in Europe, Latin America and East Asia. Many of those countries are American allies, and some are not pleased at the prospect of losing China and its giant economy as a consumer of their exports.”

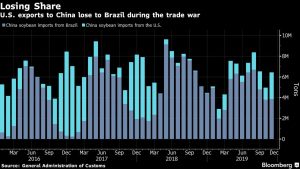

In a longer-term perspective, Bloomberg writers Alfred Cang, Javier Blas, and Isis Almeida reported last week that, “The [trade] dispute with Washington exposed Beijing’s vulnerability when it comes to food imports — especially the soybeans needed to feed its massive herd of livestock — and the Communist Party leadership will now do all it can to wean itself off the U.S.

“‘Anytime you have a disruption in your supply chain, and especially with something as sensitive as food, they have to diversify their supply chain,’ said David MacLennan, chief executive of Cargill Inc., the world’s largest agricultural commodity trader. ‘I think they don’t want to be in the same position again of being overly dependent on one supplier.'”

The U.S. and China may have a deal, but the exports are still in place and so are the tariffs, so that’s concerning for farmers, says Cargill CEO David MacLennan https://t.co/ezaCGweoRP pic.twitter.com/HBDmpFIFvJ

— Bloomberg TV (@BloombergTV) January 22, 2020

The Bloomberg article indicated that, “For U.S. farmers, the trade deal means a potentially short-lived benefit as China seeks to make good on its two-year promise. But long term, as America’s biggest customer goes elsewhere — creating a huge opportunity for rival agriculture giants like Brazil, Argentina and Russia — that could have political repercussions for Trump-supporting rural communities.”

Meanwhile, DTN China Columnist Lin Tan indicated last week that, “‘International trade for agri-products does not only mean trading, it also includes other sections in the chain, such as production, logistics, storage, processing and consumption. It will take a long time for the two countries, as well as the world market, to reestablish a balance to facilitate the deal,’ [China Agricultural University professor Jun Wang] said.”

The DTN article stated that, “‘We already booked our positions all the way to June 2020 from Brazil,’ a purchasing manager of a crushing company, who could not disclose his name, told DTN. ‘There is not a lot of room for U.S. beans in the following months. Buying more old-crop beans from the U.S. will mean importing U.S. beans in the Brazilian market season. This will flood the China market.’

#China has bought 11.6 mmt of U.S. #soybeans for 2019/20 through Jan. 16, which aside from last year, is the fewest for the date since 2007/08.

— Karen Braun (@kannbwx) January 24, 2020

China made some big promises, but 9 days after the deal, still no sign of huge purchases. Black line needs to go up, up, up! pic.twitter.com/0de0FjIgkv

“He said all of the country’s grain buyers, including state-owned companies COFCO and SinoGrain, are waiting for detailed regulations on how to buy soybeans since the 25% import tariff remains in place under the terms of the deal.”

European Union

Earlier this month, Wall Street Journal writer Josh Zumbrun reported that, “With a China trade deal signed and a new North American deal passed by Congress, the European Union stands out as the big U.S. trading partner unable to reach a significant trade pact with the Trump administration.

As the White House contemplates the next steps of its trade agenda, the EU suddenly finds itself, rather than China, under the most urgent threat of tariffs, and under the most pressure to negotiate.

The Journal article noted that, “‘The fact that the European Union has refused to engage with us on agriculture has made it very difficult to have productive conversations’ said [Stephen Vaughn, a partner at King & Spalding and formerly the general counsel under U.S. Trade Representative Robert Lighthizer].”

(For additional background on whether agriculture is a subject for negotiation with the EU, see this FarmPolicy News update from last year.)

“As part of his bid to reset relations, [new European Commission, Phil Hogan], an Irish farmer, politician, and formerly Europe’s agricultural commissioner, has emphasized Europe’s willingness to negotiate agricultural issues, but not agricultural tariffs. He has touted an agreement in 2019 that allows more U.S. beef exports to Europe, as well as a regulatory change allowing U.S. soybeans to be used in European biofuels, helping boost exports of one of Mr. Trump’s favored crops,” the Journal article said.

Financial Times writers James Politi, Phil Georgiadis and Jim Brunsden reported last week that, “Donald Trump and Ursula von der Leyen have vowed to press ahead quickly to reach a trade deal and ease tensions that have clouded transatlantic relations for months.

“Speaking at a press conference after his short trip to the World Economic Forum in Davos on Wednesday, the US president said he expected to negotiate a trade deal with the EU before November’s presidential election. Shortly after, the EU commission chief said Brussels was ‘expecting in a few weeks to have an agreement that we can sign together’ with the US, covering trade, technology and energy.”

Met with @PhilHoganEU, the EU Commissioner for Trade, on the critical EU-US trade relationship. We are confident we can reclaim our shared trade agenda as it will lead to more jobs and prosperity on both sides of the Atlantic. pic.twitter.com/KT4sEqSpZo

— Sec. Sonny Perdue (@SecretarySonny) January 27, 2020

On Sunday, Bloomberg writer Jonathan Stearns reported that, “Faced with a U.S. refusal to cut industrial tariffs unless the EU opens its agricultural market more, the European Commission might be prepared to scale back technical barriers to imports of American foods including shellfish, according to officials. They spoke on the condition of anonymity because the plan is still under discussion.”

Negotiations to slash industrial duties across the board — the centerpiece of the 2018 agreement — have yet to start because the Trump administration has insisted that agriculture be included in the scope of the talks.

The Bloomberg article explained that, “The [Ursula von der Leyen-led] commission, in office since Dec. 1, has no intention of ceding to this American demand, which would require a new negotiating mandate from EU governments.

“Including European farm tariffs in any market-opening deliberations with the U.S. is a no-go for the EU unless the Trump administration crosses a red line of its own by agreeing to discuss the opening of American public procurement and maritime services.”

Stearns added that, “Also off limits for the bloc are its longstanding bans on hormone-treated beef and on ‘chlorinated’ chicken and the European approval process — slow and unpredictable — for genetically modified foods. These three matters have long irked the U.S.

“It is in this context that von der Leyen’s commission is scrambling to meet American demands for better access to the European agri-food market. The commission wants to be able to deliver something concrete to the Trump administration and avoid triggering a political battle with EU national governments.”

On a separate issue, on Sunday, Financial Times writers Gillian Tett, Chris Giles and James Politi reported that, “The EU’s plans for a carbon tax have emerged as a potential new flashpoint in transatlantic trade ties, after the Trump administration warned that it would ‘react’ with possible punitive measures against Brussels.”

“Ever since President Donald Trump announced America’s withdrawal from the Paris climate accord, the EU and US have been at odds over global policies to tackle climate change, but those tensions had not yet spilled over into the trade arena,” the FT writers said.

India

Reuters writers Aditya Kalra and Neha Dasgupta reported on Friday that,

The United States wants India to buy at least another $5-6 billion worth of American farm goods if New Delhi wants to win reinstatement of a key U.S. trade concession and seal a wider pact, four sources familiar with the talks told Reuters.

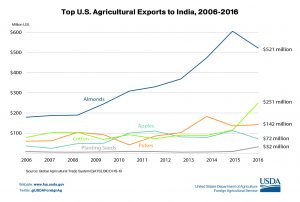

“Ahead of a Trump visit to New Delhi to meet Prime Minister Narendra Modi next month, negotiators on both sides are hammering out terms for a trade deal that would include New Delhi rolling back higher tariffs on some farm goods such as almonds, walnuts and apples, one of the sources said.”

The Reuters article stated that, “As part of the negotiation, the U.S. wants India to increase imports of frozen poultry products, the first source said. The U.S. has already been pushing India to cut the high import taxes on poultry products.

“‘The deal has to be agriculture focused, the U.S. is putting a number on everything (if India wants GSP back),’ said one of the sources.”

Kalra and Dasgupta added that, “A fifth Washington-based source with knowledge of the U.S. administration’s thinking said a U.S.-India trade deal would be far smaller than one the United States struck with China this month, but will ‘look basically the same.'”