Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Iowa Farmland Values Decline, Cash Rent Issues

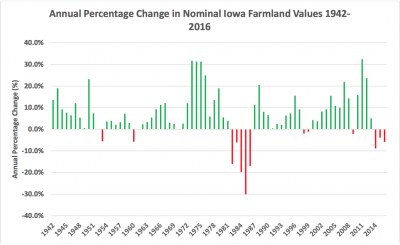

Donnelle Eller reported on the front page of Wednesday’s Des Moines Register that, “Iowa’s average farmland value declined for the third year in a row, down 5.9 percent to $7,183 an acre over the past year. It’s the first time since the 1980s farm crisis that land values have fallen three straight years, according to an Iowa State University [ISU] report released Tuesday.

“Despite values tumbling, chances are low that Iowa will face a replay of the devastating farm crisis, said Wendong Zhang, an ISU assistant economics professor who leads the university’s annual farmland survey.

Average Iowa farmland values are now 17.5 percent lower than the historic high set in 2013 at $8,716 an acre.

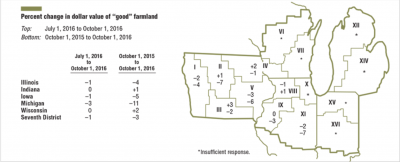

An overview of the ISU report noted that, “In general, the results from the 2016 Iowa State University land value survey echo results from other surveys. The Federal Reserve Bank of Chicago reported Iowa land values down 5 percent from October 2015 to October 2016…[T]he USDA reported Iowa farmland values down by 1.9 percent from June 2016 to June 2016.”

.@CARD_ISU has announced the results of the 2016 #ISUlandValue survey. Learn More: https://t.co/uOQbXWDdDS

— ISU CALS (@iastate_cals) December 13, 2016

More broadly when considering the decline in land values, the ISU overview explained that, “For a pessimist, there are plenty of legitimate reasons to worry: first, according to USDA, net farm income dropped another 17.2 percent to $66.9 billion in August 2016, and this represents the lowest since 2009 in both real and nominal terms.

“Second, financial stress in the agricultural sector shows slow but steady increase, with continued declines in loan repayment rates and uptakes in farm real estate and working capital debt.

“Third, while corn and soybean prices continue to fall short of production costs, livestock producers faced a tougher environment in 2016 with hog, cattle, and dairy prices all down by at least 30 percent compared to two years ago.”

On the other hand, the overview also pointed out that:

However, this decline is not a doomsday scenario.

“While they have declined three years in a row now, current Iowa farmland values are still more than double what they were 10 years ago, 64 percent higher than the 2009 values and 7 percent higher than the 2011 values,” the ISU overview stated.

Nonetheless, the ISU report explained that, “Preliminary Iowa State University cost of production estimates for 2017 indicate a 50 cents per bushel loss for corn and possibly break-even for soybean production with average costs and yields.”

And recall that the Federal Reserve Beige Book noted on November 30th that, “Record corn and soybean yields, combined with stable corn prices and rising soybean prices, implied that more crop operations than previously expected would at least break even this year. However, some operations were unlikely to be able to cover their costs, resulting in further refinancing of loans and some asset sales [Chicago District].”

Cash Rents

In her front page Register article, Ms. Eller also pointed out that, “Mark Gannon, owner of Gannon Real Estate in Des Moines, said he expects some farmland rents to drop 10 percent this year, but leases for highly productive lands aren’t following suit.

“‘We’ve had good yields and that’s held the rents up, and land prices too,’ Gannon said. ‘Gross incomes have held up better than expected.'”

DTN Special Correspondent Elizabeth Williams reported on December 9th that, “Cash rent concessions were the biggest buzz in the hallways of DTN-The Progressive Farmer’s Ag Summit Dec. 4-7 and predominated discussions at our four-hour workshop with professional negotiator Jack Williams. Not only are rents the biggest line item on most Midwest farms, they also represent one of the few categories where personal relationships can significantly influence outcomes.”

The DTN article added that, “One operator was able to get his landowner to go from $300 per acre to $200 per acre on a five-year lease that renewed in 2017 because when prices were going through the roof during the previous lease agreement, the operator voluntarily paid the landowner large bonuses. Also, the landowner had a farm background and empathized with the operator about farming in times with low prices.

“Another operator who was able to get a 30% reduction from one landowner by proposing a flex lease that allowed for a bonus if prices jump higher.”

Lastly, the Purdue Agricultural Economics Report- 2017 Agricultural Outlook stated this month that, “It is expected that on average cash rents in 2017 are likely to decline by 5% to 10%.”

Additional Resources

Langemeier, M. “Comparing Net Returns for Alternative Leasing Arrangements.” farmdoc daily (6):209, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, November 4, 2016.

Location characteristics have had a greater influence on #farmlandvalues more recently. https://t.co/zBmu7Pw6Hc pic.twitter.com/PrAKhNfr7o

— KansasCityFed (@KansasCityFed) December 13, 2016