The U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty and eroding trust in…

Amid Weaker Economic Conditions, Reports Suggest Farmland Values Holding Steady

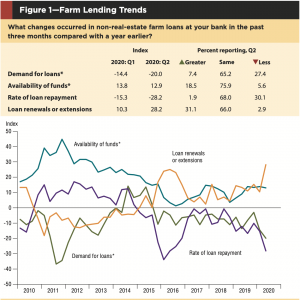

Last week, the Federal Reserve Bank of Dallas released its Agricultural Survey.

In part, the quarterly report stated that, “Bankers responding to the second-quarter survey reported overall weaker conditions across most regions of the Eleventh District. They noted that dry conditions are putting a strain on agricultural production despite some rainfall in late May. In addition, survey participants noted that commodity prices remain low, including beef prices. ‘Although beef prices are sky high at the supermarket, little of that increase has found its way to the producer, who still struggles with increased input costs and uncertainty in the weather,’ a survey participant said.

“Demand for agricultural loans continued to decline, with the loan demand index registering its 19th quarter in negative territory.

Loan renewals or extensions increased while the rate of loan repayment continued to decline.

“Loan volume fell across all major categories compared with a year ago.”

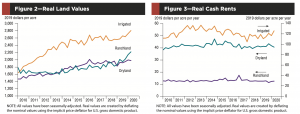

Nonetheless, the Fed update pointed out that, “Irrigated and ranchland values increased this quarter, while dryland values were flat.”

The Survey also included additional comments concerning agricultural land values and credit conditions from District bankers, some of which are noted here:

- Dry conditions combined with low commodity prices have producers very concerned about challenges in the second half of 2020.

- Commodity prices remain low. I’m not feeling very optimistic about the 2020 agriculture industry.

- The ag community is in trouble. In West Texas, we have varied areas of moisture from good to bad. Irrigated land is decent, but no rain is in the forecast. And of course prices are horrible. We must have the government’s help to make it through 2020.

Meanwhile, the University of Nebraska released a report regarding statewide land values (“Nebraska Farm Real Estate, Market Highlights 2019-2020“) this month.

The report stated that, “Reversing a half decade in market declines, the all-land average value in Nebraska for the year ending February 1, 2020 averaged about 3% higher than the prior year. Figure 2 [below] summarizes these figures and trends along with the percent changes over the prior year’s all-land average for the eight districts in the state.”

“The statewide all-land average value for the year ending February 1, 2020 averaged $2,725 per acre, or about a 3% ($80 per acre) increase to the prior year’s value of $2,645 per acre.”

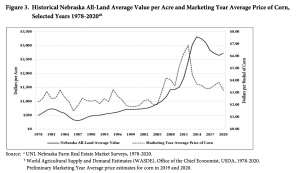

The report added that, “In 2020 the nominal (non-inflation adjusted) market value for the all-land average broke a five- consecutive year decline to improve to $2,725 per acre (Figure 3). The price of corn in 2020 declined to a Marketing Year Average of $3.20 per bushel.”

"The #agricultural sector continued to be under stress due to low prices for some #farm #commodities, reduced #ethanol production, and pandemic-related limitations on production for some #food processing plants." https://t.co/trV9EGlf1j

— Farm Policy (@FarmPolicy) July 1, 2020

Also this month Mikkel Pates reported at AgWeek Online that, “Farmers have lost out on income as animal packers and ethanol producers plants have slowed or closed in the wake of the COVID-19 pandemic, according to data from S&P Global Market Intelligence.

In a report released June 29, the data company and division of S&P Global, said the pandemic has contributed to the fact that 2.68% of ‘total agriculture loans’ for banks were delinquent as of March 31. This is the highest level since the first quarter of 2012, according to the report.

“As of the third quarter, banks held $179.52 billion in farm loans, according to the report, which does not list the Farm Credit System, a major player in ag lending. It does list John Deere Capital Corp. of Reno, Nev., as the largest U.S. bank by agriculture loans in the quarter, with $15.6 billion, up 6.1% in year-on-year growth.”

The AgWeek article pointed out that, “David Kohl, a professor emeritus of agriculture finance at Virginia Tech, was quoted in the report, saying bankruptcies are a ‘lagging indicator,’ and that bankruptcies caused by the coronavirus pandemic won’t show up for at least another year.”