Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

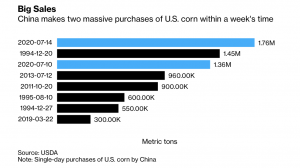

China Makes Record U.S. Corn Purchase

Bloomberg writers Michael Hirtzer and Isis Almeida reported on Tuesday that, “China made its biggest purchase ever of U.S. corn in another boost to meeting agriculture targets set in the countries’ first-phase trade accord.

“The U.S. Department of Agriculture said Tuesday that exporters sold 1.762 million metric tons of corn, the fourth-biggest spot deal ever for the grain. The agency on July 10 reported a sale of 1.365 million tons to China.

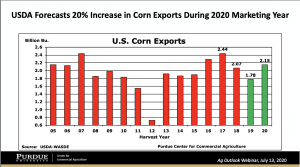

“China is poised to meet or surpass import quotas set by the World Trade Organization for 7.2 million tons of corn from any country in a year. Beijing issued a new batch of permits that allow imports at lower tariffs. The Asian nation agreed to buy $36.5 billion in agricultural commodities this year from the U.S. as part of a trade accord, up from $24 billion in 2017.”

“‘Right now, the purchases give the president something concrete to talk about in helping Corn Belt crop farmers, but I think the impact politically is pretty marginal at this point,’ University of Illinois agriculture economist Scott Irwin said in a message.”

Hirtzer and Almeida added that, “China’s imports of other raw materials from crude oil to soybeans surged in June as the economy started to recover from the worst of the virus.”

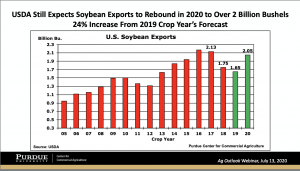

Reuters writer Mark Weinraub pointed out on Tuesday that, “China also booked deals to buy 129,000 tonnes of soybeans in the 2020/21 marketing year.”

More broadly, Wall Street Journal writer Jonathan Cheng reported that, “Chinese imports from the U.S. rose for the first time since the new coronavirus emerged earlier this year, showcasing Beijing’s post-pandemic purchasing power even as political tension between the world’s two largest economies continues to rise.

“China’s appetite for meat and other agricultural goods helped Chinese imports of U.S. goods to jump by 11.3% in June from a year earlier, after a 13.5% drop in May, data from Beijing’s General Administration of Customs showed Tuesday. The Chinese buying helped to narrow Washington’s trade deficit with Beijing from a year earlier, though Chinese exports to the U.S. also improved, rising 1.4% in June from a year earlier after a 1.3% decline in May.”

Meanwhile, Reuters writers Hallie Gu and Tom Daly reported this week that, “China’s monthly imports of soybeans leapt to a record high in June, jumping 71% from a year earlier, customs data showed on Tuesday, as a flurry of cargoes arrived from top supplier Brazil.

“China, the world’s top importer of the oilseed, shipped in 11.16 million tonnes in June from 6.51 million a year ago and up 19% from 9.38 million tonnes in May, data from the General Administration of Customs showed.

“Exports from Brazil have picked up since March after weather improved in the South American country.”

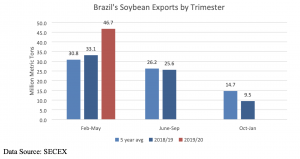

Also this week, USDA’s Foreign Agricultural Service (FAS) indicated in a report (“Brazil: Oilseeds and Products Update“) that,

China’s seemingly insatiate demand for Brazilian soybeans has been the main headline, but perhaps, the real surprise of this MY has been the remarkable performance of Brazilian transportation networks, which enabled this boom.

“From February through May 2020, Brazil shipped almost 47 MMT of soybeans, or over 40 percent more, than in the same timeframe last year, as well as, in the five-year average for this time period.”

Nonetheless, Bloomberg News explained this week that, “Intensive testing of meat, seafood and other products for the coronavirus has tripled customs clearance times at some major Chinese ports, raising concerns the delays could ensnare global trade flows.

“It normally takes about three days to clear the produce but is now taking as long as 10, said an official with Bojun Supply Chain Co., which provides buyers with customs clearance services on foods including frozen products.”

The Bloomberg article stated that, “China had been boosting meat imports in a bid to offset shortages at home, after African swine fever outbreaks last year slashed the country’s herds. Meat and offal shipments surged to almost 900,000 tons in June, up 75% from year a ago, official customs data showed on Tuesday.”