The American Farm Bureau Federation is calling on President Donald Trump to dampen the Iran war’s shocks to the market for critical agricultural supplies — which are landing as farmers…

China Makes (Another) Record U.S. Corn Purchase in July, But Achieving Phase One Targets May Still be a Stretch

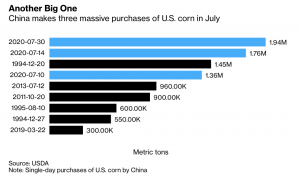

Bloomberg writers Elizabeth Rembert and Michael Hirtzer reported last week that, “China took another step toward meeting agricultural commitments made in the phase one trade agreement with the U.S. with its biggest-ever purchase of American corn.

“The U.S. Department of Agriculture said Thursday that exporters sold 1.937 million metric tons of corn, the third-largest deal for the grain to any destination. This purchase tops the previous record sale to China earlier [in July], when 1.762 million tons were booked.”

The Bloomberg writers noted that, “China is still on the line for $36.5 billion in U.S. agricultural goods as part of a trade accord, up from $24 billion in 2017.

The United States in July has sold at least 7.15 million tonnes (281 million bushels) of #corn for export, by far the largest for the month in recent memory and likely ever. 10-year average for the whole month is 3.7 mmt, including old and new crop sales. pic.twitter.com/DLXcjNAlYQ

— Karen Braun (@kannbwx) July 30, 2020

Another big sale reported to China. Largest corn sale to China ever, and third largest to any country. Lots of potential to grow our ag sales to China – we expect a big shipping season this fall. https://t.co/u0Q60TETZz

— Sec. Sonny Perdue (@SecretarySonny) July 30, 2020

Very important for our farm economy that phase 1 China trade deal is carried out 2day 1.9 million metric tons of corn was sold to China =the 3rd largest deal for grain ever But we hv 2b able to keep selling! #cornwatch #harvest2020

— ChuckGrassley (@ChuckGrassley) July 30, 2020

“Although the accelerated purchases will push the nation closer to that target, they might not provide enough momentum to reach the figure.”

Also last week, Reuters writer Mark Weinraub reported that, “In a separate report [Thursday], the USDA said soybean sales to China rose to 1.925 million tonnes in the week ended July 23, the biggest weekly total since Nov. 17, 2016.”

Through July 23, #China had purchased 8.09 million tonnes of U.S. #soybeans for delivery in 2020-21, the most for the date since 2014. pic.twitter.com/Fkm4fw3S3y

— Karen Braun (@kannbwx) July 30, 2020

“The recent purchases place China closer to the ambitious $36.5 billion target for imports of U.S. farm goods this year set in the Phase 1 trade deal.

Analysts and traders say that target may be achievable, but it is looking like a stretch.

Reuters writers Hallie Gu and Karl Plume reported last week that, “The chances of meeting the target will be clear in the next few months. Soybeans typically account for about half of China’s U.S. farm imports and the vast bulk of buying comes in the last three months of the year when supplies from top grower Brazil dry up.

“After a slow start, Chinese importers booked more than $2.5 billion in U.S. soy purchases in just the past eight weeks.”

Meanwhile, Wall Street Journal writer Lucy Craymer reported last week that, “China uses corn primarily for animal feed, but low domestic prices over the past four years caused it to find other uses as well, such as for cooking starch. Still, it has taken years to significantly reduce stockpiles and allow prices to recover. But with prices now soaring, industry analysts say they expect China to step up imports of corn and other grains, such as sorghum and barley, to help meet demand.

“That would benefit U.S. grain farmers, suffering from falling prices this year. The coronavirus pandemic has damped sales, and the market is further depressed by expectations of a larger corn crop later this year, thanks to farmers’ increasing the amount they planted. The U.S. harvest typically begins in September.”

The #corn price, at $3.16 per bushel, is down 4 cents from last month and 82 cents from June 2019.

— Farm Policy (@FarmPolicy) July 31, 2020

- July Monthly Ag Prices Report, https://t.co/MwCh6N778c @usda_nass pic.twitter.com/6yKg3S49hk

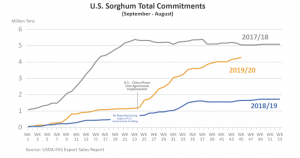

And a recent report from the USDA’s Foreign Agricultural Service (“U.S. Sorghum Prices Rally with China’s Return to the Market“) indicated that, “China’s announcement of tariff exclusions following the Phase One agreement had an immediate impact on U.S. sorghum exports mainly because of the sheer volume China purchases and its effect on prices.

“As of early-July, U.S. commitments to the world have more than doubled the entire volume sold in 2018/19 (Sep-Aug) and are headed to reach the 2017/18 level. About three- quarters of the commitments have been slated for China.”