Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

“Fragile” Farm Economic Conditions Persist, as Ethanol Waiver Concerns Remain

Wall Street Journal writer Kirk Maltais reported on Saturday that, “Following a growing season last year filled with battering rainfall and bitter trade wars, U.S. farmers hoped 2020 would provide them an opportunity to make up some ground. Instead, the situation has grown worse for many as prices remain depressed.

“Despite a wind storm tearing through Midwestern farms last week and drought conditions in isolated areas, a bumper crop of both corn and soybeans is still expected this year.”

The Journal article noted that, “That case was bolstered Friday when Pro Farmer, following a weeklong tour of farmland across seven states, assessed the national corn yield at 177.5 bushels per acre, and the national soybean yield at 52.5. That is slightly lower than earlier U.S. Department of Agriculture estimates but higher than 2019’s waterlogged crop.

For many U.S. farmers, the prospect of grain prices staying low is untenable. ‘It’s almost a day-to-day struggle to decide what to do next year,’ said Doug Sombke, president of the South Dakota Farmers Union and a farmer of 3,000 acres of corn and soybeans in Brown County, S.D.

Saturday’s article added that, “Mr. Sombke says his local grain elevator is paying $2.87 for a bushel of corn. That is nearly a dollar lower than what he would need to collect to break even. The same is true for his soybeans, for which the elevator is willing to pay roughly $8.50 a bushel.

“Prices for corn and soybeans haven’t risen since the start of the year, when the signing of the U.S.-China phase-one trade agreement stipulating China would purchase $36.5 billion of agricultural goods from the U.S. gave farmers hope that export demand from China would buoy prices. Instead, most-active corn futures on the Chicago Board of Trade are down 16% since the start of the year, while wheat has fallen nearly 6% and soybeans have shed nearly 5%.

“Chinese exports of U.S. corn, soybeans and wheat are 144% higher than they were at this point last year, according to data from the USDA’s Foreign Agricultural Service. But the onset of the coronavirus pandemic in the U.S. in March hobbled domestic demand for grains as restaurants and other institutions nationwide shut down.”

Referencing the impacts of the derecho storm that hit parts of Iowa and the Midwest earlier this month, Bloomberg writers Kim Chipman and Isis Almeida reported last week that, “This is just the latest blow to Midwestern farmers, pummeled first by the U.S.-China trade war and then by the pandemic.

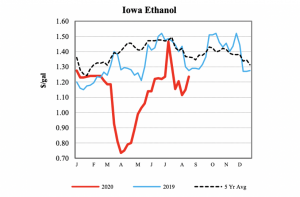

Coronavirus lockdowns served a serious hit to corn demand by delivering a knockout to the ethanol biofuel market.

“All that comes on top of years of stubbornly low prices and huge overhangs of inventory, which haven’t eased much under the administration of Donald Trump and his often-touted ‘love’ for farmers.”

Meanwhile, Tyler Jett and Brianne Pfannenstiel reported on the front page of Wednesday’s Des Moines Register that, “President Donald Trump promised Iowa leaders Tuesday that they would have the ‘full support of the federal government’ as they work to clear debris, restore power and recover from a massive windstorm that swept the state last week.

“‘Iowans have always been resilient and strong and tough and great people,’ Trump said in a briefing in Cedar Rapids.”

“Gov. Kim Reynolds, U.S. Sen. Joni Ernst, U.S. Sen. Chuck Grassley and [Cedar Rapids Mayor Brad Hart] were on hand to greet the president and participated in the briefing,” the Register article said.

Wednesday’s article explained that, “Ernst urged Trump to work with the Environmental Protection Agency to support Iowa’s ethanol industry as it faces pressure both from the storm and from effects of the pandemic. Ernst has criticized the administration’s ethanol policy after it granted some oil refineries exemptions to the Renewable Fuel Standard [RFS]. She told Trump that new exemption requests should be tossed out.

‘It’s very tough right now,’ she said. ‘From COVID we saw a decrease in driving, and so the sales of ethanol have not been up where they should be. And we’ve seen that all across the industry, the impact. And now, after the crop damage, it just sets our farmers even farther back.’

“Trump said he’d speak to administration officials.

“‘I’ll speak to them myself,’ he said.”

Iowans are hurting. Our farmers have seen their crops destroyed from the #derecho & they can’t afford for the @EPA to be playing games—the “gap year” waivers need to be thrown out.

— Joni Ernst (@SenJoniErnst) August 18, 2020

In Cedar Rapids today, I brought the concerns of our farmers & producers to @POTUS & his admin. pic.twitter.com/fPjuFDChHe

And in more detailed reporting on RFS exemption requests, DTN writer Todd Neeley reported last week that,

Just days after a Midwest lawmaker pleaded with President Donald Trump to order his EPA to deny requests for so-called gap-year small-refinery exemptions, the agency has posted updated numbers of the number of exemption requests now pending.

“The EPA has received 98 total requests for years 2011 to 2020, including now 67 for 2011 to 2018, according to the agency’s Renewable Fuel Standard dashboard.

The @EPA today announced it has received nine new gap-year small refinery exemption requests and three other waiver petitions. This new count brings the total of pending waiver requests to 98. …

— Renewable Fuels Association (@EthanolRFA) August 20, 2020

1/5 pic.twitter.com/sikQ3xdU8j

“Ethanol and agriculture industry leaders have been calling for EPA to implement a January ruling in the U.S. Court of Appeals for the 10th Circuit in Denver. The court essentially ruled the EPA mishandled exemption requests from three refining companies.”