A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

African Swine Fever in Germany Continues to Impact Pork Markets

Reuters News reported this week that, “One more case of African swine fever (ASF) has been confirmed in a wild boar in the eastern German state of Brandenburg, Germany’s federal agriculture ministry said on Wednesday.

The discovery brings the total number of confirmed cases to 50 since the first one on Sept. 10. All were in wild animals with no farm pigs affected, the ministry said.

The Reuters article noted that, “China and a series of other pork buyers banned imports of German pork in September after the first case was confirmed, causing Chinese pork prices to surge.”

And a separate Reuters News article this week explained that, “Growth in pork exports from the European Union will slow significantly as Germany faces trade restrictions following a swine fever outbreak and Chinese demand contracts, the EU’s executive forecast on Monday.”

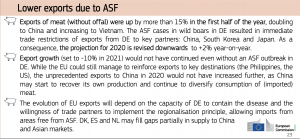

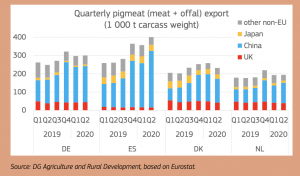

The Reuters article stated that, “After increasing by 15% in the first half of the year, including a doubling of volumes to China, EU pork exports were expected to rise by only 2% over 2020, the Commission said in a short-term agricultural outlook report.

“In its previous outlook in July, the Commission forecast a 10% increase in full-year pork shipments.”

The Reuters article added that, “‘The evolution of EU exports will depend on the capacity of Germany to contain the disease,’ the Commission said in its latest outlook, adding that Denmark, Spain and the Netherlands ‘may fill gaps partially in supply to China and Asian markets.’

“For next year, it projected a 10% decline in exports, in part due to an expected contraction in Chinese demand as the country rebuilds its own pig herd that was decimated by ASF.”

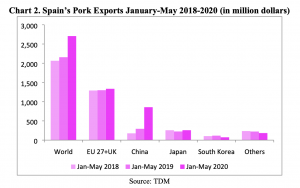

A report last month from USDA’s Foreign Agricultural Service (“Spanish Livestock and Poultry Sector Update“) pointed out that, “During the first five months of 2020, the volume of Spanish pork exports grew by 11 percent fueled by record-level exports to China. In addition, the recent outbreak of African Swine Fever in Germany may further expand Spanish pork exports to Asian markets.”

More specifically regarding Chines pork production, Reuters writer Dominique Patton reported last week that,

China’s huge pig herd is rebounding rapidly after being decimated by disease but pork output will take much longer to restore given the low quality of the new herd, say experts and analysts.

The Reuters article explained that, “In July, the herd grew for the first time in more than two years, and in August it jumped by 31% over the same month last year, said the Ministry of Agriculture and Rural Affairs.

“Some producers have even suggested that the rebuild may be overdone.

“But the large numbers mask a less productive herd. With such a severe shortage of breeding stock, many new farms are keeping back females that would normally have been slaughtered for meat to use as breeders.”

Also last week, Bloomberg News reported that, “A video showing scores of furniture store employees lining up to receive a bag of fatty pork has gone viral in China, a show of how surging prices have turned swine meat into a luxury holiday gift.”

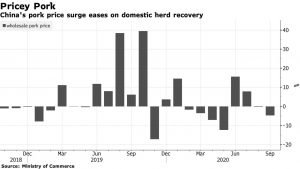

However, the article stated that, “Chinese wholesale pork prices fell by almost 5% in September from a month earlier, the biggest drop since May, according to commerce ministry data. China’s high pork prices have been a major driver of the country’s food inflation. Still, they remain about 25% higher than a year ago.

“More pork supplies from a recovery in the domestic herd may continue to cool down prices in the fourth quarter, though the market will remain tight for a while, said Zhu Zengyong, a researcher with the Chinese Academy of Agricultural Sciences.”