A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Federal Reserve Ag Credit Surveys- 2020 Third Quarter Farm Economy Conditions

Last week, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the third quarter of 2020.

Federal Reserve Bank of Chicago

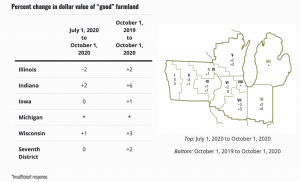

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “The District observed a year-over-year increase of 2 percent in its agricultural land values in the third quarter of 2020. The District had not seen this large of a year-over-year increase in its farmland values during the past six years. Indiana and Wisconsin led the way with year-over-year jumps in their farmland values of 6 percent and 3 percent, respectively; the growth in farmland values in Illinois (2 percent) and Iowa (1 percent) was more modest. On the whole, the District’s agricultural land values were unchanged from the second quarter of 2020, although Illinois’s experienced a 2 percent quarterly decrease.”

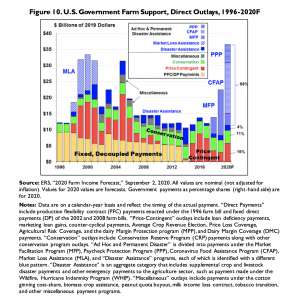

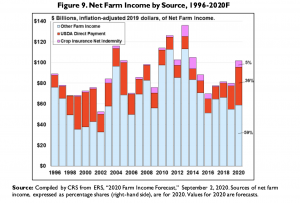

The AgLetter stated that, “There was also a pickup in agricultural trade, which helped matters. Additionally, by the end of October, the Coronavirus Food Assistance Program (CFAP) had dispersed over $2.4 billion to farm operations in the five District states (24 percent of the $10.3 billion sent nationwide). As one Wisconsin respondent noted, ‘With higher prices and government payments, dairy and crop producers will end the year better than expected.'”

Mr. Oppedahl added that, “Survey respondents who anticipated District farmland values to rise in the final quarter of 2020 outnumbered those who anticipated them to fall.”

“Highest increase in six years for farmland values.” Economist David Oppedahl discusses #farm earnings, #credit conditions and the impact of federal assistance on #agriculture as part of the release of the @ChicagoFed’s Q3 AgLetter. Read the full report: https://t.co/jPXfstMUoo pic.twitter.com/XvTv57PEUA

— ChicagoFed (@ChicagoFed) November 12, 2020

The Chicago Fed indicated that,

Another Wisconsin banker stated that because federal government payments have made up such a large share of net farm income in 2020, ‘it will be hard for farmers to find a chair when the music stops.’ Until then, the circling continues while the District’s farms prepare for uncertain times ahead.

Federal Reserve Bank of Kansas City

and

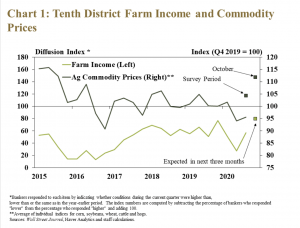

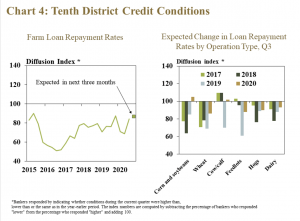

Thursday’s update stated that, “Alongside a better outlook for farm income in 2020, most measures of credit conditions also deteriorated at a more gradual pace in the third quarter. About 20% of respondents reported a decline in loan repayment rates, compared with about 35% in the previous two quarters and 30% the same time a year ago.”

Kauffman and

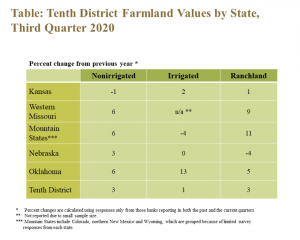

The Kansas City Fed noted that, “The stability of farm real estate values was consistent across all types of land in a majority of states. On average across all types of farmland, values increased from a year ago in all states expect Nebraska.”

In summary, the Kansas City Fed stated that,

Better profit opportunities for both crop and livestock producers, as well as additional government support across the sector, created more favorable conditions for farm finances in 2020 than earlier in the year.

“Farm income and credit conditions remained weak, but the pace of deterioration slowed from the last quarter and demand for farm loans was more subdued. Amid improvement to cash flows and repayment capacity, bankers were monitoring a smaller share of loans for problems. Bankers continued to express concerns, however, about the potential for renewed pressure in the months ahead, depending on the path of agricultural commodity prices and government support programs.”

Federal Reserve Bank of Minneapolis

In an article last week, “Agricultural outlook improves on good harvests, federal aid,” Joe Mahon pointed out that, “After multiple years of tough financial conditions for agriculture, COVID-19 might have been expected to deal another major blow to the sector. But pandemic-relief aid along with mostly bountiful harvests in the Ninth District and a slight recovery in prices have painted an optimistic picture for the end of 2020, according to the Federal Reserve Bank of Minneapolis’ third-quarter (October) agricultural credit conditions survey. ‘Increasing farm commodity prices and COVID-related government programs have most farmers sitting OK,’ reported a Wisconsin agricultural banker responding to the survey.”

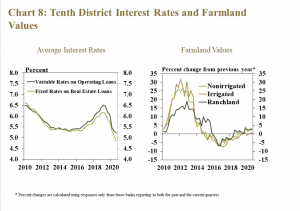

Mr. Mahon explained that, “The recent trend of declining farmland values appeared to have halted in the third quarter. The average value for nonirrigated cropland in the district increased by 3 percent from a year earlier, according to survey respondents. Irrigated land values rose by slightly less than 3 percent, while ranch- and pastureland values were unchanged on average.

“Cash rents held more steady. The district average rent for nonirrigated land dropped less than 1 percent. Rents for irrigated land increased a little more than 1 percent, while ranchland rents were flat.”

The Minneapolis Fed added that, “‘Recent rally in the grain market combined with more government support program money should make for a good last quarter in 2020 for farm incomes,’ said a Minnesota banker in a survey comment.”