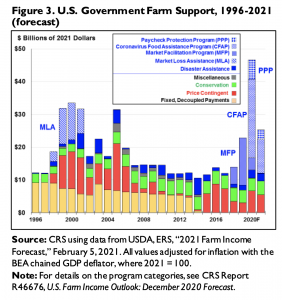

Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

Kansas City Fed: Improvement in Ag Economy Strengthens Credit Conditions

In an update this week from the Federal Reserve Bank of Kansas City (“Farm Lending Pullback Continues“), Cortney Cowley and Ty Kreitman stated that, “Agricultural debt at commercial banks eased further at the end of 2020, and loan repayment problems moderated slightly. General improvement in the agricultural economy likely drove the pullback in farm lending activity and strengthened credit conditions. Higher crop prices and an influx of government payments in 2020 also contributed stronger growth in deposits, which supported a sharp increase in liquidity at agricultural banks.”

More narrowly, Cowley and Kreitman explained that, “Agricultural loan balances at commercial banks reached a five-year low in the fourth quarter and continued to shift toward farm real estate. Although the accumulation of farm debt remained higher than the average of the past ten years, the total value of farm loan portfolios fell 5% from the previous year. Moreover, loans to purchase farmland accounted for 57% of total loan volumes, which was the highest allocation for real estate loans on record.”

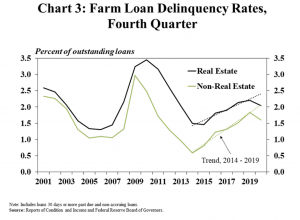

This week’s update noted that, “Alongside better farm financial conditions and lower debt levels, delinquency rates on agricultural loans declined from a year ago. From 2014 to 2019, delinquency rates on farm loans grew by about 0.2 percentage points per year in the fourth quarter, on average. However, the share of real estate and non-real estate loans past due fell 0.16 and 0.24 percentage points, respectively, from the previous year in 2020, which was a notable reversal of the previous trend.”

The Kansas City Fed update added that,

Moving forward, the pace of lending to farmers may remain slower than in previous years, as 2020 government payments and recent strength in crop prices have improved borrower liquidity and farm balance sheets.

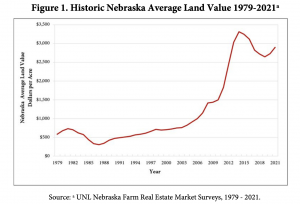

Meanwhile, with respect to farmland values, a recent update from the University of Nebraska (“The Impact of COVID-19 and Economic Policies on Nebraska Farm Real Estate in 2021“) stated that, “The market value of agricultural land in Nebraska increased by 6% over the prior year to an average of $2,895 per acre according to the 2021 Nebraska Farm Real Estate Market Survey. This improvement marks the second consecutive gain in the market value of agricultural land in Nebraska since 2019.”

The University of Nebraska report indicated that, “Land industry professionals responding to the annual survey attributed the rise in Nebraska farm real estate values to current interest rate levels, crop prices, and COVID-19 disaster assistance payments provided to operators across the state.”

And Daniel Grant reported recently at FarmWeekNow Online that, “The farmland market temporarily screeched to a halt at many locations around the state [Illinois] in 2020 due to the onset of the coronavirus pandemic before gaining momentum to end the year.

“Now, the tailwind continues to propel farmland prices higher so far this year based on reports during the farmland values conference webinar hosted by the Illinois Society of Professional Farm Managers and Rural Appraisers (ISPFMRA).”

Mr. Grant stated that, “ISPFMRA’s 26th annual farmland values and lease trends report shows average statewide prices in 2020 at $10,870 per acre for excellent quality land (up 4.2% from 2019), $8,446 per acre for good land (up 1.3%), $6,409 for average ground (down 1.4%), $5,353 for fair soil (up 5.1%) and $3,689 for recreational ground (down 5.5%).”

“The late season run-up in farmland prices in 2020 resulted from a multitude of factors, including higher commodity prices, good yields in many areas, farm program and government stimulus payments, increased investor interest, tight supplies and strong demand,” Mr. Grant said.

Recall that trends in Iowa farmland values were highlighted in a recent update from the Center for Agricultural and Rural Development (Iowa State University).