President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

Observers Watching ASF in China, Herd Size a Variable Impacting Demand for Feed and Pork

Reuters News reported last week that, “China reported an outbreak of African swine fever in Xinjiang region, the agriculture ministry said on Wednesday.

“The outbreak occurred on a farm in Yili prefecture with 466 pigs and 280 pig died, the Ministry of Agriculture and Rural Affairs said in a statement, adding that the remaining pigs had been culled.”

Also last week, Bloomberg News reported that, “Chinese authorities have collected 48 pig carcasses discarded along the Yellow River and are conducting tests for water quality and hog disease, according to state media on Tuesday.

“Two people suspected of dumping the pigs have been identified and will be investigated, according to Banyuetan, a magazine run by state news agency Xinhua, citing the local government. Authorities took samples from the pigs and river water for examination, and pigs on nearby farms would be tested, it said.”

The Bloomberg article noted that, “The latest discovery comes as China’s hog herd is recovering from the ravages of African swine fever. The disease broke out in the country in 2018 and destroyed almost half the hogs in the world’s largest pork producer. Concerns over food safety and rising costs of pork production have accelerated the closure of small pig farms in favor of larger, more efficient facilities.”

Meanwhile, Reuters columnist Karen Braun indicated on Thursday that, “China is taking in record amounts of soybeans from the United States and Brazil as its hog population recovers from a deadly disease that began nearly three years ago, but import expansion into the next marketing year might be minimal.

Additionally, China continues to report new outbreaks of African swine fever (ASF). Many market-watchers are growing fearful that the disease could be worse than it appears, adding uncertainty around the direction of global feed ingredient trade over the next year or so.

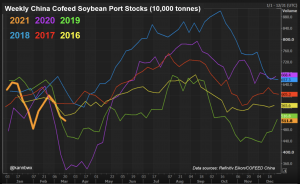

Ms. Braun explained that, “China’s soybean stocks will be a key factor to watch in the coming months for signs of ASF-linked demand problems. When the big outbreak of ASF began in 2018, soybean stocks at the ports started to build to unusually high levels given the relatively normal import volumes.”

The Reuters column stated that, “The trade war was such a good cover for China, which at that time did not need anywhere close to the amount of U.S. beans the market believed it would, that industry participants for months remained in the dark about the severity of the ASF outbreak. That likely explains why the market is more attentive to the outbreaks this time around.

With the Phase 1 deal in effect and trade relations patched up for the time being, it will certainly raise red flags if China does not start ramping up U.S. soybean purchases in a few months. The country already had at least 2.3 million tonnes of U.S. soybeans on the books for 2021-22 as of March 11, more than usual, but the bigger deals should start coming in by June or July.

In a segment last week on USDA Radio (MP3- 1 minute), Secretary of Agriculture Tom Vilsack indicated that, “There are probably some [ASF] hot spots that are taking place in China,” and he added that, “But I don’t think it’s anywhere near as devastating as it was, perhaps six to nine months ago.”

Recall that an analysis of Chinese pig herd size was discussed in a FarmPolicyNews update from last week, “Recent CARD Paper Discusses China’s Hog Inventory, with Implications for Corn Demand.”

Wowzers #corn and #soybean exports are approaching 4.8 billion bushels, 98% and 100% of #WASDE, respectively. BUT...outstanding corn sales still a concern w/ only 49% accumulated & slowest pace in over 30 years @FarmBureau pic.twitter.com/ynEo4nx2Dq

— John Newton (@New10_AgEcon) March 25, 2021

In a separate focus on U.S. pork price variables, Bloomberg writer Michael Hirtzer pointed out last week that, “New outbreaks of the African swine fever virus in China threaten the world’s biggest hog herd.

“China’s animal-disease resurgence and outbreaks in top pork-supplier Europe could keep demand strong for U.S. meat exports as the U.S. starts reopening restaurants and resuming sporting events, driving up more domestic sales of hot dogs and other pork products.”

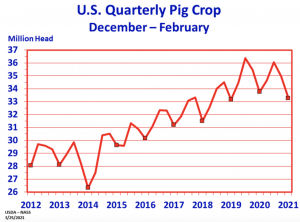

Simultaneously, as ASF remains a potential variable impacting U.S. pork demand, Reuters writer Christopher Walljasper reported late last week that, “Lean hog futures on the Chicago Mercantile Exchange found life-of-contract highs for a second day on Friday after the U.S. Agriculture Department reported tight supplies in its quarterly hogs and pigs report after the close Thursday.”

“The USDA’s quarterly report noted a 2% drop in the U.S. herd as of March 1, compared with a year earlier, well below analyst expectations.”

The Reuters article added that, “The USDA also projected a 4% drop in sows birthing new piglets from June to August, compared with a year earlier.”