A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

An Increase in Wheat Feeding to Hogs in China, as China’s First-Quarter Pork Production Rose

Reuters writer Dominique Patton reported late last week that, “China’s first-quarter pork production rose 31.9% from a year earlier to 13.69 million tonnes, data showed on Friday, the highest quarterly volume in two years.

“The surge comes after huge investments in rebuilding China’s hog herd since the deadly African swine fever disease ravaged farms in 2018 and 2019.

“China’s pig herd increased to 415.95 million head at the end of March, a 29.5% rise on the year, and up from 406.5 million at the end of December, the National Bureau of Statistics said.

Ms. Patton explained that,

A severe wave of disease over the winter added to pork production as many farms wary of the rising risk of infection sent pigs to slaughter early.

“Average weights of pigs slaughtered were lower than a year ago, said [Pan Chenjun, senior analyst at Rabobank], indicating liquidation by farmers, and a key reason for the increase in output.”

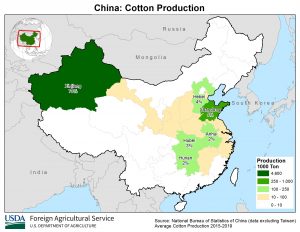

Also last week, Bloomberg News reported that, “China should build more pig farms in Xinjiang as its cotton industry is under threat from declining soil fertility, according to a government researcher, commenting after some international companies avoided fiber produced in the region over allegations of forced labor.

“Hog farming could become a pillar industry in the region and supply 10% of the nation’s output, up from 1% now, wrote Mei Xinyu, a think-tank researcher at the commerce ministry. Xinjiang already grows more than 80% of the country’s cotton, and some of those pig farms would replace fields sown to the fiber that have been degraded.”

“Outbreaks of African swine fever that started in 2018 slashed hog herds by as much as half and sent meat imports spiraling to a record,” the Bloomberg article said.

Meanwhile, Reuters writers Hallie Gu and Naveen Thukral reported on Thursday that, “China’s wheat feeding to pigs and poultry has dented demand for alternate feeds and clouded the market outlook for soybean meal and other key ingredients used by the country’s massive feed sector, analysts and traders said.

"What's the Story with #Wheat and #China?" https://t.co/VqMDnxAB6d (MP3- 1 minute). @USDA Radio.

— Farm Policy (@FarmPolicy) April 14, 2021

* Remarks from @usda_oce Chief Economist @SethMeyerMU. pic.twitter.com/NcF9hG6qF4

“Chinese feed producers have sharply raised wheat purchases in the past several months to replace corn, which has rallied by more than a third in the past year to a rare premium over wheat following a drop in corn output and state stockpiles last season.

“Greater feed use of wheat, which has more protein than corn, has also cut demand for soymeal, the main protein source in livestock rations, putting further pressure on local crushing margins and raising questions about China’s appetite for soybeans just as U.S. farmers gear up to commit more than 87 million acres to the crop.”

The Reuters article noted that,

China is expected to use up to 40 million tonnes of wheat for feed in the 2020/21 crop year that started in June, replacing roughly the same amount of corn and also displacing more than 4 million tonnes of soymeal, according to two sources.

“The ongoing wheat substitution is expected to continue for several more weeks as many feed producers have built up wheat stocks through May, traders and crushers said.”

The Reuters article added that, “The pressure on soybean meal comes just as millions of tonnes of soybeans are en route from Brazil. China is expected to receive more than 7 million tonnes of soybeans in April, and around 10 million tonnes for both May and June, traders said.”

#Soybeans arriving in #China, ones that were shipped in the earlier stages of #Brazil's 2020/21 campaign. pic.twitter.com/sel7lprnYg

— Karen Braun (@kannbwx) April 16, 2021

More broadly with respect the Chinese domestic economy, Financial Times writers Thomas Hale, Sun Yu and Martin Arnold reported last week that, “China’s economy continued its strong recovery from coronavirus in the first quarter of 2021 as the country unveiled a record annual growth rate, but the figures masked the lingering damage left by the pandemic last year.

“China’s output leapt 18.3 per cent year on year in the first three months, the fastest rate since records began in the early 1990s. The high rate was anticipated because in the same period last year China’s economy contracted for the first time in decades as the country went into lockdown.”

The FT article stated that, “The expansion was also supported by household consumption, which had previously lagged behind the wider recovery but is expected to play a greater role in driving growth this year. Retail sales beat expectations to add 34.2 per cent in March, rebounding from a period of lockdowns a year earlier.

“Eswar Prasad, a China finance expert at Cornell University, said that even after taking into account the ‘phantom effect’ of the low-base comparison from last year, the first-quarter figure was ‘clear confirmation of the resilience and momentum of the Chinese economy.'”