President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

World Food Price Index Highest Since 2014, Few Signs of Higher Prices Curbing Demand

Bloomberg writers Agnieszka de Sousa and Megan Durisin reported on Thursday that, “Consumers are seeing little letup in surging food prices, as rallies in everything from grains to sugar keep pushing global costs higher.

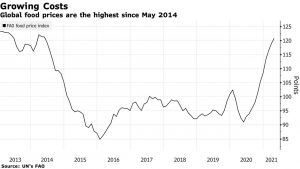

“A United Nations gauge of world food costs climbed for an 11th month in April, extending its rally to the highest in seven years.

Prices are in their longest advance in more than a decade amid weather worries and China’s crop-buying spree that’s tightening supplies, threatening faster inflation.

The Bloomberg article indicated that, “‘Markets are a bit fragile and stressed because of supply issues,’ said Abdolreza Abbassian, a senior economist at the UN’s Food and Agriculture Organization. ‘If you get a stronger demand than currently projected, then you could see these prices rise further.'”

Faster increase in demand could lead to even higher food prices ahead! https://t.co/rbW7bfSywS

— Abdolreza Abbassian (@Abbassian_A) May 6, 2021

Also this week, Reuters News reported that, “World food prices increased for a 11th consecutive month in April, hitting their highest level since May 2014, with sugar leading a rise in all the main indices, the United Nations food agency said on Thursday.”

The Reuters article noted that, “FAO’s cereal price index rose 1.2% in April month-on-month and 26% year-on-year. Worries about crop conditions in Argentina, Brazil and the United States pushed maize prices up 5.7% last month, while wheat prices held largely steady. By contrast, international rice prices slipped, FAO said.”

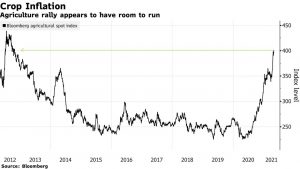

Meanwhile, Bloomberg writers Isis Almeida and Fabiana Batista reported earlier this week that, “Crop prices are already at the highest levels in more than eight years, and with meat and fuel markets running hot, the rally may still have further to go.

“Meat producers and biofuel makers have so far seen a bull market of their own, passing on the increase in grain costs as the world emerges from the pandemic.

Executives from Archer-Daniels-Midland Co. and Bunge Ltd., two of the world’s top agricultural commodities traders, say there are very few signs the rally is curbing demand.

“And the U.S. is approaching summer — peak time for grilling and driving — which should only boost consumption further.”

The Bloomberg writers explained that, “Everything from corn to soybean oil has surged as top commodities buyer China scoops up U.S. supplies just as dry weather in Brazil fuels concerns about the size of crops in the South American agriculture powerhouse.”

USDA Daily #Ethanol Report, https://t.co/vCMyEktFEc @USDA_AMS

— Farm Policy (@FarmPolicy) May 6, 2021

* #Iowa: #Corn and ethanol average prices.

* 2021, 2020, and five-year average. pic.twitter.com/wI5zzWonYb

In a look at U.S. crop production issues, Donnelle Eller reported on the front page of Friday’s Des Moines Register that, “Concern that dry conditions in Iowa and other parts of the nation will reduce crop yields is helping to drive grain prices to highs farmers haven’t seen in nearly a decade. Corn that farmers will deliver in October is inching toward $6 a bushel at Iowa elevators; soybeans are trading around $13.”

Ms. Eller noted that, “A report Thursday showed drought conditions expanding across Iowa. About 40% of the state is in moderate or severe drought, the U.S. Drought Monitor showed. Severe drought continues to grip northwest Iowa, and moderate drought has grown to encompass much of the northern half of the state, including Franklin County, where [farmer April Hemmes] lives.”

The Register article stated that, “[Dennis Todey, director of the U.S. Department of Agriculture’s Midwest Climate Hub in Ames] said parts of Iowa over the past 30 days have received less than half the average rainfall. ‘Not only are we not getting precipitation,’ but hot, dry air and strong winds last week ‘evaporated a lot of water from the surface,’ he said.

“‘That was that great sucking sound you heard last Saturday,’ Todey said.

Approximately 26% of #corn production is within an area experiencing #drought. pic.twitter.com/NLTojJSXlC

— Farm Policy (@FarmPolicy) May 6, 2021

“Some showers this week have helped stem worsening drought conditions, he said. But only one-fifth of the state had adequate moisture, and mostly in corridors along Iowa’s eastern and western borders, the Drought Monitor shows.

“The outlook for the next couple of weeks calls for cooler and wetter than average conditions, Todey said. “’We may not fix the situation, but it may improve,’ he said.”

Also this week, Liam Denning stated in a Bloomberg column that, “Having scraped $7.50 a bushel, corn is up roughly 50% so far this year, hitting its highest level since 2012. Like all commodities, it’s feeling the recovery from Covid-19, including big post-pandemic restocking by China. A rebound in gasoline demand, with its attendant corn-based ethanol component, helps too. The essential element is on the supply side, however, with drought, both actual and feared, providing an extra boost.

“Feverish talk of a new commodities supercycle has also been thrown around in 2021. Yet the premise is flawed, and grains certainly won’t drive one.

“Unlike metals or fuels, spikes in crop prices tend to be short-lived. Shortages induced by weather such as droughts or floods are usually brief and isolated in their impact. And while bringing a new mine or oilfield into production can take years, farmers respond to price signals on a seasonal schedule.”