Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

Federal Reserve Ag Credit Surveys- 2021 First Quarter Farm Economy Conditions

Last week, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of 2021.

Federal Reserve Bank of Chicago

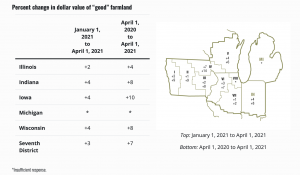

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in The AgLetter that, “District agricultural land values jumped 7 percent in the first quarter of 2021 relative to the first quarter of 2020, topping the year-over-year increase for the fourth quarter of 2020. Farmland values gained 3 percent in the first quarter of 2021 from the fourth quarter of 2020.

“Indiana, Iowa, and Wisconsin had steeper year-over-year increases in farmland values than did the District as a whole, but Illinois had a more modest increase.”

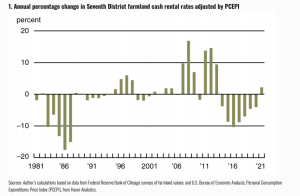

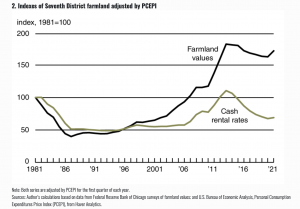

The Ag Letter stated that, “After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), District farmland values in the first quarter of 2021 were up on a year-over-year basis for the fourth quarter in a row; prior to this positive trend, there had been real year-over-year declines in farmland values from the third quarter of 2014 through the first quarter of 2020.”

Mr. Oppedahl added that, “Cash rental rates for District agricultural acres climbed 4 percent from 2020 to 2021. For 2021, average annual cash rents for farmland were up 2 percent in Illinois, 4 percent in Indiana, 5 percent in Iowa, and 5 percent in Wisconsin (not enough survey responses were received from bankers in Michigan to report a numerical change for that state).

“After being adjusted for inflation with the PCEPI, District cash rental rates rose 2 percent from 2020.

This was the first increase after seven straight years of declining cash rents (in both nominal and real terms), which constituted the longest such streak in the history of the survey.

The Chicago Fed indicated that, “In real terms, both the index of farmland cash rental rates and the index of agricultural land values peaked in 2013. Even after rising in 2021, the index of real cash rents was 38 percent below its level in 2013; the index of real farmland values was just 6 percent off from its 2013 peak.”

The AgLetter explained that, “Higher farmland values and cash rents were the result of a dramatic turnaround in agricultural prospects from a year ago—generated in part by higher earnings for farms as key agricultural prices recovered (and even rose above year-earlier levels) after the initial impacts of the pandemic lessened.

#Midwest farmland values continued to rise in the first quarter of 2021, reports David Oppedahl, senior business economist. Find the full #AgLetter video and report here: https://t.co/jPXfstMUoo#farmlandvalues #agindustry #agriculture pic.twitter.com/4GnZJ4cAaK

— ChicagoFed (@ChicagoFed) May 13, 2021

“In March 2021, corn and soybean prices were 33 percent and 56 percent higher than a year ago, respectively, according to data from the U.S. Department of Agriculture (USDA). And hog prices were 38 percent above those in March 2020. In addition, the USDA’s Coronavirus Food Assistance Program pumped $24.1 billion into the farm economy over the past year, with 23.5 percent ($5.68 billion as of May 2, 2021) coming to the five states of the District. Combined, these factors (along with lower real interest rates) boosted farm incomes, helping drive up both farmland values and cash rents.”

Federal Reserve Bank of Kansas City

and

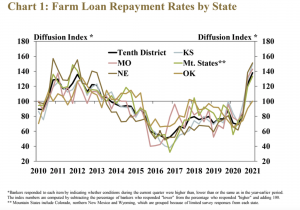

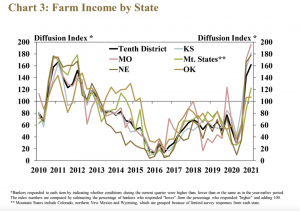

Agricultural credit conditions in the Tenth District continued to strengthen in the first quarter of 2021.

“After a sharp rebound at the end of 2020, conditions in the broad agricultural economy continued to improve alongside additional increases in crop prices. Stronger profit potential for farm borrowers supported a second consecutive quarter of significant increases in farm income, loan repayment rates and farmland values.

“Overall, farm borrowers in the District were in a better financial position than at the beginning of 2020, but the pace of improvement was notably slower for livestock producers and for producers in areas affected by severe drought.”

Thursday’s update stated that, “Repayment rates for farm loans in the first quarter improved significantly throughout the region. The rate of loan repayment increased rapidly for the second consecutive quarter in nearly all states.”

Cowley and Kreitman also noted that, “About two-thirds of all banks throughout the region reported that farm income was higher than a year ago, the largest share since 2011.”

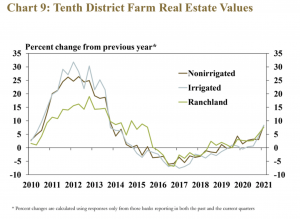

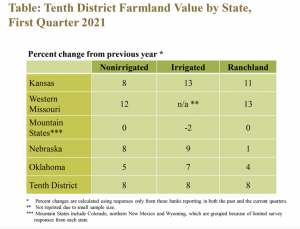

With respect to farmland values, the Ag Credit Survey indicated that, “With support from a stronger farm economy and historically low interest rates, farm real estate values increased throughout the District. All types of farmland rose 8% in value in the first quarter.”

More narrowly, the Survey added that, “Farm real estate markets were especially strong in states less impacted by drought.

“Values for nonirrigated cropland rose at least 8% in Kansas, Missouri and Nebraska. In contrast, cropland values remained unchanged in the Mountain States, where more than 70% of the land area was in severe to exceptional drought in the first quarter.”

Federal Reserve Bank of Minneapolis

In an article last week, “Farm finances strong heading into growing season,” Joe Mahon pointed out that, “Farm incomes and capital spending increased over the first three months of 2021, according to lenders responding to the Minneapolis Fed’s first-quarter agricultural credit conditions survey, conducted in April.

.@MinneapolisFed webinar: Regional Economic Conditions: Agricultural Credit.

— Farm Policy (@FarmPolicy) May 13, 2021

Ag Sector in Recovery. pic.twitter.com/55JfWFDvZ7

“Growing incomes also led to increased loan repayment rates, while loan demand decreased and renewals and extensions held steady. Farmland values increased on average from a year earlier, and cash rents jumped as well. The outlook for the growing season is positive, as respondents expected further growth in farm incomes and spending.”

.@MinneapolisFed webinar: Regional Economic Conditions, Agricultural Credit.

— Farm Policy (@FarmPolicy) May 13, 2021

Big Bump in #Farm Income Over Last Six Months. pic.twitter.com/eQeNaljFEr

Mr. Mahon explained that, “Cropland values and cash rents generally increased in early 2021, continuing a trend from recent surveys. Ninth District nonirrigated cropland values rose by 6.8 percent on average from the first quarter of 2020. Irrigated land values fell slightly, by 1.3 percent on average, while ranchland values were unchanged.

.@MinneapolisFed webinar: Regional Economic Conditions, Agricultural Credit.

— Farm Policy (@FarmPolicy) May 13, 2021

Ag Interest Rates Continue to Trend Down. pic.twitter.com/kF4BhHK0vv

“The district average cash rent for nonirrigated land jumped by 7.7 percent from a year ago. Rents for irrigated land and ranchland increased 2.6 percent and 5.8 percent, respectively.”

“Expectations heading into the growing season were generally optimistic,” Mr. Mahon said.