President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

ERS Report: U.S. Beef Exports Up in March on Robust China Demand, Pork Exports Accelerate, and Short Term Chicken Supply a Challenge

In its monthly Livestock, Dairy, and Poultry Outlook report from Tuesday, USDA’s Economic Research Service (ERS) indicated that, “In March, the United States exported the most beef (in volume) ever recorded, totaling 300 million pounds, an increase of 12.3 percent (or 32.9 million pounds) from a year ago. Besides the year-over- year increase in beef shipments to South Korea, Hong Kong, and Mexico, there was a significant rise in exports to China.

U.S. beef exports there totaled 43.1 million pounds, by far the largest volume the United States has ever exported to China. Year-to-date, China ranks the third-largest U.S. beef destination, surpassing both Mexico and Canada.

“The rise in exports to China reflects, in part, China’s growing demand for beef and its ongoing challenges with the African swine fever as the country works to rebuild its swine inventory and industry.”

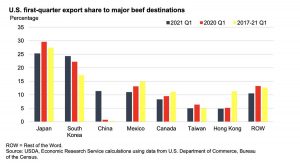

The ERS update explained that, “First-quarter beef exports totaled 797 million pounds, 3.6 percent larger than last year. The chart below shows U.S. beef export shares in first-quarter 2021. Japan and South Korea continue to account for the greatest share of U.S. beef exports. Among major U.S. beef destinations, China’s share increased from less than 1 percent in March 2020 to over 11 percent in March 2021. South Korea had the second- largest increase in share of 2 percentage points more than a year ago. The export shares to other major U.S. beef destinations and the Rest of the World were all lower in 2021 relative to a year earlier.”

Looking ahead, the Outlook report added that, “The forecast for the second and third quarters was increased by 20 and 15 million pounds from last month to 810 and 825 million pounds on expectations for continued strong exports to China. No changes were made to the fourth-quarter export forecast from last month. The annual forecast for 2021 beef exports is 3.227 billion pounds. The first-quarter 2022 is forecast to be slightly lower than 2021 due to lower expected cattle slaughter and tighter beef supplies. The 2022 annual forecast for beef exports is 3.225 billion pounds, flat relative to 2021 due to limited exportable supplies.”

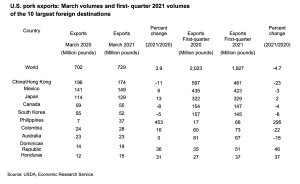

With respect to U.S. pork exports, ERS stated that, “U.S. pork exports in March were 729 million pounds, almost 4 percent greater than a year ago. Shipments to Mexico, Japan, the Philippines, and South and Central America were particularly strong. While exports to China\Hong Kong were year-over-year lower, they led the list of the 10 largest foreign destinations for U.S.-exported pork in March.

“With expectations that higher feed costs and continuing problems with swine diseases will limit domestic pork production in several major importing countries, forecasts for U.S. pork exports were increased in the second quarter of 2021 by 75 million pounds to 1.85 billion pounds, and by 50 million pounds in the third quarter to 1.7 billion pounds. For 2021, total U.S. pork exports are expected to total about 7.4 billion pounds, almost 2 percent higher than exports last year.

“Expectations are that U.S. pork exports in 2022 will be about 7.4 billion pounds, almost the same as this year. Export volumes are likely to be determined by factors similar to those driving foreign demand for U.S. pork this year, namely swine diseases, economic recovery from the COVID-19 virus, and feed costs.”

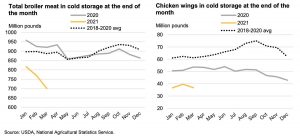

In a closer look at poultry variables, the ERS Outlook pointed out that, “In March, broiler production totaled 4 billion pounds. This was 3.6 percent above production in March 2020 but a 1-percent year-over-year decrease in production on a per day basis. First-quarter production totaled 10.884 billion pounds, 3 percent below first-quarter 2020, but reflected an additional slaughter day in 2020. Low chicken supply is currently being compounded by record-low stocks in cold storage. Broiler meat in cold storage at the end of March totaled 700 million pounds; November 2014 was the last time chicken stocks were this low.

Chicken wings, which have been in high demand as a takeout item during the pandemic, are at their lowest level in cold storage since 2012.

“As the restaurant sector begins to reopen, in the short term, supplying the growing demand for chicken will be a challenge.

“As hatchery data and preliminary weekly production data remain consistent with expectations, production forecasts for the outlying quarters of 2021 are unchanged. The 2021 total forecast is 44.764 billion pounds, an increase of less than half-a-percent over the 2020 total. In 2022, broiler production is forecast to total 45.3 billion pounds, a year-over-year increase of 1 percent over the 2021 forecast. Despite expectations of firm broiler prices through most of 2021 and into 2021, increased feed costs will likely dampen the rate of expansion.”