A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

China Accelerates Corn Orders From the U.S., While Farmers in Argentina Prepare to Strike

On Wednesday, Bloomberg writers Daniela Sirtori-Cortina and Breanna T Bradham reported that, “China has tapped the U.S. for more than a third of next season’s expected corn imports, accelerating its pace of buying from the world’s top supplier to fill its growing grain needs.

The Asian nation bought about 9.5 million metric tons of U.S. corn from the 2021-22 season so far this month, according to U.S. Department of Agriculture figures. The agency expects China to import around 26 million tons from worldwide suppliers for the period that begins in September.

“China has been a key source of demand for grains to feed its rapidly expanding hog herd, helping push the price of crops to record highs, and there’s little indication its appetite is abating. The country’s purchases from the U.S., the world’s top corn supplier, is happening as dry conditions threaten crops in Brazil, which ranks second for global shipments of the grain.”

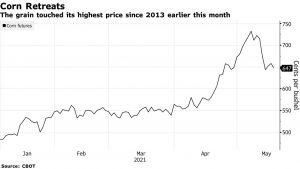

The Bloomberg article noted that, “Corn futures have slid about 13% from a eight-year high of $7.3525 a bushel on May 7, a peak that followed a run-up in prices that began mid-April. The most-active contract fell as much as 3.2% to $6.37 a bushel in Wednesday trading in Chicago.”

The USDA’s Foreign Agricultural Service (FAS) reported the following export sales of corn for delivery to China this week:

- Monday, 1,700,000 metric tons.

- Tuesday, 1,360,000 metric tons.

- Wednesday, 1,360,000 metric tons.

- Thursday, 1,224,000 metric tons.

China has also made large corn purchase over the past couple of weeks.

Just this week (Mon-Thu), it has been announced that 5.64 million tonnes of new-crop U.S. #corn has been sold to #China. That is 222 million bushels.

— Karen Braun (@kannbwx) May 20, 2021

China now has more than 10 mmt of U.S. corn secured for 2021/22 (starts Sept. 1).

Reuters columnist Karen Braun indicated on Wednesday that, “The 2021-22 marketing year is still a few months away, but China within the last few days has secured nearly a third of its expected corn needs out of the United States for next season.

“The volume and timing of the recent purchases are stronger and earlier than those of a year ago, which along with U.S. crop shortfalls catapulted Chicago corn futures to multi-year highs in unprecedented fashion.”

Ms. Braun added that, “USDA last week projected China will import 26 million tonnes of corn from all suppliers in 2021-22, unchanged from the current year, so the recent sales are not outside the scope of market expectations. However, no one was certain how soon they might occur or how big they would be to start.”

Meanwhile, Reuters writer Jorge Otaola reported earlier this week that, “Argentina is set to announce a 30-day halt on meat exports amid rising prices, two sources from government and the industry said on Monday, underscoring rising concern over inflation that has been driven by spiraling food prices.

“A production ministry source, declining to be named, confirmed the plan to suspend meat exports, which comes with Argentina’s 12-month inflation rate soaring at around 46% after a monthly peak in March.”

Also this week, Bloomberg writers Silvia Martinez and Jorgelina Do Rosario reported that, “Argentina is limiting shipments of beef, a staple in the world’s fifth-biggest exporter, the latest unorthodox move by the government to try to contain runaway inflation that’s approaching 50% annually.”

And on Wednesday, Financial Times writer Benedict Mander reported that,

Argentine farmers are braced for a showdown with the government as they prepare for a nine-day strike, starting on Thursday, to protest against a month-long suspension of beef exports aimed at controlling spiralling inflation.

“Some fear a repeat of the farming strikes of 2008, which were triggered by similar interventionist policies implemented by then-president Cristina Fernández de Kirchner, who now serves as Argentina’s powerful vice-president,” the FT article said.

Also this week, Bloomberg writer Jonathan Gilbert reported that, “Trade unions that are key to Argentina’s $20 billion-a-year crop export industry have gone on strike, the latest in a string of protests by workers demanding vaccination against Covid-19 as the South American nation grapples with a shortage of jabs.

“Skippers, engineers and seamen, who help berth and unberth vessels, and grain inspectors at ports and processing plants will strike this week, shipping agency Nabsa said in emails to clients.”

“Argentina is the biggest exporter of soy meal and soy oil,” the Bloomberg article said.