As 2026 ushers in a fresh start, agricultural economists say the U.S. farm economy has stopped sliding, but it’s far from fully healed.The December Ag Economists’ Monthly Monitor shows month-to-month…

As Phase One Purchases Fall Short, China Cracks Down on Commodity Inflation- Sparking Reflection on Demand

Bloomberg writer Ailing Tan reported on Monday that, “China’s imports of American goods slowed in April, pulling back on the already incremental progress toward the purchase targets agreed with the U.S. in the 2020 trade deal.

“China bought $10.4 billion worth of manufactured, agricultural and energy goods in April, taking the total in the 16 months since the trade deal was signed in January 2020 to $147 billion, according to Bloomberg analysis of official Chinese data. That progress was the slowest pace this year and reached 38.9% of the two-year target of $378 billion, compared to March’s 36.1%.”

The Bloomberg article added that, “There’s no sign of when the two sides might next talk about the deal, although the U.S. side said it would meet with China to discuss it ‘soon.'”

Meanwhile, Reuters News reported this week that,

China will strengthen price controls on iron ore, copper, corn and other commodities in its 14th five-year plan for 2021 to 2025 to address abnormal fluctuations in prices, the state planner said on Tuesday.

“The country will also step up monitoring and analysis of commodity prices such as crude oil, natural gas and soybean, the National Development and Reform Commission (NDRC) said in a statement.”

The Reuters article added that, “The NDRC said it will build a solid grain supply and stabilise prices.”

Also this week, Thomas Hale and Neil Hume reported at The Financial Times that, “The National Development and Reform Commission, China’s economic planning agency, said on Monday it would crack down on monopolies in commodities markets, the spread of false information and hoarding.”

“The Chinese government’s statement reflects its mounting concerns over soaring commodity prices, which have been turbocharged by the country’s industrial recovery from the pandemic. The prospect of a global economic rebound has added more fuel to the rally in prices,” the FT article said.

And Bloomberg News reported this week that, “With global commodities rising to record highs, Chinese government officials are trying to temper prices and reduce some of the speculative froth that’s driven markets. Wary of inflating asset bubbles, the People’s Bank of China has also been restricting the flow of money to the economy since last year, albeit gradually to avoid derailing growth.”

The Bloomberg article noted that, “For agriculture, credit tightening may only affect China’s soaring crop imports around the margins, said Ma Wenfeng, an analyst at Beijing Orient Agribusiness Consultant Co. Less cash in the system could soften domestic prices by curbing speculation, which may in turn reduce the small proportion of imports handled by private firms, he said.

The wider trend is for China’s state-owned giants to keep importing grains to cover the nation’s domestic shortfall, to replenish state reserves and to meet trade deal obligations with the U.S.

Reuters writer Karl Plume reported this week that, “U.S. corn and soybean futures fell on Monday as rains boosted recently planted crops across the U.S. Midwest and as traders weighed future export demand following a flurry of corn purchases by China last week.”

The Reuters article noted that, “‘And with the crackdown on inflation in China, people are wondering if they’re going to keep buying,’ [Don Roose, president of U.S. Commodities] said.

“Beijing last week announced stepped-up measures to restrain soaring commodities prices that threaten to undermine China’s economic recovery.”

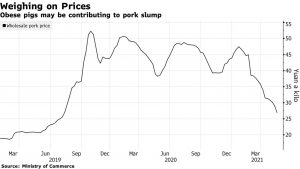

In other news, Bloomberg News reported this week that, “Obese pigs in China are being blamed for worsening a sudden rout in the country’s pork prices.

“Farmers have been fattening hogs since late last year to almost double their normal weight — roughly the size of a pygmy hippo or a female polar bear — in the hope the animals will generate higher returns should prices rebound.”

The Bloomberg article added that, “Instead, Chinese wholesale pork prices have plunged more than 40% since mid-January amid sluggish demand, increased imports and panic selling by farmers after fresh outbreaks of African swine fever. Muyuan Foods Co., the country’s biggest pig breeder, said this week it’s expecting a continued drop in domestic hog prices, with the slump not bottoming out until next year or even 2023.”