President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

USDA Attache Updates from Beijing Highlight Corn, Soy Variables

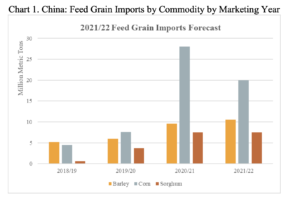

A report on Thursday [corrected, an earlier version erroneously said, “Monday”] from the USDA’s Foreign Agricultural Service (FAS) post in Beijing (“China: Grain and Feed Update“) stated that, “Post’s MY2021/22 corn import forecast is 20 MMT, 6 MMTs below USDA’s official forecast with the expectation that demand softens as corn imported during the current marketing year enters commercial channels, stock building moderates, and the expansion of domestic corn area results in greater production. In addition, imported corn’s previous price advantage has narrowed as global grain prices and shipping costs are on the rise.”

Thursday’s update noted that, “FAS China’s total MY2021/22 feed and residual use is forecast to increase by 17.2 MMT, a 6.7 percent increase over MY2020/21. MARA [the Ministry of Agriculture and Rural Affairs] stated that by the end of the first quarter of 2021, the national live hog inventory and sow inventory recovered to 94.2 percent and 96.6 percent of pre-African Swine Fever (ASF) levels seen in 2017. Based on MARA’s projections, the live hog inventory will reach 2017 levels in July 2021.

However, post believes that overall pork production will remain below the pre-ASF levels.

“In late 2020 a resurgence of ASF reduced China’s population of breeding sows and piglets. These losses continued through the first quarter of 2021 as ASF outbreaks were reported in multiple provinces.”

More specifically with respect to China’s corn production, FAS stated that, “Corn production for MY2021/22 is forecast at 272.0 MMT, up by 11.3 MMT, or 4.3 percent from last year on higher planting area and the assumption of normal yields. Area planted to corn in Heilongjiang, one of China’s most important corn producing provinces, increased by 1.1 million hectares this year, or by 27 percent year-over-year according to the Heilongjiang Agricultural Bureau. Nationwide, area planted to corn is expected to increase by 2.1 million hectares this year, or by 6.2 percent year-over- year. The increased acreage is attributed to a mix of high prices and government policies encouraging or mandating the planting of additional corn acreage.”

“Post estimates MY2020/21 corn imports remain at 28 MMT, 2 MMT higher than the USDA official estimate due to continued strong import demand fueled by high domestic prices and restocking efforts,” FAS said.

And an additional FAS update this week from Beijing (“China: Oilseeds and Products Update“) stated that, “FAS China forecasts soybean production to fall to 17.5 million metric tons (MMT) in marketing year (MY) 21/22 from an estimated 18.5 MMT the previous year due to a shift in planted area to corn production. With domestic corn prices currently near a six-year high and corn subsidies up, farmers are switching from soybeans to corn, particularly in China’s northeastern grain belt. Soybean imports are forecast to reach 102 MMT in MY21/22 and an estimated 100 MMT in the current marketing year to meet modestly growing soybean meal demand for feed.”

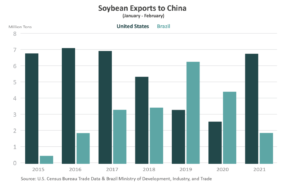

Meanwhile, a separate FAS report this week (“2021 U.S. Soybean Outlook Remains Strong After Record First Quarter Export Volume“) pointed out that, “In the first quarter of 2021, U.S. soybean exports reached the second-highest value ever at $7.7 billion, nearly double the same period last year. This growth was driven by record first quarter export volumes coupled with high prices, which have been climbing steadily during the past year. Export volumes are up substantially due to the rebound of trade with China owing to the removal of retaliatory tariffs, the rebuilding of the swine herd from African swine fever (ASF), and a delayed South American harvest extending the U.S. selling window.

“Export values were further supported by U.S. soybean prices increasing to 7-year highs on strong China purchases, high corn prices, and tight supplies in the United States and South America.

Building off record first quarter export volumes, 2021 is poised to be an excellent year for U.S. soybeans

FAS noted that, “The major growth driver in the second half of 2020 and the first quarter of 2021 for U.S. soybeans has been the reemergence of China imports.

“Expanding swine inventory in China increased feed demand. In addition, a higher proportion of corn and soybean meal was used in the feed mixture to avoid further ASF outbreaks through the consumption of infected pig swill. China had more pigs to feed and soybean meal became a larger percentage of their diets, resulting in double-digit year-over-year China soybean import growth in 2020.”