The U.S. ag economy enters 2026 in a clear crop-sector recession, but the deeper crisis is one of confidence. High input costs, weak prices, policy uncertainty and eroding trust in…

China Pork Production Balloons in Second Quarter, While Meat Inflation in the U.S. Climbs

Reuters writers Emily Chow and Dominique Patton reported this week that, “China’s second-quarter pork production surged to its highest in at least seven years, official data showed on Thursday, after producers launched thousands of new breeding farms last year to rebuild a hog herd decimated by the African swine fever.

Pork output for April-June was 13.46 million tonnes, up 40% compared with the same period last year and well above the usual 10 million tonnes during this period, according to Reuters’ calculations based on official data.

“The National Bureau of Statistics said China’s pork output jumped 35.9% in the first half of 2021 versus a year earlier to 27.15 million tonnes.”

The Reuters article noted that, “Sales data from 16 listed hog producers showed they produced 42.8 million hogs for slaughter in the first half, an increase of more than 100% over the prior year, said Boya Consulting in a report on Wednesday.

“But that surge in volume pressured live hog prices, which shed about 65% from January to June, leaving many with significant losses for the period.”

Chow and Patton added that, “However, analysts are closely watching a recent surge in swine fever outbreaks in Sichuan province, which could trigger more panic slaughtering and pressure prices again.

“The statistics bureau said China slaughtered 337.42 million hogs in the first six months of the year, up 34.4% from the corresponding period a year earlier.”

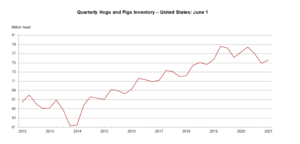

Meanwhile, with respect to meat price dynamics in the U.S., the USDA’s Economic Research Service noted in its monthly Feed Outlook report this week that, “The outlook for livestock inventories and implied demand for feed is lower in July, compared with the previous month. Total grain consuming animal units (GCAUs) for 2021/22 are projected to be 101.3 million units, compared with the previous month’s projection of 101.8 million. The current projection compares with 2020/21 estimates at 101.5 million units in July—which was estimated at 101.8 million units a month ago. The month-to-month reduction is primarily due to a 0.5-million-unit reduction from the hog sector, based on the latest indications from the quarterly Hogs and Pigs report released on June 24 by NASS. While the latest forecasts are reduced from the previous month, GCAUs remain relatively large by historical standards. Prior to the current peak of 101.9 million units in 2019/20, animal units averaged 98.4 million units from 2016/17 to 2018/19.”

And Bloomberg writers Michael Hirtzer and Dominic Carey reported this week that,

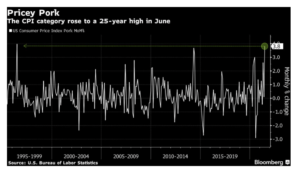

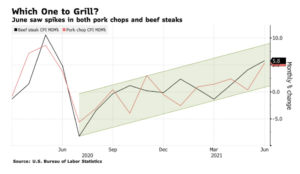

An increase in backyard barbecuing collided with a shortage of hogs as U.S. consumer prices for pork jumped in June by the most in 25 years.

“Pork prices climbed 3.8% from a month earlier while beef gained 4%, according to a U.S. Bureau of Labor Statistics report on Tuesday. The elevated meat prices contributed to the biggest overall surge in U.S. consumer prices since 2008.

“Food inflation has been on the rise since the coronavirus upended supply chains, with sick workers shutting down meat plants while consumers pivoted away from restaurants to prepare more food at home.

“The American hog herd hasn’t recovered from culling during the onset of the pandemic. Meanwhile, droughts globally have sent animal-feed prices soaring, and labor shortages at slaughterhouses have also pushed up prices for pork, beef and chicken.”