A package of funding bills assembled by House and Senate appropriators that needs to pass before the end of January does not contain any more aid for farmers. It's also…

Bout of Higher Prices for Beef, Chicken and Other Products Could Continue

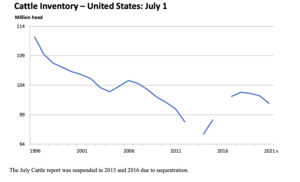

Bloomberg writer Michael Hirtzer reported this week that, “A little-known market, that of young cattle, is signaling that pricey beef could be here to stay awhile.

“Feeder cattle are animals that have not yet been fattened on corn for slaughter in feedlots. Prices for those on the futures market climbed to the highest since March 2016 in Chicago.

“The gains followed a survey showing the American herd shrank 1.3% from a year ago.”

The Bloomberg article stated that, “The shift could mean that even higher beef prices are on the way for consumers, who have already seen increases on burgers and steaks in the past year after the pandemic threw supply chains into turmoil.”

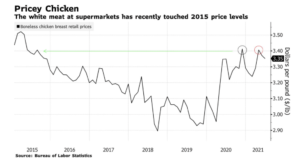

And in a separate Bloomberg article this week, Mr. Hirtzer reported that, “America’s chickens aren’t multiplying fast enough to keep pace with soaring demand.

“Bird breeds used by some of the biggest chicken companies are ‘producing less eggs,’ according to Fabio Sandri, chief executive officer of Pilgrim’s Pride Corp., the No. 2 U.S. poultry producer.

“That’s inflaming already rising food inflation, with strong chicken sales at grocery stores and restaurants such as Popeyes Louisiana Kitchen and McDonald’s Corp. embroiled in chicken-sandwich wars. The demand helped Pilgrim’s beat analyst estimates for their second-quarter earnings, released Wednesday.”

The Bloomberg article noted that, “‘Hatchability has been the issue in the industry and that is constraining the industry to exceed the growth that everybody is expecting,’ Sandri said Thursday on a call with investors.”

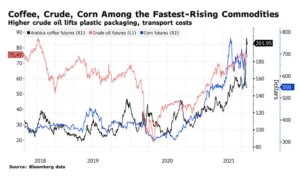

Also this week, Wall Street Journal writer Nick Kostov reported that, “The makers of some of the world’s bestselling food and drink brands warned they would keep raising prices as they grapple with the strongest inflation in years.

“Nestlé SA, Diageo PLC, Anheuser-Busch InBev SA and Danone SA all said Thursday that sales were rising as key markets rebound from the pandemic, but that the recovery was also leading to rapidly increasing costs for ingredients, packaging and transport.

“Nestlé said its ice creams had gotten more expensive, spirits giant Diageo has raised prices on brands like Baileys and Casamigos tequila, and Budweiser brewer AB InBev is exploring higher prices for its beers. Meanwhile, Danone, which makes Activia yogurt and Evian water, said it would increase prices across all of its categories to try preserve its profitability.”

The Journal article pointed out that, “While executives Thursday said the bout of higher costs and rising product prices would likely persist into 2022, they said it was hard to predict whether the recent jump in inflation was transitory as the Federal Reserve forecasts, or here to stay for longer.”

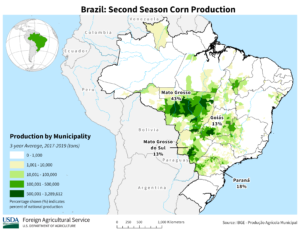

More broadly with respect to commodity supply issues, Reuters writer Ana Mano reported this week that, “Freezing temperatures on Wednesday and Thursday will hit crops like corn and wheat in Brazil’s southern and southeastern states, according to a warning issued to farmers by the government’s food supply and statistics agency Conab.

“In São Paulo and Paraná states, there is the risk of moderate and severe frosts and this could affect second corn that is in the grain-filling stage, as well as wheat that is in the flowering stage, Conab said late on Tuesday. Second corn is planted after soybeans are harvested in the same fields.

“Corn and wheat in Mato Grosso do Sul could also be hit by frosts, though in fewer areas, Conab said.”

And regarding transportation variables, Bloomberg writers Fabiana Batista and Mariana Durao reported this week that,

Drought is making one of Brazil’s most important river systems unnavigable, making it more challenging and costly for the commodities powerhouse to get grains and iron ore out to global markets.

“The Parana River Basin in central Brazil is experiencing its worst water crisis in 91 years, according to the national grid operator, with June flows at 55% of the historical average for the month to sink to the lowest on record. South America’s second-largest river system provides electricity and water to Brazil’s industrialized south and supports river levels in neighboring countries, where drought has also made navigation difficult.”