President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

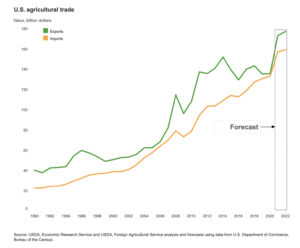

USDA Forecasts Record Farm Exports in FY 2021 and FY 2022

On Thursday, the USDA released its Outlook for U.S. Agricultural Trade, a quarterly report from the Department’s Foreign Agricultural Service (FAS) and Economic Research Service (ERS). Today’s update includes highlights from the report, which was coordinated by Bart Kenner, Hui Jiang, and Dylan Russell.

In a news release Friday, FAS explained that, “The August forecast is USDA’s first look at expected exports for FY 2022.”

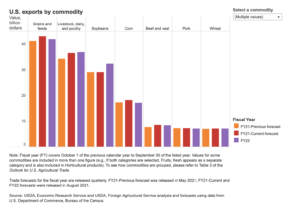

The Outlook stated that, “U.S. agricultural exports in fiscal year (FY) 2022 are projected at $177.5 billion, $4.0 billion higher than the revised forecast for the preceding year. The FY 2021 export forecast of $173.5 billion represents an increase of $9.5 billion from May’s projection, mainly due to higher livestock, poultry, and dairy exports, as well as the adoption of a new definition of ‘Agricultural Products.'”

Soybean exports are projected to increase by $3.3 billion from FY 2021 to a record $32.3 billion on higher prices, which more than offset lower projected volumes.

The Outlook also noted that, “Livestock, poultry, and dairy exports are forecast up $400 million to $36.8 billion in FY 2022, primarily due to growth in dairy and poultry products. Grain and feed exports are forecast down $1.1 billion from prior forecast levels, primarily due to lower corn export prospects.”

FAS-ERS pointed out that, “Agricultural exports to China are forecast at $39.0 billion—an increase of $2.0 billion from FY 2021—largely due to higher expected soybean prices and strong cotton and sorghum demand. Agricultural exports to Canada and Mexico are forecast at $23.8 billion and $22.3 billion, respectively.”

More narrowly, FAS-ERS pointed out that, “FY 2022 U.S. grain and feed exports are forecast at $41.8 billion, down by $1.1 billion from FY 2021 on lower corn and feed and fodder exports, despite higher sorghum exports.

Corn exports are forecast at $17.1 billion, down by $1.0 billion on reduced volumes from stronger foreign competition, though unit values are expected to be higher.

“Sorghum exports are forecast at $2.5 billion, up by $300 million from the FY 2021 estimate on larger exportable supplies and expected continued strong demand from China.”

Thursday’s update added that, “FY 2021 U.S. grain and feed exports are forecast at $42.9 billion, up by $1.7 billion from the May forecast, as higher wheat, corn, and feeds and fodders exports more than offset lower sorghum exports.”

With respect to oilseeds, The Outlook stated that, “FY 2022 oilseed and product exports are forecast at $43.5 billion, a new record, up $3.5 billion from FY 2021 mostly on higher soybean unit values. Soybean export values are projected to reach a new record of $32.3 billion although volumes are expected to fall below the previous year. U.S. soybean volume exports are expected to decline from last year due to a combination of factors, including higher soybean prices, tight U.S. supplies, slowing growth in China’s global demand, and increased competition from Brazil.”

FAS-ERS indicated that, “FY 2021 oilseed and product exports are forecast at $40.3 billion, down by $300 million from the May forecast. Soybeans are forecast at $29.0 billion, up $100 million on higher unit values. Soybean volumes are slightly lower, though still a record.”

Thursday’s update also pointed out that, “The export forecast for China is $39.0 billion, $2.0 billion higher than the revised FY 2021 estimate. Sharply higher projected soybean prices more than offset lower expected volumes and helped boost U.S. soybean export value. Continued strong demand for sorghum, cotton, and poultry products also contribute to the increased forecast. U.S. corn export prospects are expected to be steady as higher projected unit values offset lower volume resulting from strong Ukrainian competition.”