Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

USDA Attache Update from Beijing Highlights Corn Import Variables

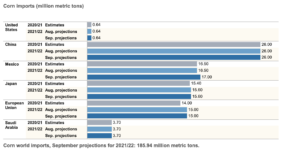

A recent report from the USDA’s Foreign Agricultural Service (FAS) post in Beijing (“China: Grain and Feed Update“) stated that, “Post’s MY 2021/22 corn import forecast is 20 MMT, 6 MMTs below USDA’s official forecast.

“FAS China expects domestic corn prices to fall over the next year, stock building to moderate, and demand to soften as imported corn held in reserves and other stocks finally enters the market.

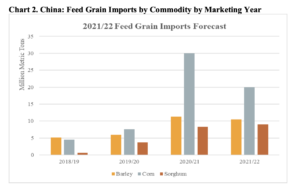

The consensus among Chinese agricultural think tanks is that China has a corn supply gap and will require feed grain imports and/or will continue substituting other commodities for corn as feed grains over the long run.

“It is notable that in July and August China had ‘washed boat’ sales of close to 500,000 MT, or 10 boats, of U.S. corn. China booked the U.S. corn in the second half of 2020, when the CBOT corn nearby contract price was 330-340 cents per bushel and January and March 2021 U.S. corn futures were around 550 cents per bushel. Current U.S. corn prices have left almost no profit for Chinese importers and feed mills.”

FAS also noted that, “According to Export Sales Reports for mid-September 2021, China currently holds over 10 MMT of U.S. corn contracts for MY 2021/22. Chinese buyers may withdraw from significant future corn purchases from the United States as the domestic harvest is approaching, feed demand is weakening, local prices have slumped to the cheapest since late 2020, and ports are congested. With current U.S. corn prices, China may turn to Ukraine for MY 2021/22 imports. New crop Ukraine corn is quoted at less than U.S. $338.50 (RMB 2,200) per metric ton now.”

The attache update added that, “FAS China estimates MY 2020/21 corn imports at 30 MMT, 4 MMT higher than the USDA official estimate.

Some industry sources place China’s total corn imports as high as 32 MMT for MY 2020/21, based on current trade reports, U.S. export sales reports (ESR), and estimates of freight waiting to be declared.

The FAS update also indicated that, “Sorghum imports for MY2021/22 are forecast at 9 MMT, 0.8 MMT lower than the USDA forecast due to the availability of other, cheaper substitutes for imported sorghum…[and]…Barley imports are forecast at 10.5 MMT in MY 2021/22, 0.9 MMT higher than USDA forecast.”