Congress has quickly engaged in putting together potential aid packages for farmers that would more than double the Trump administration's $12 billion under the Farmer Bridge Assistance (FBA) Program.

The Reach of Higher Fertilizer Prices Continues to Extend, Implications for Illinois Grain Farmers

On Thursday, Bloomberg writers Tatiana Freitas and Fabiana Batista reported that, “Brazilian farmer Antonio Carlos Jacobsen usually buys fertilizer a few weeks before planting his corn fields. Soaring fertilizer prices are pushing him to move up purchases for the March seeding — although it may already be too late.

‘We were caught by surprise with these skyrocketing prices,’ said the 64-year-old grower who planned to seed 1.2 million hectares on his farmland in the northeastern state of Bahia. ‘Even worse, there is uncertainty whether this fertilizer will be delivered on time,’ he said in an interview.

“Jacobsen’s predicament isn’t unique among grain growers in this South American nation, and the impacts may reverberate beyond Brazil’s borders. The agricultural superpower is the world’s top exporter of soybeans, sugar and coffee and No. 2 supplier of corn, and it needs to buy around 80% of its fertilizer requirements. Soaring fertilizer prices and tight supplies may end up limiting Brazil’s corn yields in the coming year.”

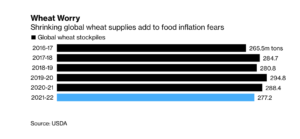

And on Friday, Bloomberg writer Nicholas Larkin reported that, “Warnings about the fertilizer crisis’s threat to global food security are coming thick and fast.

“In Europe, the high nutrient prices have farmers questioning whether to curb plantings. Canadian authorities cautioned that growers may cut back on usage, while in corn powerhouse Brazil, there’s a risk that soaring fertilizer costs and less supply will limit crop yields.”

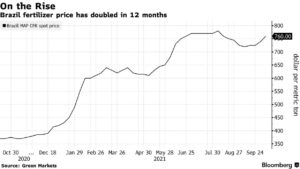

Recall that a gauge of North American fertilizer prices recently set a record high.

The Bloomberg article added that, “It’s a worrying sign for future harvests a time when global food prices are at a 10-year high. There are concerns that farmers in France, the European Union’s top wheat grower, may find it hard to source fertilizers next spring, regardless of the price.”

A farmdoc webinar on Thursday contained additional insight on what the potential implications of higher fertilizer prices may mean for Illinois grain farmers.

In the following three clips from the webinar, farmdoc’s Gary Schnitkey discusses fertilizer prices, what higher costs may mean for profitability, and looks at corn and soybean acreage allocation considerations for 2022.

In Thursday’s farmdoc webinar, Gary Schnitkey pointed to rising fertilizer prices and indicated that fertilizer costs are going up by about $50 acre for #Illinois #corn production (clip, 75 seconds). pic.twitter.com/v0BdZp5qqI

— Farm Policy (@FarmPolicy) October 15, 2021

farmdoc’s Gary Schnitkey noted in Thursday’s webinar, that even with higher input costs, based on a $4.50 (#corn) and $12.00 (#soybeans) prices, operator and land returns would still be above cash rents going into 2022 (clip, 90 seconds). pic.twitter.com/JaRxaXsdYE

— Farm Policy (@FarmPolicy) October 15, 2021

In Thursday’s farmdoc webinar, Gary Schnitkey discussed the profitability of #corn compared to #soybeans going into 2022 (clip, 90 seconds). pic.twitter.com/guntM82EaR

— Farm Policy (@FarmPolicy) October 15, 2021