Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

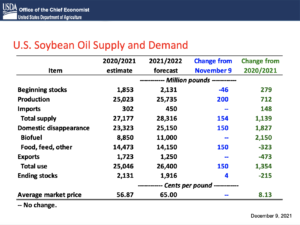

ERS: “Soybean Oil Domestic Use Expected to Grow,” Renewable Diesel a Factor

In its monthly Oil Crops Outlook report this week, the USDA’s Economic Research Service (ERS) indicated that, “U.S. processors crushed a record 197 million bushels of soybeans in October, nearly 0.5 million bushels higher than the record established in October 2020. This translates to an impressive 6.35 million bushels of soybeans crushed per day.”

Monday’s update noted that, “In response to the monumental crush volume, the 2021/22 soybean oil extraction rate was raised from 11.66 to 11.75 pounds of oil per bushel. Increased production of soybean oil, projected at 25.7 billion pounds, is expected to be consumed domestically through food, feed, and other industrial uses which is raised 150 million pounds to 14.15 billion pounds.”

ERS stated that, “Soybean oil use for 2020/21 biofuel production was finalized this month at 8.85 billion pounds as projected by USDA. After reviewing the Environmental Protection Agency’s (EPA) proposed rules for 2020–2022 renewable fuel obligation targets, soybean oil used for biofuels in 2021/22 is unchanged from last month’s forecast at 11 billion pounds. This projection is 2.2 billion pounds higher than 2020/21 and considers expansions in renewable diesel production capacity planned in 2022, elevated feedstock prices, and substitution impacts among biofuel categories.”

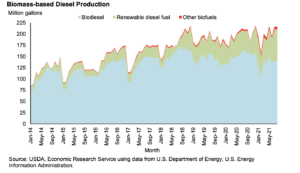

More narrowly with respect to renewable diesel production, the Outlook pointed out that, “Data from the U.S. Department of Energy’s U.S. Energy Information Administration (EIA) in [the figure below] shows the recent growth in renewable diesel production.

“Incentives associated with California’s Low Carbon Fuel Standard (LCFS), the Renewable Fuel Standard (RFS), and blender’s tax credits have provided production capacity growth opportunities across feedstock categories. Over the past few years, renewable diesel production has grown while total biomass-based diesel production has remained relatively constant.

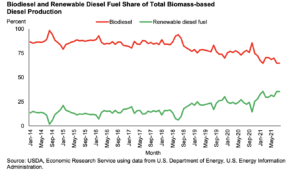

“Thus, renewable diesel now captures a larger share of total biomass-based diesel production. Increased production of renewable diesel has come at the expense of biodiesel (fatty acid methyl ester (FAME)) production, however, as feedstock prices increased dramatically over the last year.

“In fact, renewable diesel has replaced biodiesel production in a near 1:1 tradeoff throughout 2021.

Expectations of large expansions in renewable diesel production capacity point toward greater use of soybean oil in future biofuel production.

ERS added that, “Recent RFS volume obligations proposed by the EPA indicate support for expanded biomass- based diesel production. Markets have evolved such that renewable diesel fuel production currently commands 30 percent of the total biomass-based diesel market. The prospect of a large expansion in 2022 renewable diesel capacity suggests feedstock prices will remain elevated, continuing to foster competition between FAME and renewable diesel producers. As soybean oil looks to expand its share of feedstocks utilized for biofuel production in 2022, profitability opportunities remain a key consideration for producers in future production decisions.”

And Daniel Grant reported this week at FarmWeekNow Online that,

Soybean growers could see demand growth from the biofuels sector in the next decade reminiscent of the ethanol boom that shifted into high gear in the early 2000s and pushed corn use to new heights.

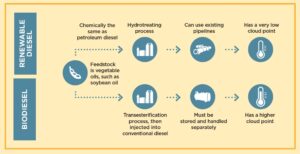

“The key product set to take off is renewable diesel, not to be confused with biodiesel.

“Both fuels use any oil or fat, mostly soybean oil, as feedstock. But the processing for each product differs, with renewable diesel generated from more high free fatty acid feedstocks, which produce better carbon intensity scores.”

The article noted that, “‘Renewable diesel has emerged. It’s all about reducing the carbon intensity of fuel blends,’ James Fry, founder and chairman of LMC International, said during a webinar hosted by the U.S. Soybean Export Council (USSEC).”