Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Wheat: Major Exporters’ Ending Stocks Lowest Since 2007/08, as U.S. Winter Wheat Crop Struggles

In its monthly Wheat Outlook report last week, the USDA’s Economic Research Service (ERS) stated that, “U.S. wheat exports in October dropped by nearly half from the previous month to only 46 million bushels, the smallest monthly total in more than 30 years.

“Furthermore, USDA/Foreign Agricultural Service’s Export Sales data show a continued weak pace of sales and shipments throughout November, suggesting that a quick turnaround in export pace is unlikely.

Tight domestic supplies and high prices have put U.S. wheat in an uncompetitive position internationally with other major exporters.

“U.S. wheat will likely maintain much of its typical sales to core markets in Latin America and Asia, but exports are expected to be uncompetitive to much of Africa and the Middle East.”

ERS pointed out that, “2021/22 global ending stocks are projected at 278.2 million MT, up 2.4 million from November based on higher global production.”

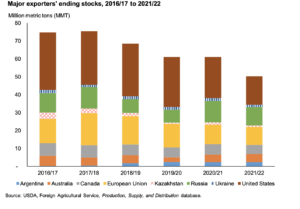

“These revisions bring major exporters’ 2021/22 ending stocks to 50.7 million MT, up 2.3 million month-to-month.

While this brings some relief to the tight balance sheet, major exporters’ ending stocks remain the lowest since 2007/08.

In other developments regarding global wheat market dynamics, Bloomberg writer Yuliya Fedorinova reported this week that, “Russia is considering imposing a higher tax on wheat exports, based on a formula that links the tax rise to increases in the price of the commodity.

“Under the formula, the tax will rise if prices reach $375 a ton and again if they hit $400 a ton, according to documents published on the government’s proposed regulations website.”

The Bloomberg article added that, “Russia also plans a wheat export quota of 8 million tons for Feb. 15 through June 30, according to a statement from Economy Ministry, on Friday.”

And last week, Bloomberg writer Jonathan Gilbert reported that, “Argentina is putting a ceiling on exports of corn and wheat in a fresh bid by the leftist government to quell food inflation at home.

“The government will first decide how much of the grains are needed in Argentina, and then proceed to stop exporters from registering shipments that’d jeopardize those domestic supplies, according to a resolution published on its website Friday.”

Also last week, Reuters News reported that, “French soft wheat shipments outside the European Union last month reached their lowest for a November since the 2018/19 season as shipments to China slowed following a brisk October, Refinitiv data showed.”

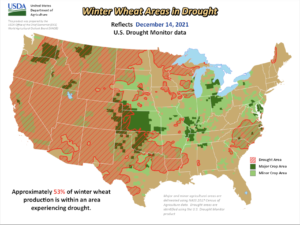

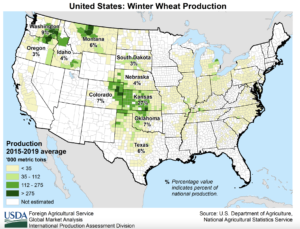

With respect to the U.S. winter wheat crop, Reuters writer Julie Ingwersen reported on Monday that,

Hurricane-force winds that raked the U.S. Plains belt last week appeared to cause varying degrees of damage to a winter wheat crop that was already struggling with dry conditions, Kansas crop observers said.

“Young wheat plants were blown right out of the ground on the hardest-hit fields, but remaining wheat may be able to bounce back, especially if the plants’ root crowns were protected just below the soil surface. Nonetheless, the crop will need moisture, and near-term forecasts look dry.

“‘Some acres today no doubt are gone. But there is probably a larger set of acres that have been severely damaged, and the weather we get from here on out will play a role,’ Lucas Haag, a Kansas State University extension agronomist, said on Friday.”

The Reuters article noted that, “Farmers should have a better idea of recovery prospects in about 10 days. But the crop’s biggest needs are for moisture and possibly fertilizer, both of which are in short supply.”