The US meatpacking industry faces a fresh wave of scrutiny, this time from Senate Democrats seeking to allow companies to process only one type of meat and set stricter limits…

Federal Reserve Ag Credit Surveys- 2021 Fourth Quarter, Rise in Farmland Values Accelerates

Last week, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the fourth quarter of 2021.

Federal Reserve Bank of Chicago

David Oppedahl, a Senior Business Economist at the Chicago Fed, explained in the AgLetter that, “On the whole, the District experienced a very steep annual increase of 22 percent in its farmland values in 2021 (see table and map below). In nominal terms, 2011’s annual increase was the last gain as large as 2021’s.

In the fourth quarter of 2021, all District states saw double-digit year- over-year increases in their agricultural land values.

“The District’s farmland values were up 7 percent in the fourth quarter of 2021 from the third quarter.”

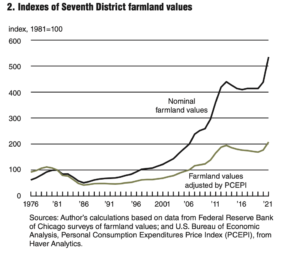

The AgLetter stated that, “More than making up for their real declines from 2014 through 2019, District farmland values reached a new peak in 2021. At the end of 2021, District farmland values were up nearly 7 percent from their prior peak (in 2013) in real terms; they were up even more (about 22 percent) in nominal terms after almost fully recovering to their previous peak (also in 2013) by the end of 2020 (see chart 2).”

Mr. Oppedahl added that, “Propelled by higher receipts for both crop and livestock products, net farm income swelled by $24 billion for the nation in 2021, based on the USDA’s February forecast. This surge in agricultural income provided momentum for the rapid rise of District farmland values in 2021.”

And the Chicago Fed indicated that, “Improving agricultural credit conditions for the District also played an important role in 2021’s striking gains in farmland values.”

Recall that an Iowa State University report from late last year showed that, “the average value of an acre of Iowa farmland skyrocketed 29% in 2021.”

Federal Reserve Bank of Kansas City

Francisco Scott and Ty Kreitman, writing in last week’s Ag Credit Survey from the Kansas City Fed, noted that, “Farmland values continued to increase at a rapid pace through the end of 2021.

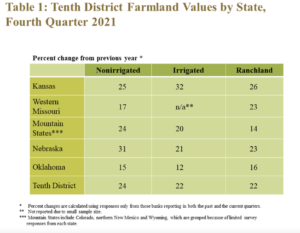

Alongside sustained strength in farm income and credit conditions, the value of all types of farmland in the Tenth District was more than 20% higher than a year ago.

“The recent strength in agricultural real estate markets has been supported by strong demand, historically low interest rates and vastly improved conditions in the farm economy.”

Last week’s update stated that, “Lenders reported a mostly favorable outlook for agriculture in the District but cited the rise in input costs as a risk to the sector. Even with uncertainty around input costs, lenders expected favorable conditions in the economy to support farm finances and lead to further gains in farmland values in 2022. The possibility of weaker agricultural income and higher interest rates in the economy remain as risks for farmland markets. Despite the risks, the agricultural sector appears to be well positioned for the year ahead, supported by strong balance sheets, high agricultural commodity prices and sharp gains in farmland values.”

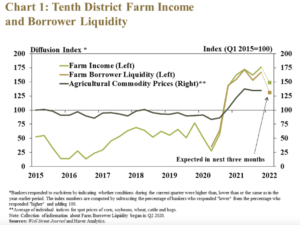

Scott and Kreitman noted that, “Strength in the agricultural economy continued to support farm income and borrower liquidity through the end of 2021. Profit opportunities remained strong alongside elevated commodity prices, and both farm income and borrower liquidity increased from a year ago at a pace similar to recent quarters (Chart 1).”

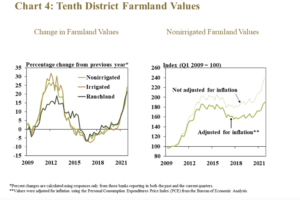

The Ag Credit Survey indicated that, “Together with historically low interest rates and strong agricultural credit conditions, farmland values rose rapidly, according to respondents. Farm real estate values rose more than 20% from a year ago, the highest increase among recent quarters (Chart 4, left panel). The strong growth pushed the average value of nonirrigated cropland to record levels even after adjusting for inflation (Chart 4, right panel).”

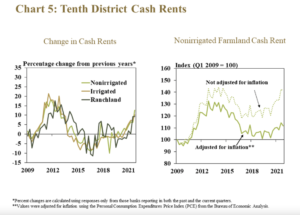

With respect to cash rents, the Kansas City Fed pointed out that, “Cash rents continued to increase alongside farmland values, but at a slower pace. Cash rents for all land types increased by about 10%, a faster pace than previous quarters but about half of the increase in farmland values (Chart 5, left panel). After adjusting for inflation, cash rents on nonirrigated cropland remained about 15% below the historic high reached around 2012 (Chart 5, right panel).”

The Survey added that, “The sharp increase in farmland values was consistent across all states and land types throughout the District. The value of nonirrigated cropland and irrigated cropland increased notably in Nebraska and Kansas, respectively (Table 1).

“Oklahoma, however, faced the slowest increase in values across all land types.”