China, the world’s largest soybean importer, has ramped up orders for Brazilian cargoes of the oilseed after meeting an initial shipment volume from the US as part of a trade…

A Closer Look at Ukrainian Corn and Wheat Exports- Recent USDA Reports

The USDA’s Economic Research Service (ERS) indicated last week in its monthly Feed Outlook report that, “Ukraine borders Russia to the north and east, Belarus to the north, and several Eastern European countries—Poland, Romania, Hungary, Slovakia, and Moldova—to the west. The southernmost part of the country is the Crimean Peninsula, which juts into the Black Sea and was occupied by Russia in 2014. The Dnieper River cuts the country into two parts, with the western part somewhat larger, with about 60 percent of the country’s land area. The capital Kiev is in the north central part of the country, on the Dnieper.”

ERS explained that, “Over the last 15 years, area planted for corn in Ukraine has tripled, while corn yields have roughly doubled.

Corn production has increased 6-fold and is projected to reach 42 million tons in the current year, though still only 3.5 percent of global corn output.

“Corn is produced mainly in the north, central, and central-west parts of the country—while wheat and barley are grown mainly in the southern and eastern regions. Less than 40 percent of Ukraine’s corn is produced east of the Dnieper, largely in the regions in the northern tip of the country.

“Despite having a small share of global corn output, Ukraine is forecast to account for about 17 percent of global corn exports (on an October-September trade year basis).

“Higher corn production has not been matched by rising domestic consumption, as the Ukrainian population is decreasing and livestock development is stalling, making Ukraine an exceptionally export- oriented country. Since about 10 years ago, when the country’s corn production and exports soared, Ukraine has become one of the 4 major world exporters of corn, on par with Brazil and Argentina.”

The Outlook report also noted that,

Since Ukraine exports only a small amount of corn to its immediate neighbors, almost all of the country’s exported corn is shipped out of ports on the Black Sea.

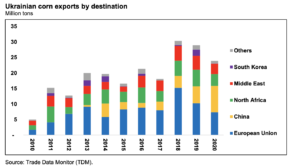

With respect to corn exports to China, ERS explained that, “In 2012/13 Ukraine exported corn to China for the first time, and within 2 years (2014/15) Ukraine had become by far the major supplier of corn to the country, supplanting the United States and providing (in any given year) 60 to almost 90 percent of Chinese imports. When (in 2020) China’s demand for imported corn surged and its imports almost quadrupled, the country became Ukraine’s largest export destination, for the first time outstripping the European Union. For 2021/22 (for the October- December period), about 30 percent of Ukraine’s corn exports went to China, down from about 40 percent during the same period a year ago, which puts Ukraine on track to send about a third of its corn exports to China this year, directly competing with the United States.”

Meanwhile, in its Grain: World Markets and Trade update last week, the USDA’s Foreign Agricultural Service (FAS) stated that, “Amid a bumper crop and competitive prices, Ukraine wheat exports are forecast at a record 24.0 million tons, with over 17.0 million exported between July and the end of January. Ukraine harvested a record crop of 33.0 million tons and has followed its typical pattern of strong exports in the first half of the year.

“Exports are usually brisk in the first few months given the limited storage infrastructure and the pressure to ship other grains, especially corn, later in the season. Ukraine directly competes with Russia in nearby markets such as Egypt and Turkey and has been very price competitive thus far.”

FAS added that, “Ukraine has significantly expanded its wheat exports to Turkey in the first 5 months of the year and aims to deepen that trading relationship with the signing of a bilateral free trade agreement this month. Pakistan has been a recent global importer and has relied once again this year on price- competitive Ukraine wheat.

“The forecast was lowered slightly this month on trade to date and more competition from India, Australia, and Argentina for supplying feed-quality wheat to Asian importers. Exports to Indonesia are now challenged by large Australian exportable supplies.”