President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

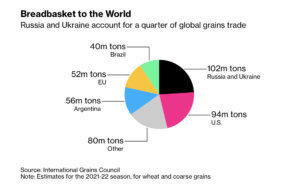

Grain Flows Dry Up, Ukraine’s Ports Closed- Wheat Prices Soar, Food Inflation Worries Persist

Valerie Hopkins, Steven Erlanger and Michael Schwirtz reported on the front page of Tuesday’s New York Times that, “The first talks between Ukraine and Russia aimed at halting the Russian invasion were eclipsed Monday by a deadly Russian rocket assault on Kharkiv, Ukraine’s second-largest city, that raised new alarms about how far the Kremlin was willing to go to subjugate its smaller neighbor.

“The bombardment of a residential area of Kharkiv, which may have included internationally banned cluster munitions, killed at least nine civilians and wounded dozens.

“With the Ukrainian-Russian talks ending with little more than an agreement to meet again, the bombardment signaled a potential turn in the biggest military mobilization in Europe since World War II, in which Russia has met unexpectedly stiff resistance by Ukrainians and strong condemnation from much of the world.”

Meanwhile, Reuters writer Jonathan Saul reported on Monday that,

Ukrainian ports will remain closed until Russia’s invasion ends, the head of Ukraine’s Maritime Administration said on Monday, adding that the port of Mariupol has sustained damage from Russian shelling.

The Reuters article stated that, “Navigation in the Azov Sea was stopped on Feb. 24, and while Russian Black Sea terminals continue to load and ship grain, a big question mark looms over new shipments due to a lack of freight offers, consultancy Sovecon said.”

And Bloomberg writers Megan Durisin, Irina Anghel, and Archie Hunter reported on Tuesday that, “Ukraine’s ports are closed, and while some grain is still leaving Russia for now, traders and shipping representatives said there were little or no new deals being signed because of the uncertainty around the conflict, potential new sanctions and surging costs for freight and insurance. Top importer Egypt held a wheat tender Monday but canceled it after only getting high-priced offers for French and American supplies.”

The Bloomberg article indicated that, “‘If the conflict is prolonged — three months, four months from now — I feel the consequences could be really serious,’ said Andree Defois, president of consultant Strategie Grains. ‘Wheat will need to be rationed.”

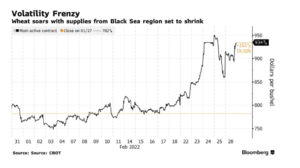

“Wheat futures in Chicago surged 23% in February, and corn and soybeans were both up about 10%. The gains continued Tuesday.”

‘Even with Russian ports open, a lot of operators are afraid of working with the Black Sea,’ Defois said. ‘Exporters and importers will be very careful with Russia.’

Dow Jones writer Paulo Trevisani reported on Monday that, “Wheat for May delivery rose 8.6% to $9.34 a bushel on the Chicago Board of Trade Monday…corn for May delivery rose 5.3% to $6.90 3/4 a bushel…[and]…soybeans for May delivery rose 3.3% to $16.36 3/4 a bushel.”

A Bloomberg News article from Tuesday pointed out that, “The war in Ukraine and the sweeping sanctions from the U.S. and its European allies have brought deals with Russia and Ukraine to a virtual standstill, with few traders willing to take the risk of entering new business or pay the extra cost of chartering and insuring ships to go into the war zone to collect cargo.

“That’s given another boost to crop prices that were already climbing on tight supplies after droughts and labor shortages, and the blistering rally in recent weeks may be enough to send global food costs to a record when the United Nations publishes its latest price index on Thursday.”

Reuters writers Maya Gebeily and Menna A. Farouk reported on Monday that, “Across the Middle East and North Africa, fallout on food prices from the war in Ukraine could drive millions more into ‘food poverty,’ said the WFP’s senior regional spokesperson, Abeer Etefa.”

However, Bloomberg writer Sybilla Gross reported on Monday that, “Australia’s record wheat production this year is now estimated to be even larger than expected after mostly favorable weather, helping to ease global shortages caused by drought and the war in Ukraine.”

Also on Monday, Reuters writers Rajendra Jadhav and Mayank Bhardwaj reported that, “India’s wheat exports are expected to accelerate with a flurry of enquiries from buyers seeking alternatives to Black Sea shipments as Russia’s invasion of Ukraine threatens to disrupt supplies from the two major producers.

“After five consecutive record crops, India is struggling with mammoth wheat inventories and both the government and private traders are keen to capitalise on any opportunity to sell the grain on the world market.”

Looking ahead, Reuters columnist Karen Braun indicated on Tuesday that, “Spring grain planting is right around the corner for both [Russia and Ukraine], most importantly corn for Ukraine and spring wheat for Russia, and it is unclear whether the ongoing conflict will impact production either physically or economically.”