Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Wheat Price Swings Wildly, as Food Inflation and Hunger Concerns Mount Due to Russia’s Invasion of Ukraine

David L. Stern, Ellen Francis, Ellen Nakashima and Joanna Slater reported on the front page of today’s Washington Post that, “The desperate effort to secure safe passage for civilians trapped in Ukrainian cities under attack by Russian forces remained deeply precarious on Tuesday: A single evacuation route opened, allowing thousands to escape safely, while Ukraine accused Russia of shelling another proposed corridor.

“Ukraine’s foreign ministry said the Russian military violated a cease fire by shelling an evacuation route out of the besieged city of Mariupol. It was the fourth day in a row that Ukraine has accused Moscow of firing on routes used by civilians to flee the fighting.”

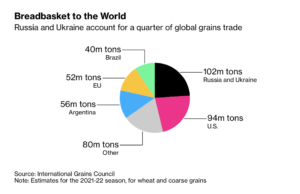

Bloomberg writers Megan Durisin and James Poole reported today that, “Wheat futures dropped from near a record ahead of the first global crop report that will factor in the blow to supplies wrought by Russia’s invasion of Ukraine.

“The U.S. Department of Agriculture’s monthly world grain report is due at noon in Washington, and could offer the first glimpse of how the war will alter worldwide food trade. The USDA will detail its latest export estimates for all major shippers.”

Durisin and Poole added that, “USDA chief economist Seth Meyer said the agency will consider ‘all relevant factors impacting agricultural markets; in its supply and demand outlook later on Wednesday. Mark Jekanowski, chairman of agency’s outlook board, also told a USDA radio interview that the report would ‘absolutely’ factor in the situation in Ukraine.

“‘That grain is not flowing, ports are closed,’ Jekanowski said late last week. ‘Our analysts are putting together their best analyses to try to come up with some reasonable expectation of what that means for the supplies for the rest of the marketing year.'”

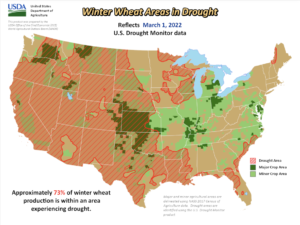

Dow Jones writer Kirk Maltais reported on Tuesday that, “The [wheat] selling also comes in reaction to drought conditions in U.S. regions growing winter wheat – bad timing for a smaller U.S. crop when Ukraine and Russia exports aren’t making it to market amid the fighting there.”

Also this week, Bloomberg writer Irina Anghel reported that, “Grain prices are set to jump even more as war in Ukraine and sanctions on Russia upend supplies from the Black Sea region, Goldman Sachs Group Inc. said in a note Tuesday.”

“Goldman increased its forecasts for corn, soybean and wheat prices. Corn could reach $7.75 per bushel by summer, while soybeans could trade at $17.5 and wheat at $12.5 per bushel,” the Bloomberg article said.

Meanwhile, Jacqui Fatka reported yesterday at FarmProgress Online that, “Senate Agriculture Committee Ranking Member John Boozman, R-Ark., called on Secretary of Agriculture Tom Vilsack to delay the Conservation Reserve Program sign-up deadline and provide flexibility for farmers to purchase crop insurance to help counter the unprecedented disruption in global crop markets brought on by Russia’s invasion of Ukraine.

“In a letter to Vilsack, Boozman stresses flexibility should be a ‘top priority’ so that ‘millions of acres of cropland and pasture that would have otherwise remained idle’ can be farmed to ‘address both inflation and food security concerns.'”

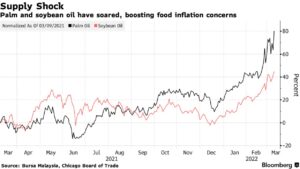

Bloomberg writers Eko Listiyorini and Anuradha Raghu reported today that, “Indonesia, the world’s biggest exporter of edible oils, will tighten its control over shipments in a sign of growing protectionism around the world as countries grapple with soaring food prices.”

And Bloomberg writer Anuradha Raghu reported today that, “Cooking oils are facing ‘a perfect storm,’ with as much as 60% of sunflower oil exports from the Black Sea region being delayed in the current marketing year because of Russia’s invasion of Ukraine, according to James Fry, a veteran analyst and chairman of LMC International, a consultancy.”

More broadly, Bloomberg writers Megan Durisin, Elizabeth Elkin, and Pratik Parija reported yesterday that, “Russia’s invasion of Ukraine means the food inflation that’s been plaguing global consumers is now tipping into a full-blown crisis, potentially outstripping even the pandemic’s blow and pushing millions more into hunger.”

.@nickdpaulson discussed global #fertilizer needs in yesterday’s farmdoc webinar, with a focus on the U.S. and #Brazil (Clip, two-minutes). pic.twitter.com/xD3fuUH9mW

— Farm Policy (@FarmPolicy) March 9, 2022

Durisin, Elkin and Parija stated that, “The crisis extends beyond just the impact of grain exports (critical as they are). Russia is also a key supplier for fertilizers. Virtually every major crop in the world depends on inputs like potash and nitrogen, and without a steady stream, farmers will have a harder time growing everything from coffee to rice and soybeans.

Plainly speaking, there are few other places on the planet where a conflict like this could create such a devastating blow to ensuring that food supplies stay plentiful and affordable.

And Wall Street Journal writer Jacky Wong reported yesterday on how Russia’s war is impacting food security issues in China: “The direct impact on China should be manageable. China imports around 7% to 10% of its wheat and corn, according to Goldman Sachs. Such imports have jumped in recent years, partly because the country has been filling up its strategic reserves. China’s grain reserves are at a historically high level, state media reported in November. They could probably be used to soften the blow.

“There could be secondary impacts that drive up food prices further in the coming months. Fertilizer prices, which were already surging due to the pandemic, may go higher as Russia is also a major exporter. Producers of nitrogen fertilizers, in particular, could see their costs rise since they use natural gas as a key ingredient. Supply shortages of sunflower oil, of which Ukraine is a major exporter, may drive up prices for alternatives such as soybean oil. The latter is important as China imports more than 80% of what it consumes. Soy is also critical as feed for pigs, the country’s main source of meat protein.”