As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Wheat Falls in “Most Volatile Market in at Least a Decade”

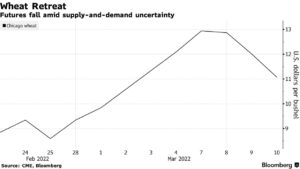

Reuters writer Mark Weinraub reported yesterday that, “U.S. wheat futures fell on Thursday, with the most-active Chicago Board of Trade soft red winter wheat contract plunging 9.5% as traders said the rally sparked by Russia’s invasion of Ukraine had made the grain too expensive for potential buyers.

Weinraub added that, “Benchmark Chicago wheat futures tumbled by their daily limit on Wednesday after surging 54% since the fighting between those two key global exporters started.

The sell-off on Thursday was the biggest in percentage terms for the most-active contract since May 2008.

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat dived roughly 18% in the past three days.”

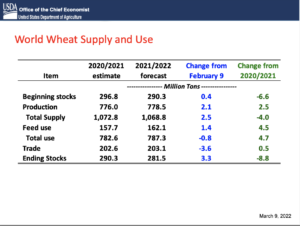

Also yesterday, Bloomberg’s Kim Chipman and Megan Durisin reported that, “Wheat futures tumbled as much as 10%, the most since 2008, following disappointing U.S. export sales even as a quarter of the grain’s global trade is at risk due to Russia’s invasion of Ukraine.”

“Wheat sales to other countries were unchanged last week from the prior one, below the average Bloomberg survey estimate., the U.S. Department of Agriculture said Thursday.”

Chipman and Durisin added that, “Meanwhile, traders are trying to position themselves in the most volatile wheat market in at least a decade as the world tries to gauge the potential length and severity of the war.”

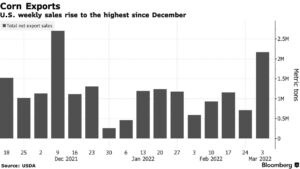

In a separate Bloomberg article from today, Megan Durisin reported that, “Corn futures are set for a fifth weekly gain, their longest such run since May, as the war in Ukraine sidelines its supplies and leaves buyers turning elsewhere for grain.

“The U.S. reported net corn export sales of 2.2 million tons in the week to March 3, topping analyst expectations, government data showed Thursday. Ukraine is a major corn shipper and its ports have been shuttered since Russia invaded. The country still had about 16 million tons left to export this season — about half the total expected before war erupted — and questions remain over how much of that can ultimately make it to market.”

In other developments, Bloomberg writer Vanessa Dezem reported today that, “European natural gas prices erased earlier losses as the market continues to face volatility over the risk to supplies from Russia.”

“Earlier in the day, the market was seeing a bit of a reprieve as Russia excluded energy and raw materials from export ban on more than 200 products. The country is the European Union’s biggest gas supplier, accounting for about 40% of imports, and the bloc is trying to tap all available resources to reduce this dependence,” the Bloomberg article said.

Nonetheless, Reuters News reported this week that, “Russia will suspend exports of wheat, meslin, rye, barley and corn to the Eurasian Economic Union (EEU) until Aug 31 in a move to secure its home market with enough food, the economy ministry said on Thursday.”

Bloomberg writer Godfrey Marawanyika reported today that, “Russia, which is being subjected to sanctions by countries from the U.S. to Japan, is trying to halt exports of fertilizer by its producers and the war has largely closed trade out of the Black Sea region, used by other producers.

“Zimbabwe imports about a quarter of a million tons of nitrate fertilizer from Russia annually and while there is enough in stock to allow the growing of wheat this southern hemisphere winter there is likely to be little left for corn, the country’s staple food, when summer planting starts. If sourced from elsewhere, fertilizer prices are likely to surge.”

Meanwhile, Reuters writers Hallie Gu and Dominique Patton reported this week that, “China has allocated 1.6 billion yuan ($253 million) to strengthen field management for winter wheat, the country’s finance ministry said, in an effort to bolster security of food supply.”

While Reuters writer Michael Hogan reported this week that, “The German government is worried about the growing number of countries curbing food exports as the Ukraine crisis causes tight supplies and a sharp rise in world commodity prices, junior agriculture minister Silvia Bender said on Thursday.”

And Gus Trompiz and Forrest Crellin reported today at Reuters that, “An estimated 92% of French soft wheat crops were in good or excellent condition by March 7, down from 93% a week earlier but above a year-earlier rating of 88%, farm office FranceAgriMer said on Friday.”