Tariffs imposed by the Trump administration collected an estimated $958 million in revenue from selected agricultural inputs from February to October of 2025, according to North Dakota State University's monthly…

Ukraine Increases Planting Forecast, as EU Farmers Face Headwinds: “The Crisis is Now”

Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s agriculture ministry on Saturday revised up its forecast for the area to be sown to 2022 spring crops, giving no reason for the new outlook.

Around 13.4 million hectares of various commodities, such as corn, cereals, sugar beet and sunflower might be sown this year, 3.5 million hectares less than in 2021, the ministry said in a report.

“The forecast is significantly higher than an estimate in March from Roman Leshchenko, then the agriculture minister, who said the 2022 spring crop sowing area could more than halve from last year to some 7 million hectares.”

The Reuters article added that, “The ministry said farmers had already started sowing spring wheat, barley, peas, sunflower, rape seed, sugar beet and soy beans.”

In a separate Reuters article from yesterday, Pavel Polityuk reported that, “Ukraine’s railways are struggling with a backlog of grain wagons on the country’s western border as traders look for alternative export routes after Russia’s invasion blocked off the main Black Sea ports, analyst APK-Inform said on Saturday.”

Yesterday’s article stated that, “But with war raging along much of the coast, traders are scrambling to transport more grain by rail.

“APK-Inform said Ukrainian Railways had opened 12 terminals for traders, but wagons were backing up and the railways would need two or three weeks to process them and send to consumers.

“‘Traders are continuing to search for the possibility of redirecting exports to the EU by rail or via Romanian ports, but the key barriers remain limited bandwidth logistics ability and its high cost,’ APK-Inform said.”

Polityuk added that, “Analysts have said Ukraine, which had exported 43 million tonnes of grain from the start of the season in July up to the invasion in late February, could export only around 1 million tonnes in the next three months, due to logistics difficulties.”

Meanwhile, Jude Webber, Daniel Dombey, Andy Bounds and Emiko Terazono reported yesterday at The Financial Times Online that, “Europe is one of the world’s leading agricultural producers and is a net food exporter. The EU obtains half its corn from Ukraine and a third of its fertiliser from Russia, and rising energy prices driven by the war have added to the strain. Farmers said they cannot immediately pass on such rapid cost increases to customers, leading to cash flow problems.

“‘It’s the four F’s — feed, fertiliser, fuel and financing. The war in Ukraine has had a huge knock-on effect for farmers,’ said Swithun Still, a grain trader and adviser to DCX, an online agricultural commodity trading platform.”

The FT writers explained that, “Brussels last month put together a package of measures to support EU farmers including temporarily easing state aid rules to allow governments to give them financial support.

“The EU will also bring forward annual agricultural subsidy payments from December to October to help with cash flow and will assist pig producers with the cost of storing carcasses for up to five months, in anticipation of meat being released to the market when prices have improved.

“But a €500mn crisis fund, which also allows member states to match their share of the funds by up to 200 per cent, needs approval by national governments and the European parliament, a process likely to take several weeks.”

The Financial Times article stated that, “The headwinds facing farmers have left many wondering if they can weather the storm. ‘Farmers need to make decisions today but they can’t because they don’t know where they stand,’ said Eddie Punch, general secretary of the Irish Cattle and Sheep Farmers’ Association. ‘The crisis is now.'”

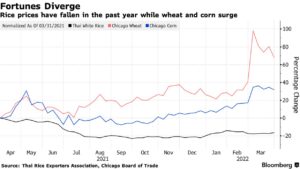

In other developments, Bloomberg writer Jasmine Ng reported late last week that, “Concerns are rising over the ability of Southeast Asia to retain its title as a major rice supplier to the world as countries such as Indonesia and the Philippines struggle to even produce enough for their own needs.

“Current yield trends will not allow the two countries to be self-sufficient in rice, according to a study published in Nature Food journal in March. This means they will have to rely on imports to meet domestic demand for a staple crucial to food security, political stability and export potential.”

“It’s particularly crucial for regions like sub-Saharan Africa and the Middle East that Southeast Asia continues to produce a large surplus of rice, the researchers added, as it can help reduce global price volatility and provide stable and affordable rice supplies,” the Bloomberg article said.