Republican U.S. lawmakers plan to create a task force to study potential year-round sales of higher-ethanol E15 gasoline blends in the U.S., after an attempt to pass such legislation in…

Chicago Corn Exceeds $8- Approaches Record, While Russian Fertilizer Reaching Brazil

Bloomberg’s Tarso Veloso Ribeiro reported yesterday that, “Corn futures in Chicago exceeded $8 a bushel for the first time in almost a decade, approaching a record high as war threatens global supplies, boosting demand for U.S. grain.

“The most-active July contract rose 3% to $8.07 a bushel in Chicago with the conflict in Ukraine showing no signs of easing as Russian forces attacked Mariupol overnight. Futures are nearing an all-time high of $8.49 a bushel reached in 2012 after devastating drought and heat damaged crops in the U.S. Midwest. Wheat contracts surged as as cold and snow slowed planting.”

Ribeiro explained that, “The global outlook for corn supplies has taken a hit as Russia’s invasion of Ukraine disrupts farming and trade flows in a region responsible for about a fifth of exports. Not only that, but spring planting is also a worry now. That comes on top of a surge in fertilizer costs that’s dimming planting prospects in the U.S., the world’s top shipper. Demand is increasing as well. The U.S. Department of Agriculture reported multiple sales this month of American corn to China exceeding 1 million tons.”

Dow Jones writer Kirk Maltais reported yesterday that, “For corn, the move higher in recent sessions–up over 8% since the start of April–comes as the war in Ukraine continues to rage and weather in the U.S. Corn Belt is keeping farmers from getting started with their planting.”

Also yesterday, DTN Managing Editor Anthony Greder reported that, “Farmers made little headway planting corn and soybeans last week as winterlike weather returned to much of the Midwest and Northern Plains, USDA NASS reported in its weekly Crop Progress report on Monday. In addition, dry weather in major winter-wheat-growing regions eroded the crop’s condition last week.”

My #FDD article last week showed why it is too soon to worry about the US corn crop being planted late. In two weeks could be a different story https://t.co/QIuprRDxRl https://t.co/4davBuXfkn

— Scott Irwin (@ScottIrwinUI) April 18, 2022

Reuters writer Enrico Dela Cruz reported today that, “U.S. corn planting was 4% complete as of Sunday, below the five-year average of 6%, the U.S. Department of Agriculture said in a report issued after CBOT grain markets closed on Monday, and the 5% forecast in a Reuters poll of analysts.”

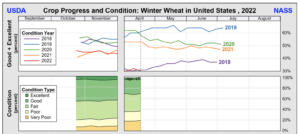

The Reuters article pointed out that, “The USDA rated 30% of U.S. winter wheat in good-to-excellent condition, down two percentage points from a week ago. The rating was below an average of analyst expectations and the lowest for this time of year since 1996.

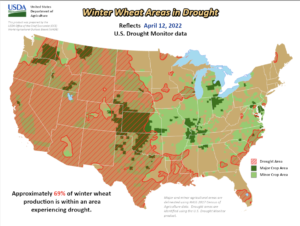

“Approximately 69% of the U.S. winter wheat crop was in an area experiencing drought as of April 12, the government said.

“The USDA’s first estimate of soybean progress for 2022 showed planting as 1% complete, matching the average analyst expectation but behind the five-year average of 2%.”

Meanwhile, Bloomberg writers Jen Skerritt and Michael Hirtzer reported yesterday that, “Farmers in Canada, the world’s top canola grower and a major wheat exporter, will probably have to wait to get in their fields this spring after a blast of wintry weather.”

And with respect to Ukraine planting, Dow Jones writer Yusuf Khan reported yesterday that, “Farmers in Ukraine are also planting where they are currently able to but uncertainty remains with fighting in eastern regions such as Donbas likely to exacerbate in the coming days.”

“The war in Ukraine is looking like it's going to make a very serious and potentially long-lasting disruption in world grain markets.”

— Bloomberg TV (@BloombergTV) April 18, 2022

Former IMF First Deputy Managing Director and JPMorgan Chase Chief Economist John Lipsky discusses global food imports https://t.co/ELEgVEkd0F pic.twitter.com/5TRbWxnqgp

In addition to price and production related news, Bloomberg writer Ann Koh reported yesterday that, “The war in Ukraine will put further pressure on grain-importing countries in Africa and Asia as a reduced number of vessels for delivering cargoes drives up shipping rates, according to the head of the International Chamber of Shipping.

“About 80 to 100 ships, mostly bulk carriers, have been unable to leave Ukrainian waters for almost two months due to underwater mines and military blockades, ICS Chairman Esben Poulsson said in an interview. Bulk freight rates are rising as owners and charterers price in the fact that ships will be tied up for longer periods.”

A surge in freight rates could further drive up food costs, piling more inflationary pain on consumers and worsening a global hunger crisis.

And today, Bloomberg writers Pratik Parija, Mai Ngoc Chau, and Ditas B Lopez reported that, “Soaring fertilizer costs have rice farmers across Asia scaling back their use, a move that threatens harvests of a staple that feeds half of humanity and could lead to a full-blown food crisis if prices aren’t curbed.”

Also on the issue of fertilizer and shipping, Reuters writer Ana Mano reported yesterday that, “Despite concern that sanctions against Russia would cause a shortfall of fertilizer in Brazil, preliminary shipping data shows orders being fulfilled and vessels heading for Brazil, potentially allowing a normal grain planting season.

“At least 24 vessels carrying almost 678,000 tonnes of Russian fertilizers from ports in the country are expected to reach Brazil in the next weeks, according to preliminary shipping data compiled by Agrinvest Commodities and seen by Reuters on Monday.”