As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Wearing Body Armour, Dodging Mines- Ukrainian Farmers Press Ahead, Cope With Logistics

Reuters writer Joseph Campbell reported yesterday that, “Ukrainian farmers in the southern region of Zaporizhzhia which borders the frontline of the military conflict with Russia are now wearing body armour to plough their fields.

“A week after the war started, grad rockets began falling right next door to the fields where contract farmer Yuri worked.

“He now drives a tractor in a bulletproof vest and a ballistic helmet provided by his employer – kit he says he is used to from time spent doing military service. Farmers in the surrounding fields are following suit.”

The Reuters article noted that, “Last week Ukraine’s agriculture ministry said farmers have sown 2.5 million hectares of spring crops so far this year, 20% of the expected area, adding the spring sowing area could fall 20% due to the Russian invasion.”

Bloomberg’s David Wainer reported yesterday that, “Russia sowed land mines and booby traps in areas of Ukraine as it withdrew from some areas, making it harder to resettle parts of the country until the deserted battle zones are painstakingly cleared, according to the head of a humanitarian organization.”

“Ukrainian President Volodymyr Zelenskiy has said Russia, itself a key agricultural exporter, is deliberately targeting farmland, placing mines in fields and destroying equipment and storage facilities. Ukraine is the world’s largest producer of sunflower oil and ranks among the top six exporters of wheat, corn, chicken and honey,” the Bloomberg article said.

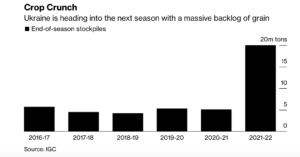

Meanwhile, Megan Durisin reported yesterday at Bloomberg that, “As Ukrainian farmers press ahead with fieldwork during the war, they’ll soon be grappling with a fresh problem: where to stash the next harvests.

“Russia’s invasion began during a peak period for Ukraine’s corn exports, which has left a hefty volume of grain stuck on farms as ports closed. While some crops are still trickling out by rail and road, it will take at least 10 months to clear the current crop surplus, Kyiv-based analyst UkrAgroConsult said in a note.”

In more detailed reporting on logistics in Ukraine, Reuters writer Luiza Ilie pointed out yesterday that, “Ukraine has sent around 80,000 tones of grains to the Romanian Black Sea port of Constanta so far, with more expected to arrive, the port’s manager said on Tuesday.”

“‘There are around 80,000 tonnes of grains which have already arrived, they are stored in silos, a part of them were loaded on ship,’ Constanta Port manager Florin Goidea told Reuters.

“‘Another roughly 80,000 tonnes are approved and en route.’

“The grains arrived either by rails or on barges through the Danube river, Goidea said, adding the port had the capacity to handle exporting additional grains exports,” the Reuters article said.

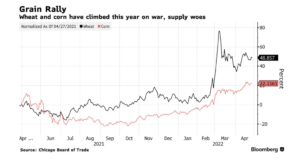

More broadly regarding the commodity price outlook, Wall Street Journal writer Yuka Hayashi reported yesterday that, “Global prices of fuel and food are forecast to rise sharply this year due to shocks caused by Russia’s invasion of Ukraine, the World Bank said Tuesday, a sign higher commodity costs will continue to put upward pressure on inflation.

The World Bank expects commodity prices to remain elevated for years to come, as the war in Ukraine alters how commodities are traded, produced and consumed around the world.

“Food prices are projected to rise 22.9% this year before declining 10.4% next year. Food prices rose 31% last year,” the Journal article said.

Hayashi explained that, “And the price increases of some commodities have resulted in higher prices for other commodities by raising their production costs. A case in point: Higher energy prices pushed up the costs of fuel and fertilizers needed for food production, causing rises in the [prices] of wheat and other agricultural products.”

War in Ukraine Cuts #Fertilizer Supply, Hurting #Food Prices and #Farmers https://t.co/cLFNssjuV1

— Farm Policy (@FarmPolicy) April 25, 2022

Also yesterday, Bloomberg writers Tarso Veloso Ribeiro and Michael Hirtzer reported that, “Archer-Daniels-Midland Co., one of the world’s biggest agricultural traders and processors, predicted several years of tight supplies due to a confluence of smaller crops in the Americas and the war in Ukraine.”

In other news, Bloomberg writer Anuradha Raghu reported today that, “Palm oil jumped 10% while rival soybean oil hit a fresh record high as traders prepare for the start of Indonesia’s export halt.

“Malaysia, the world’s second-biggest producer, is set to see a surge in demand for its products after top grower Indonesia said it will ban exports of RBD palm olein from April 28 to protect domestic supply. Crude palm oil shipments can continue. The move will remain in place until domestic cooking oil prices ease.”